Look For More Billionaires And Millionaires To "Go Portable" To Stave Off Inflation, Yuan Revaluation#

With wealthy Chinese consumers becoming the darlings of the luxury industry, the auction market, the automotive industry and the art world, it's no surprise that companies are bending over backwards to find out what drives the estimated 825,000 people worth over 10 million RMB (US$1.46 million) and 51,000 individuals worth over 100 million RMB (US$14.64) to make purchases.

As Jing Daily has noted before, for some things, like luxury cars, consumers in China have very specific needs, for which automakers have made adjustments (such as larger backseats) to localize the product. In terms of luxury products, major brands have had to become more conscious of the rapid increase in consumer sophistication and low brand loyalty, increasing the quality of products offered in the China market and understanding that Chinese consumers of a certain income level generally prefer to purchase luxury goods outside the mainland.

For these industries, looking into why wealthy individuals are spending so much money can often come down to their desire to set themselves apart -- to "show off" -- but there is also the perception that luxury goods also offer superior quality and, in some ways, have great investment value.

In other areas, like the auction market and its counterpart, the art world, Chinese consumer behavior is often more nuanced. In many ways, Chinese buying habits at auctions (particularly in Hong Kong) follow a cultural predilection towards long-term value and stability. Hence, although wealthy Chinese consumers have gotten something of a bad rap in the media over the past several years, often being depicted as frivolous nouveaux riches one and all, many wealthy Chinese have a very pragmatic way of looking at auction buying.

Much like gold and jewelry, which remain highly popular in China and have been a sort of traditional hedge against inflation there for centuries (despite occasional historical interruptions), art, fine wine, important watches and other auction prizes are seen by many in China as a great "portable hedge" that will hold or grow value in the face of inflation or gradual revaluation of the yuan.

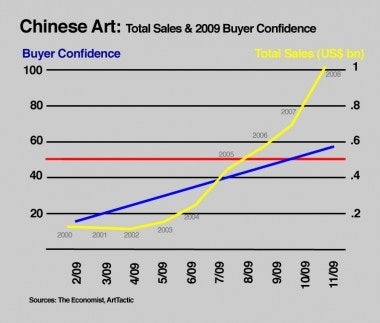

As the Chinese currency is increasingly "going global," and the country faces more pressure to loosen its tight grip on the yuan, it's not a bad investment strategy. Perhaps that -- along with the growing specter of inflation -- is why we've seen such an upsurge in new mainland Chinese collectors fighting to get their hands on every piece of blue chip Chinese contemporary art, every ancient Chinese antiquity, and every bottle of Petrus or Lafite up for grabs in Hong Kong or elsewhere -- because they're worried about the future value of yuan-denominated investments and want to diversify their holdings.

Though most of China's millionaires and billionaires still have their "permanent" investments -- cars, apartments and commercial properties -- a good number of them with keen long-term vision know that in a world of unpredictable currency or economic shifts, it's not a bad idea to "go portable" to stay on the safe side. In terms of the art and auction worlds, the increasing number of mainland-based buyers of art, wine and other portable assets is interesting in other ways, too -- they're not just following trends anymore, they're actively setting them.

As Chinese collectors become increasingly sophisticated and picky, we should see a sort of domino effect on the prices of certain artists (most of them likely Chinese, as the vast majority of mainland collectors have only just begun to dip their toes into collecting non-Chinese artists) or popular wines around the world.

Wealthy Chinese consumers, then, shouldn't be misunderstood or misrepresented as fickle, profligate showoffs. Rather, it's important to keep in mind that there are reasons why mainland Chinese tourists flood Parisian duty free shops (selection, avoiding China's high luxury tax), why huge sedans are so popular in China (personal drivers popular among well-heeled businesspeople), and why new Chinese collectors have become so visible in the last few years (hedge against inflation and yuan revaluation, growing personal interest in the arts, desire to "repatriate" antiquities and China's future cultural heritage).