For the world’s top luxury brands, grappling with how to preserve traditions and heritage in a digitized world is one of the most crucial issues they face today. The recent Luxury Interactive conference in New York from October 17 to 19 addressed this topic with panels and talks on the latest technological developments in the luxury industry, from experimenting with new online sales channels to adapting brick-and-mortar stores to the connected shopper.

Naturally, a big part of the conversation involved one of the world’s most important and digitally savvy groups of luxury customers: Chinese shoppers. Below are six key takeaways from the conference on pursuing China luxury sales and marketing strategies for the digital world.

“Dig deep in the trenches” of influencers to reach China’s millennials.#

According to speaker Nancy Zhang, the COO of multi-brand luxury retailer Otte New York, finding the right social media influencers in China means having in-depth knowledge of which fashion bloggers are truly resonating with a younger consumer base. The right influencer can be useful not only for major labels, but also for niche luxury brands and retailers to gain significant visibility and cachet.

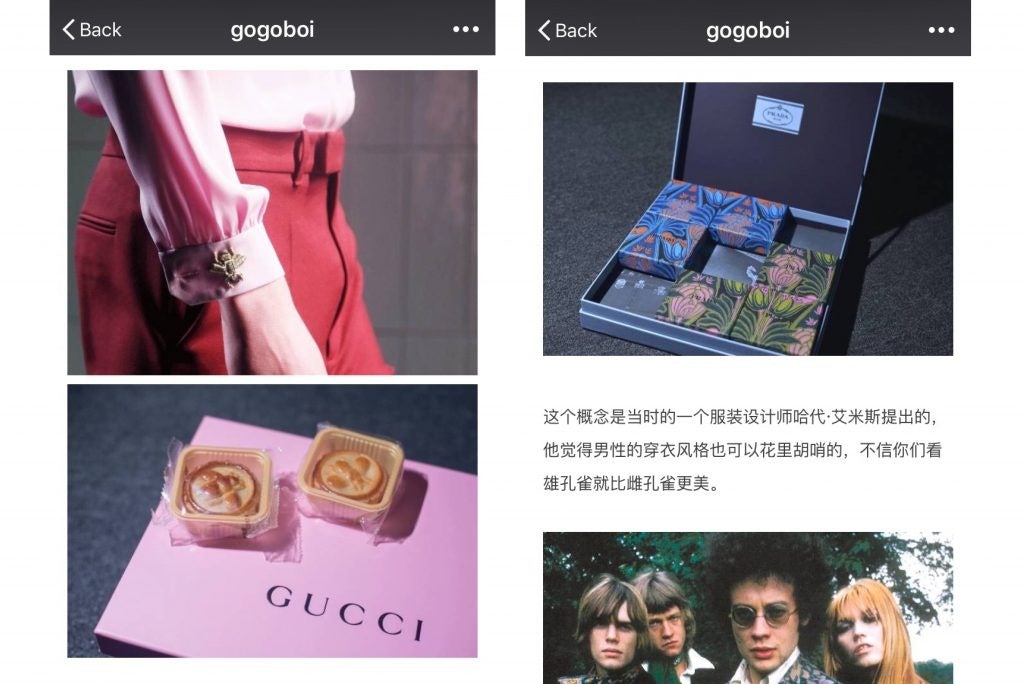

The reach of China’s top fashion influencers may not be immediately apparent, as their content often differs not only from that of a major fashion magazine, but also from their U.S. counterparts. For example, Zhang discussed the example of fashion blogger Gogoboi, one of the top fashion bloggers on WeChat. He has a “very unique approach to fashion,” she said, noting that he once spent an entire month matching outfits to Pokemon characters. Also known for his acerbic wit and sharp critiques, “he’s basically like Joan Rivers” in the Chinese fashion world. This blogging style has been a hit with attracting fans and brands alike, as he’s been sponsored by brands like Louis Vuitton, Marc Jacobs, and Bulgari.

“If you really want to dig deep in the millennial market, you have to dig deep into the trenches” when it comes to finding the most influential personalities, said Zhang.

Engage the Chinese-American consumer for a “gateway” to the China market.#

In a separate talk, Jennifer Wang, the co-founder and CMO of U.S.-based online shopping and daily deals site Dealmoon, discussed how she reaches 15 million Chinese-American shoppers a month with her site that has featured over 3,000 brands. Her main strategy to build up this audience revolved around developing a specific voice on Chinese-language social media, which included “not doing marketing, but being their friends.” For example, the company was the first enterprise in the United States to include travel advice on its Weibo account, and she considers her company’s 5 million Weibo followers to be part of a “shopping community.”

Even though the site is based in the United States, U.S.-based Chinese users offer a direct line to China with a big influence on their contacts living there. “This audience can teach their family and friends about how to shop from this site,” she said.

Define a flagship luxury experience online.#

Another important strategy for China outlined by Zhang was the concept of the digital “flagship luxury experience” to create a sense of exclusivity online when it comes to both browsing for information and shopping. While many heritage luxury brands are worried that e-commerce may not create a high-end experience, it is crucial for smaller niche retailers who “cannot rely on opening giant black flagship stores,” she said. As Chinese shoppers’ top travel destinations are constantly changing, reaching them online through clear promotion strategies—and sales and distribution if e-commerce is involved—is key.

Embrace a “phygital” future when it comes to retail.#

In addition to e-commerce, brands’ brick-and-mortar shops are now a crucial platform to employ a digital strategy, whether they’re aware of it or not, according to Euromonitor International Senior Analyst Ayako Homma. She called this strategy “phygital,” or a combination of digital and physical. She cited examples of “retail theater” such as Burberry’s “magic mirrors” in fitting rooms, which scan products and transform into a video screen with a clip from the product in a runway show, and Tommy Hilfiger’s in-store virtual reality headsets that allow shoppers to watch fashion shows. Meanwhile, Sephora has enacted a “teach, inspire, and play” (TIP) plan for stores. She noted that these technological developments are especially important in emerging markets like China, which Euromonitor considers to be home to comparatively digitally focused luxury consumers—for example, she stated that emerging market consumers have a higher rate of purchasing via social media such as WeChat.

Develop a tailored social commerce strategy.#

“Social commerce really does allow the user to drive their brand discovery,” said Zhang, who recommended that brands need to carefully examine top Chinese platforms like Tmall, JD.com, Red, and Mogujie to see if any fit with their identity. “They’re able to target a much more specific sector of the retail world—in the millennial market—and really speak a very specific language to them and give them specific products that match their identity.” Her company decided to sign on with social e-commerce app Red and works with it on a weekly basis. It is also getting on board with the Alibaba-created e-commerce shopping bonanza Singles’ Day on November 11, launching promotions on its global site that will be available to consumers across the world.