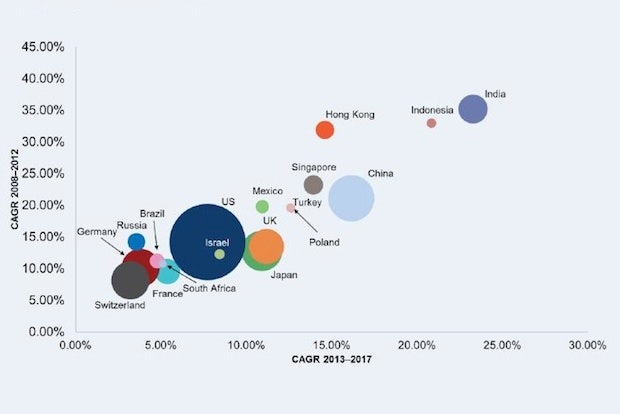

The growth of luxury investments by country. (WealthInsight)

Wine, art, gems, jewelry, and watches are a few examples of luxury items rapidly growing in popularity as investment items for China’s wealthy as hard assets continue to be seen as more stable than an unpredictable stock market at home and global economic instability.

According to a new report released yesterday by research firm WealthInsight, Chinese collectors hold the second-highest amount of luxury investment worldwide, with a compound annual growth rate (CAGR) that rose by 21.11 percent from 2008 to 2012 for a total value of US$43 billion.

As a result, Chinese collectors “were the major driving force behind the growth” of global luxury investment over this time period. Ouliana Vlasova, head of content at WealthInsight, said, “Looking forward, millionaires’ preference towards real assets is expected to drive demand for art assets and other collectables.” These types of investments are expected to increase at the fastest rate in emerging economies such as BRIC countries, with their total share of worldwide luxury investments expected to grow from 29 percent in 2013 to 36 percent in 2017.

This rapidly rising demand for luxury goods as investment pieces has also spurred the need for more market advice among investors. The report states that in the last half-decade, “ there was an increase in independent art advisors and art advisories as millionaires became more aware of the need to manage their art investments.” We have seen this demand flourish in China, with auction houses such as Christie’s and Sotheby’s education wings jumping into the art education market with new mainland and Hong Kong course offerings. The report also states that when it comes to art, China “continued to drive demand for value-added services as young millionaires began to amass substantial collections and look for ways to diversify their wealth.”

Chinese investors’ tastes in luxury products are evolving to become more diverse as well, as is shown by the evolution of the Chinese wine market. “As the Hong Kong and Chinese market becomes increasingly fixated with burgundies and, to a lesser extent, the super Tuscans, the less well-known wines are becoming well known among Chinese high net worth circles,” said WealthInsight analyst Oliver Williams.