Jing Daily has partnered with Wunderman Thompson Intelligence to produce Transcendent Retail: APAC.

Download here.#

The past 18 months have witnessed an evaporation of the borders separating markets, digital channels, and media, with the coronavirus pandemic only accelerating global retail’s unstoppable march towards digitalization. Nowadays, consumer markets that previously had little in common have become closely linked, with trends rising and interacting in real-time. During this time, the Chinese market has emerged as especially influential with its transformations of both online and offline retail. “Made in China” trends such as livestreaming, social commerce, and the widespread adoption of “super apps” that blend messaging, commerce, payment, and fulfilment are now making their way around the world.

Global brands have rushed to adapt by adjusting their strategies for their home markets and joining the fray in China. During Alibaba’s 2020 Singles’ Day shopping festival (the world’s biggest online sales event), 12 percent of the 250,000 participating brands hailed from overseas, accounting for around $5 billion of the more than $74 billion in sales racked up during the course of the festival. In an 11-day period, Alibaba chartered more than 3,000 flights and ships to import foreign goods into China and sent another 700 flights to deliver orders outside of the country. Once a very localized e-commerce event, the increasingly global nature of Singles’ Day is a microcosm for how trends birthed in China now influence business strategy and investment elsewhere.

China’s dominance of global e-commerce is no accident, having taken shape over the past decade alongside the rollout of high-speed mobile networks, the development of sophisticated logistic networks, and the near-universal adoption of mobile payments among consumers. This year, China’s retail revenues from e-commerce are expected to hit $2.8 trillion, up from $2.3 trillion last year, as the country becomes the first in the world where more than half of all total retail sales originate online.

To analyze emerging trends from the world’s largest e-commerce market and assess the readiness of other global markets to embrace them, Jing Daily partnered with Wunderman Thompson Intelligence to produce the in-depth report “Transcendent Retail: APAC.” Incorporating survey data from more than 10,000 consumers in China, India, Indonesia, Thailand, Japan, and Australia, as well as interviews with experts, the report highlights lessons for brands interested in selling to consumers in China as well as adapting Chinese-born-and-bred retail trends for a global market.

Below, Jing Daily highlights four of the many actionable takeaways from the 17 key trends identified in the report. For more, be sure to download the report

here#

.

1. The Clicks-and-mortar store is here to stay#

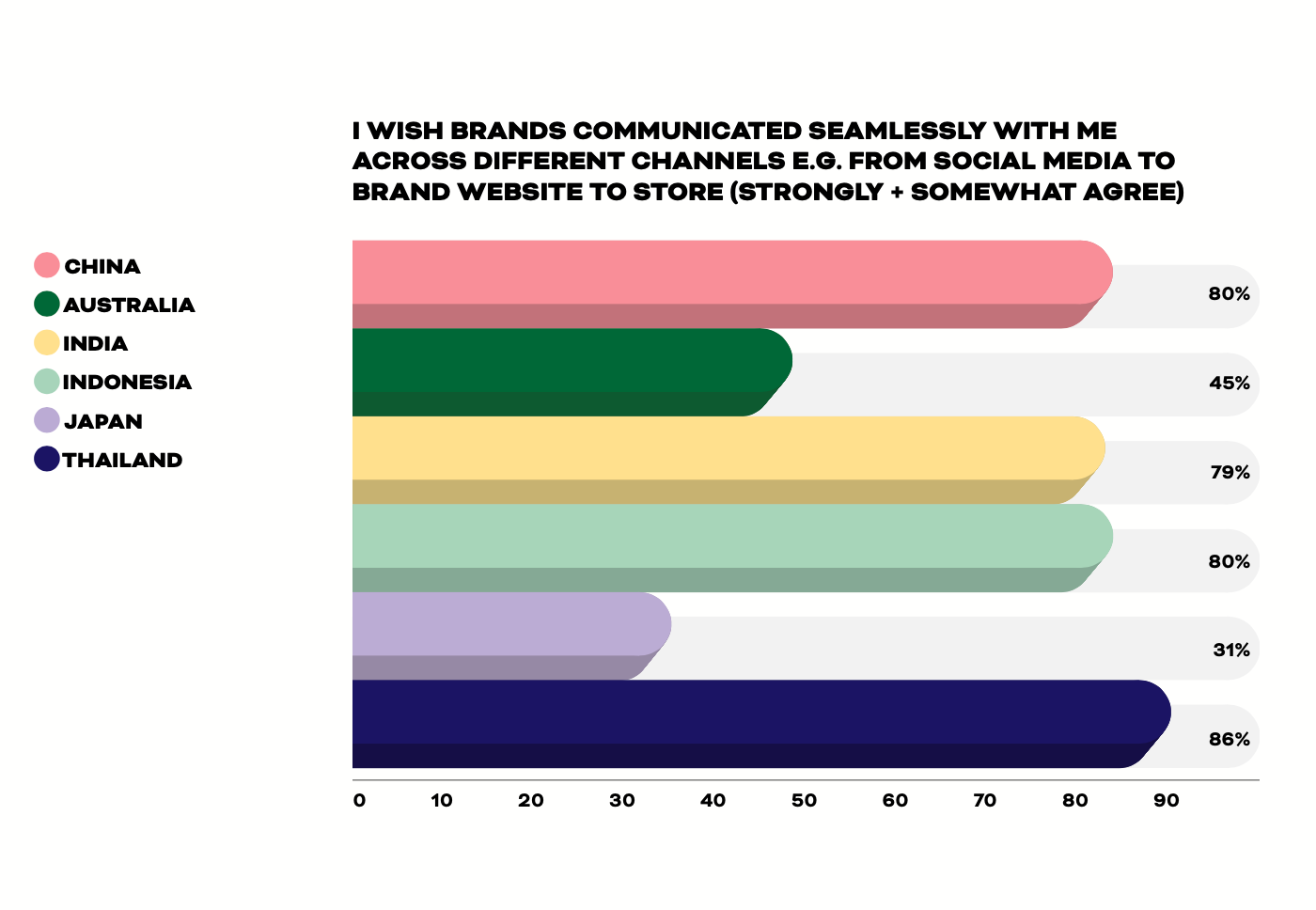

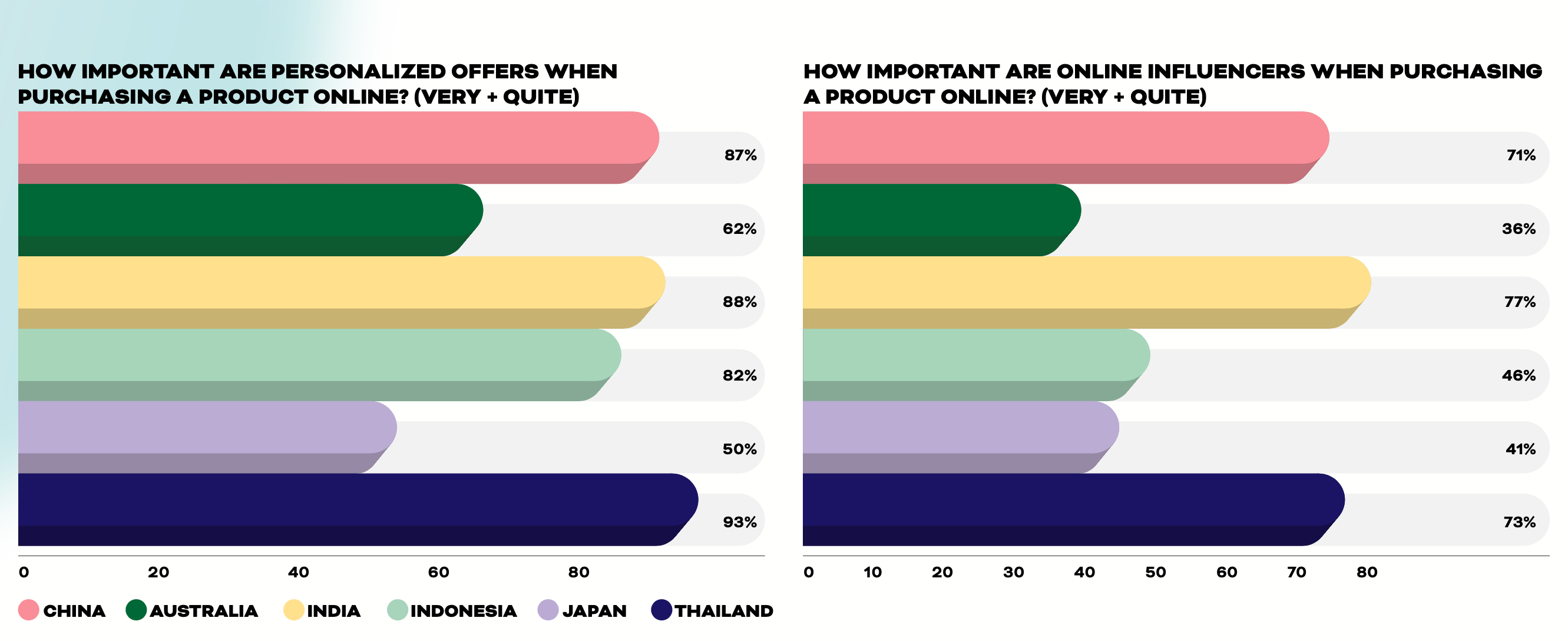

As online shopping evolved with the pandemic, so too did physical stores, making the two inseparable. Now, consumers are accustomed to the convenience of at-home shopping and expect the same level of service at physical stores. In turn, physical stores are taking on digital bells and whistles, from putting QR codes on products to creating immersive apps and gaming experiences to amuse consumers while they shop. Meanwhile, China’s digitally native brands are moving offline and investing in pop-up stores to leverage their vast social media followings. Yet brick-and-mortar retail won’t be killed off by the evolution of e-commerce in China, even as it goes through a major transition. The winners will be those that understand consumer expectations for in-person shopping to replicate some of the features prevalent in e-commerce, such as gamification, higher levels of personalization and perks, and the ability to keep consumers entertained.

2. The world is racing to catch up to Chinese-style e-commerce livestreaming#

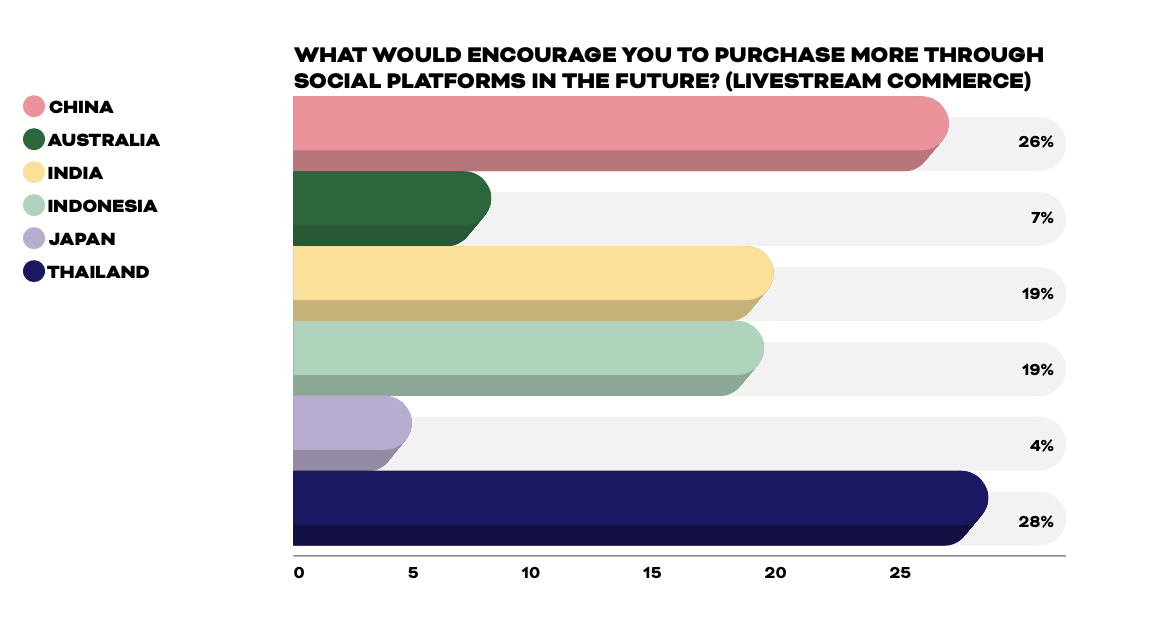

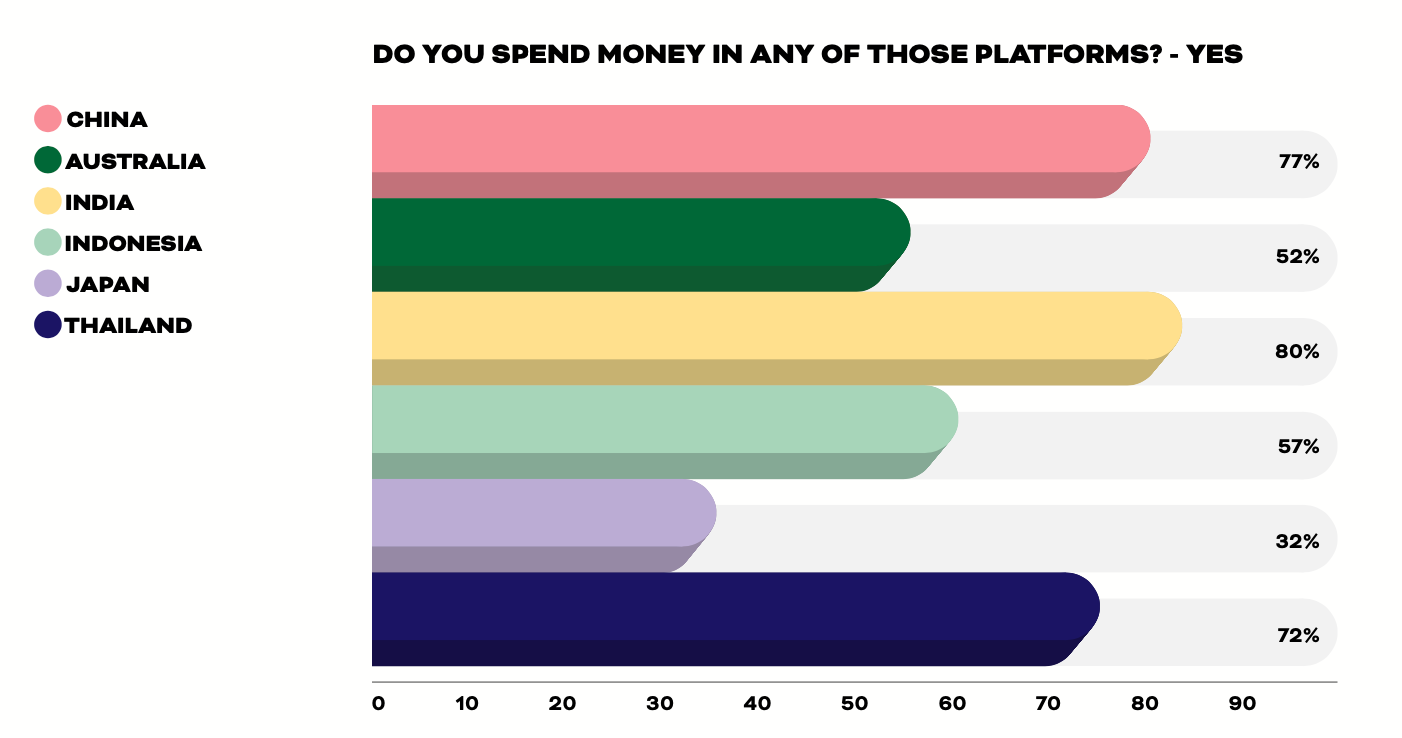

The live video sales model pioneered by Alibaba’s Taobao Live in 2016 and has become a feature of just about every e-commerce and social platform in China, and now brands, retailers, and tech firms around the world have been vying to introduce their own versions of its seamless “see now, buy now” functionality. The year 2020 marked a turning point for e-commerce livestreaming in China, as it went from a “nice-to-have” offering to a necessity for Chinese brands and retailers during COVID-19 lockdowns, with everyone from out-of-work actors to CEOs joining the livestreaming fray. Perhaps more importantly, e-commerce livestreaming has also firmly moved up the value chain — while it was previously centered around fast-moving consumer goods and low prices, it has since drawn the attention of luxury brands from fashion to watches and jewelry to autos thanks to its ability to reach, influence, and sell to consumers in real-time.

3. Brands are going all in on gaming#

With nearly 518 million gamers, China is already the world’s largest gaming market, and one of the most heavily female-leaning (56 percent of mobile gamers) and youngest (47 percent under 30). Brands increasingly see the virtual worlds of games as important marketing channels, with premium names in fashion and automobiles offering aspirational virtual possessions to young consumers who may not (yet) be able to afford their real-world equivalents. For the world’s biggest luxury brands, gaming collaborations can also generate new revenue streams through the development of limited-edition physical goods tied to gaming content.

4. China’s top influencers are poised to build their own brands#

Known as Key Opinion Leaders (KOLs) in China, influencers have long been seen as critical to brand success in the market, where consumers rely heavily on recommendations from trusted sources. Meanwhile, the rapid rise of e-commerce livestreaming has boosted demand for on-air sales talent capable of engaging consumers and racking up millions in sales during hours-long broadcasts. This has launched leading influencers like Viya and “Lipstick King” Li Jiaqi into the stratosphere, with tens of millions of followers each and marketing clout to launch their own brands and intellectual property extensions, opportunities that may ultimately become more profitable than livestreaming alone.

With 81 pages of actionable insights and deep market analysis, “Transcendent Retail: APAC” is a must-read for any brand, marketer, or retailer interested in leveraging China’s next-generation commerce trends to reach consumers worldwide.