Sotheby's, Christie's And Others Trying To Cultivate "New Medicis" In Emerging Markets Like China#

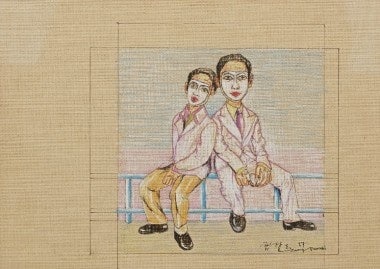

Zeng Fanzhi is actively collected by some of China's "aspiring Medicis," like Liu Yiqian and his wife, Wang Wei

Although Hong Kong is clearly already a money-maker for auction houses like Sotheby's and Christie's, over the past year these auction houses have sought to cultivate a broader collector base in emerging markets like mainland China via more educational offerings. Earlier this year, Jing Daily looked at the mainland Chinese-focused short courses offered by Christie's around the time of the 2011 spring auctions, noting that several of these courses were offered in Hong Kong in Mandarin for the first time ever. In July, the demand for arts education by visiting mainlanders enticed Hong Kong's Peninsula Hotel to add its own educational short course as well, toting well-to-do aspiring art connoisseurs around the city in a customized MINI Clubman to visit, and learn about, the local art scene.

Unable to operate in the Chinese mainland, by catering to the needs of mainland Chinese "new collectors" -- few of whom have formal arts educations -- Sotheby's and Christie's hope to get a leg up on their mainland Chinese competition by offering a wider range of services. By working to cultivate a wider base of collectors interested in a deeper appreciation of what they're actually buying at auction, and how they can use their new collections as financial collateral (a much newer development), these auction houses have the potential to bring about a greater number of savvy collectors in China, who buy not for short-term gain but for long-term security.

At the moment, as Reuters writes this week, the idea of cultivating a Chinese (or Indian, or Russian, for that matter) Medici -- an appreciator of art who knows how to leverage his or her collection in clever ways -- is becoming more possible than ever, a reality upon which the major auction houses have been quick to pounce:

At Christie's auction house in London one evening last July, as art investors bid millions for an 18th-century painting of a horse, the sons and daughters of the capital's super-rich were going through their paces in a simulated auction.

In an upstairs room in London's plush St James's district, around 30 people mostly in their 20s chatted politely in fluent English, their accents Russian, Arabic, South Asian and Chinese. After a three-course dinner of salmon and roast lamb, the programme began: a role-play in which teams bid in an imaginary auction for various works of art.

...

For the young would-be buyers, the event was one of a series of workshops aimed at grooming them for the responsibilities of inheriting vast wealth. A taster of how to invest in alternatives to stocks and bonds, the session showed how some of their 'high net worth' parents are protecting their wealth from the market ructions of the financial crisis.

But it went further. It also showed the young investors how they could boost their budgets by offering art in their collections as collateral for loans.

"It's a way for them to get liquidity out of the art collection to invest back into their business or buy other new business," said Suzanne Gyorgy, a New York-based art finance manager at Citi's private banking arm, which organised the event.

Teaching new collectors how to build, then use, their collections is a smart move, but the bread and butter of the auction house educational offering is teaching these buyers how to cultivate multi-generational collections that will turn new money to old. With competition for works by China's best blue-chip contemporary artists continuing to heat up at domestic and overseas auctions, we may see more ultra-wealthy collectors try to work more closely with emerging younger artists and function, in essence, as patrons in the mold of the Medicis. However, Jussi Pylkkanen, president of Christie's Europe, has pointed out one difference between this famous Italian family and the wealthy Chinese, Russian, Indian and Middle Eastern families now getting involved in the global art market:

Where the original Medicis built one of Europe's mightiest banks, The Medici Bank, the "new Medicis" that Pylkkanen has identified are using the arts as a refuge from investments in financial services that have become less and less reliable. With interest rates low and stock markets so volatile, alternative investments offer investors the chance to buy assets with little correlation to global financial markets.

"I've got clients who are looking for something a bit different to do after falling out of favour with stock markets," said Chris Belcher, a partner at law firm Mills & Reeve.

If the potential "new Medicis" courted by Christie's and others are indeed fleeing from "financial services that have become less and less reliable," wealthy mainland Chinese -- who are buying value-storing assets ranging from art and gold to Hermès handbags and diamonds to hedge against rising inflation, low interest rates, a questionable real estate market and an unreliable stock market -- appear to fit the profile.