Though luxury brands are still celebrating China’s reopening earlier this year, inflation in North America is weighing on consumers, denting demand for entry-level luxury goods there.

China’s recovery, including the gradual return of Chinese tourists globally, may mitigate some of this softness, but it’s a timely reminder of the importance of market diversification amid the volatile economic backdrop.

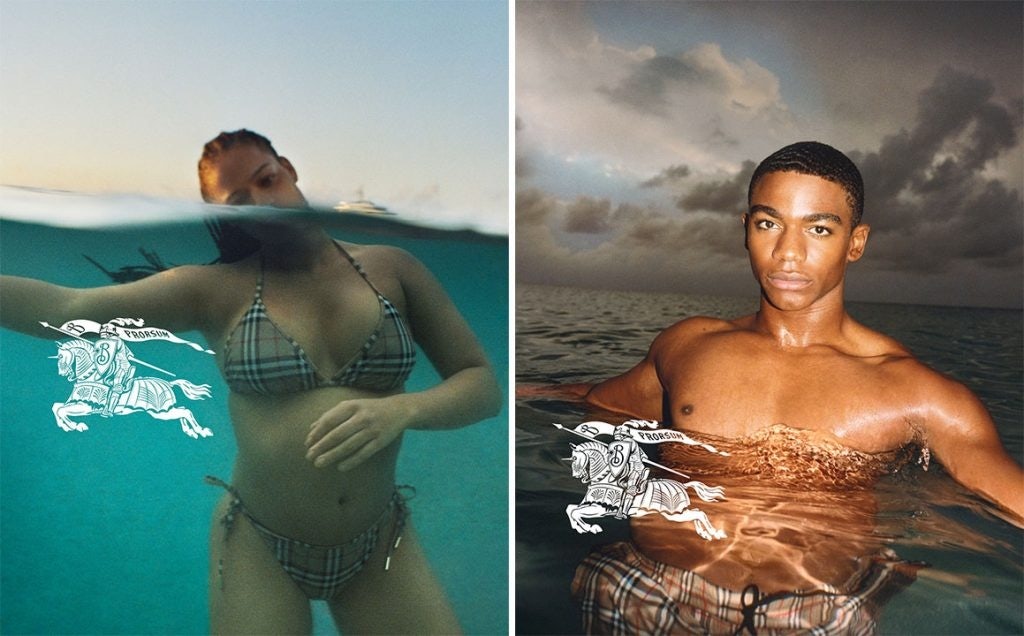

Burberry pins hopes on Chinese tourism, Lee’s debut#

Burberry reported that comparable store sales jumped 16 percent year on year in its fourth quarter, largely thanks to acceleration in its largest market, China, where sales increased 13 percent YoY in the same period. Revenue for the fiscal year ended April 1 was just below expectations, rising 10 percent YoY to £3.09 billion (3.8 billion).

The British luxury brand experienced many changes over the past year, the most significant being the appointment of Daniel Lee as chief creative officer and the revamp of its brand aesthetic. It also doubled down on store refurbishments, especially in Asia, updating 26 stores in the mainland with the redesigned logo and new displays.

However, it’s not all sunshine for the heritage brand. Sluggish demand for entry-level items like sneakers, hats and belts in the Americas caused retail sales in the region to drop 7 percent YoY in Q4. Moreover, with Burberry’s home market the UK scrapping its tax-free shopping scheme, some spending was transferred to mainland Europe.

Still, the fashion house maintains its medium-term target of hitting £4 billion (4.98 billion) in sales. China will be a key propellent of this growth, said CEO Jonathan Akeroyd in a media call on May 18. The company’s hopes are pinned on the return of Chinese tourists, in addition to Daniel Lee’s debut collection in late September last year.

Tapestry beats expectations on China sales#

The parent company of Coach, Kate Spade and Stuart Weizman reported Q1 results that were “significantly ahead of expectations, demonstrating the power of brand building, customer centricity, and our agile operating model,” said Joanne Crevoiserat, chief executive officer of Tapestry, Inc.

Net sales rose 9 percent YoY to 1.51 billion, boosted by 20-percent revenue growth in Greater China. Driving customer acquisition in China was Coach’s collaboration with the nostalgic White Rabbit candy brand for this year’s Lunar New Year; half of the collection’s buyers were new to the brand.

At the same time, an uptick in domestic Chinese travel boosted revenue in Hong Kong, Macau, and Hainan, although “global Chinese tourist trends still remain well below pre-pandemic levels, representing an area of further opportunity,” said Tapestry CFO Scott Roe on an earnings call on May 11.

Like Burberry, Tapestry encountered challenges in North America as consumers grew more cautious about spending, with sales rising in the low-single-digits. Although it acquired 1.2 million new customers in the region — half of which were millennial and Gen Z consumers — this was less than the 2.6 million customers gained in the previous quarter.

The American fashion group expects outperformance in China to offset an expected mid-single-digit sales decline in the next fiscal period. As Crevoiserat put it, “we're winning in China.”

Alibaba Group breaks up, bets on AI#

Revenue at the Chinese tech giant climbed 2 percent YoY in Q1 to 29.6 billion (208.2 billion RMB). Sales from its retail business, its biggest revenue engine, fell 3 percent YoY despite gross merchandise value on Taobao and Tmall turning positive in March.

While consumption in China has gradually recovered, “consumer confidence and spending power still need further momentum,” Alibaba chairman and CEO Daniel Zhang noted in an investors call on May 18.

In March this year, Alibaba Group announced that it would be split into six different business entities, each led by its own CEO. As part of this reorganization, the Cloud Intelligence Group, logistics arm Cainiao, and high-tech grocery chain Freshippo will all pursue public offerings in the next year or so.

“We would love nothing more than to see one of these little Alibabas spinning off from Alibaba [and] becoming another big Alibaba,” Zhang said.

In particular, Zhang, who heads the company’s cloud unit, stressed that artificial intelligence would be key to future business development. Not only will Alibaba Cloud provide enterprise customers with the high-performance computing services necessary for AI model training, but it also plans to integrate its own version of ChatGPT, Tongyi Qianwen, into all its business applications.

“The world is standing at a new starting point in the age of AI. The breakthroughs in artificial intelligence will reshape every aspect of our society, how we work and how we live, creating opportunities for disruptive innovations while bringing new problems for mankind to solve together,” he said.