Key Takeaways:#

- Although they have dominated the market for decades, top-selling imported luxury fragrances face stiffer competition from domestic Chinese upstarts.

- A rising number of young consumers associate scents like Chanel N°5 with older relatives or parents, and are looking for brands that show cultural awareness and offer personalization and differentiation.

- A new breed of high-end domestic fragrance brands is rushing to cater to big-spending young consumers in search of niche scents.

For decades, China’s fragrance market has been dominated by top-selling global names such as Chanel N°5, and Dior J’Adore. And while international luxury giants and beauty groups still account for the lion’s share of the fragrance sales in China, the evolution of consumer tastes in recent years has seen a greater willingness to experiment with lesser-known brands from both overseas and domestic producers. According to Euromonitor data, the Chinese perfume market maintained a compound annual growth rate of 15 percent from 2015 to 2020, and the compound growth rate in the next five years will surpass 22 percent, or three times that of the global market. This year, China's domestic perfume market is expected to exceed 40 billion yuan (6.29 billion).

As noted in Jing Daily's recent Insight Report, How Niche Fragrances Are Winning Over Young Chinese Consumers, millennial and Gen Z consumers in China are changing the fragrance landscape in what has traditionally been a relatively small market, opening the door for niche brands to gain a foothold and take on the entrenched players like Chanel and Dior. Only 2.5 percent of China's massive population of 1.4 billion uses personal fragrance, according to local market research firm iResearch, which translates to enormous growth potential. By way of comparison, nearly 52 percent of Americans (172 million) use or purchase perfume or cologne, according to data from the U.S. Census data and the Simmons National Consumer Survey (NHCS). In France, where the use of fragrance is deeply ingrained in the culture, 42 percent use scents on a daily basis, while another 42 percent use perfume products somewhat less often, according to a 2017 survey.

Having weathered the now two-year-long pandemic, and all of the mask-wearing and quarantining it has entailed, some Chinese consumers are cooling on cosmetics and becoming passionate about luxury fragrances. Even hardcore beauty and skincare enthusiasts, famed for spending lavishly on whatever lipstick influencers like Li Jiaqi happen to be hawking, are turning their attention more towards personal fragrances. As Chinese-language media recently noted, “In the post-pandemic era, perfume has replaced the lipstick economy, and [sales are] skyrocketing.”

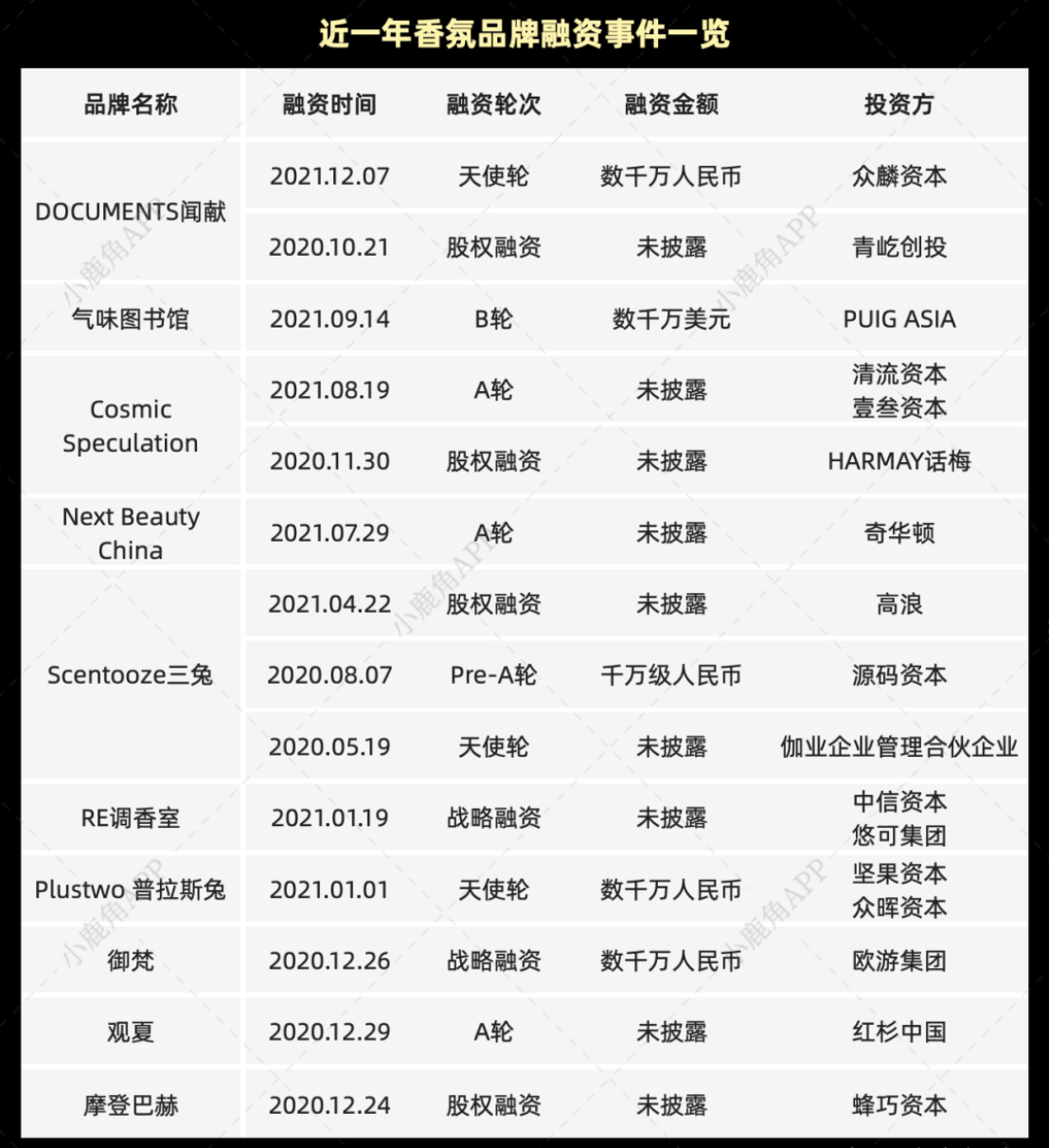

But this growth is not only benefiting international fragrance brands. Guochao-loving younger consumers, in particular the “post-95” and “post-00” demographics – those respectively born after 1995 or 2000 – are boosting the prospects for new higher-end domestic Chinese fragrance brands. Over the past year, 10 domestic fragrance brands, among them Scent Library, DOCUMENTS, Cosmic Speculation, and Scentooze have completed successful funding rounds. Perhaps most notably, Spanish luxury group Puig, owner of Jean Paul Gaultier, Penhaligon’s and L’Artisan Parfumeur, acquired a stake in Scent Library last fall.

Recognizing the market's potential, even companies with no previous interest in fragrances have sought to get their foot in the door. Earlier this year, TikTok parent company Bytedance announced the launch of its perfume subsidiary, EMOTIF, offering three fragrances in 2 ml and 9 ml bottles at an affordable cost of 19.9 yuan ($3.94) and 198 yuan ($31.20), respectively.

But perhaps the greatest activity in China’s burgeoning niche fragrance market comes from domestic startups aggressively tackling the premium and luxury segments. Two-year-old brand DOCUMENTS has quickly established a foothold in the premium niche fragrance market despite (or perhaps partly due to) prices that scrape up against some major global names. DOCUMENTS fragrances range from 850 yuan ($133.57) for a 30 ml bottle to 1,750 yuan ($275) for a 90 ml bottle, with the brand’s most expensive product priced at roughly 2,650 yuan ($416).

Eschewing e-commerce in favor of brand-owned WeChat mini-programs and offline stockists, DOCUMENTS opened its first physical store in Shanghai in July 2021. Over the following six months, the brand claimed an average purchase value of 1,500 yuan ($236), a conversion rate of 30 percent, and a repurchase rate of 15 percent. In terms of core consumer demographics, post-90s shoppers accounted for more than half of DOCUMENTS sales.

The freshness and cultural awareness of local fragrance brands are key factors driving their success against imported market incumbents, which have carved out a strong presence in the market over the past two decades – meaning, in many cases, they are associated with young consumers’ parents or older relatives.

Young Chinese consumers, particularly the post-95s and post-00s, are now using fragrances as something of a cultural code, with fashion and lifestyle-focused social platform Xiaohongshu packed with nearly 200,000 posts about niche fragrances and lesser-known brands both foreign and domestic. Compared to the post-70s and even the post-80s demographics, younger Chinese millennials and Gen Zers are willing to pay more for products that give them personal pleasure and are more personalized, which give them access to niche communities or indicate wider knowledge than the average consumer.

Add that to their relatively lower economic pressure and high willingness to try domestic brands that ride the Guochao wave, and this indicates massive potential ahead for the new breed of high-end Chinese fragrance brands.