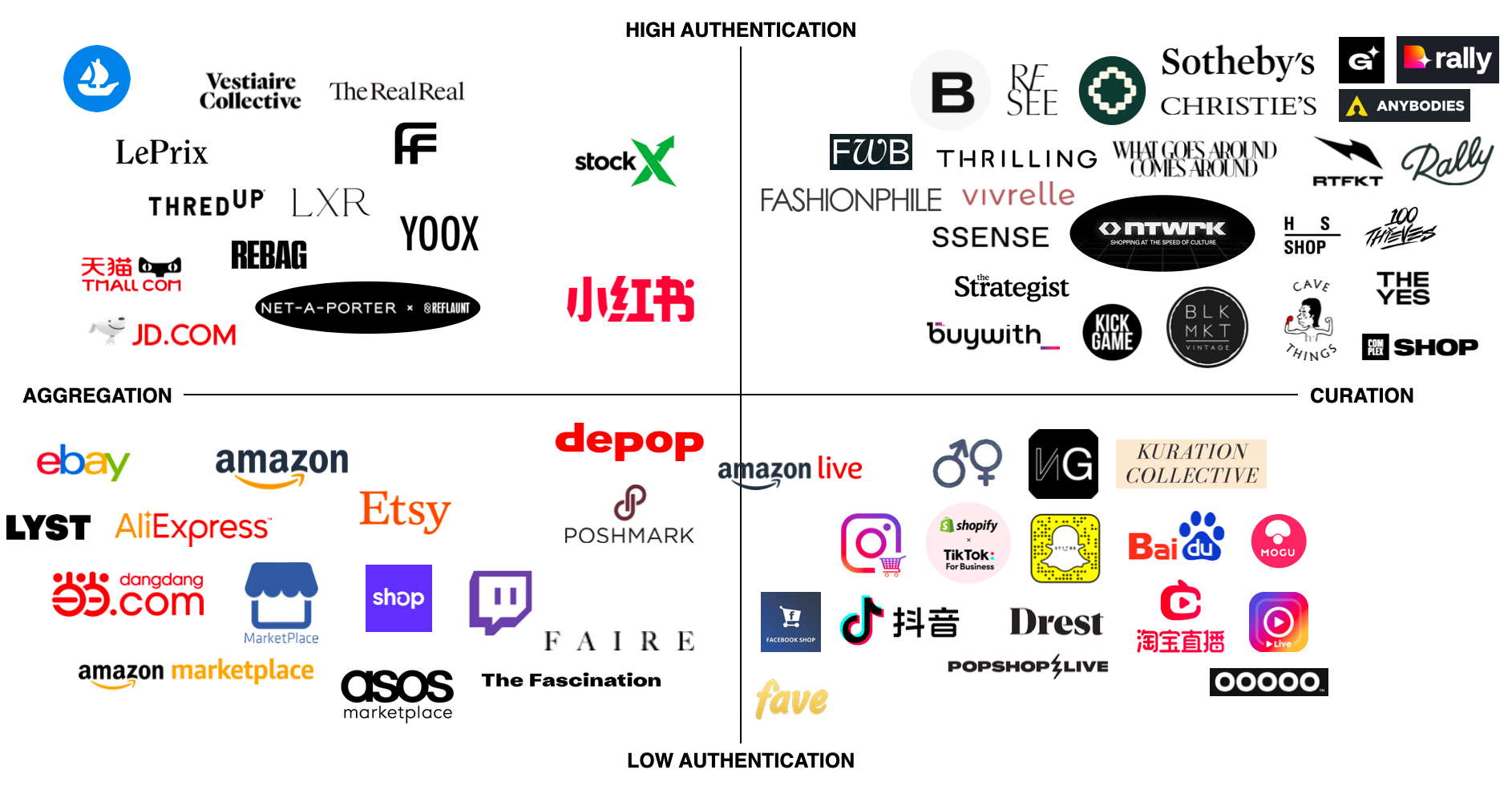

In the latest installment of her Sociology of Business newsletter, marketing executive and author Ana Andjelic looks at the features that power many incumbent and emerging e-commerce destinations, plotting platforms across two axes, ranging from the generalized aggregation of items to a curated selection of products, and from nonexistent product authentication to high product authentication. Spanning everything from broad, low-authentication platforms like Amazon Marketplace or DangDang on one end of the spectrum to Sotheby’s or ReSee on the other, the scatter-plot graph is a valuable snapshot of today's global (yet primarily western) e-commerce landscape.

In terms of the China market, however, the right-hand quadrants of this graph are particularly crucial. As Andjelic notes, these two curation-centric quadrants “are the future of commerce as they provide guided navigation through the authenticated assortment of items.” Going further, Andjelic points out that the upper-right-hand quadrant (high authentication and high curation) is the “most desirable future” for commerce, and in particular is where emerging elements like Web3 enter the picture both as a value-add to physical goods and a reliable authentication mechanism.

Image: The Sociology of Business

Looking at the China market, this is a particularly intriguing idea, albeit a complicated one. As detailed in Jing Daily’s recent market report, “NFT Collaboration: Luxury’s Metaverse Opportunity,” China’s emerging Web3 environment is shaping up to be a very unique place, meaning its application for e-commerce is likely to differ from that in western countries.

Both the Chinese government and leading Chinese technology giants have been active in developing the country’s home-grown Web3. Authorities in Beijing in particular are intent on developing an inward-facing metaverse to advance many of their strategic initiatives, such as boosting domestic and self-sufficient cloud computing and blockchain technologies. Meanwhile, Chinese tech companies are eager to shore up their digital offerings to tap the tremendous market potential presented by increasingly digitally savvy Chinese consumers.

Where things get a bit tricky in terms of the application of elements like blockchain-based authentication for the future of commerce in China is in the particularities of what is legal, what is not, and what sits in a gray area at the moment. While cryptocurrencies – save for the official “digital RMB” – are banned in China, NFTs are not. However, they are not called NFTs, but rather "digital collectibles," and can only be purchased once and not resold or traded, a fact that has kept their average value relatively low. (According to one estimate, about 4.56 million NFTs were sold in China in 2021, with a total value of 100.5 million yuan ($15.83 million) and an average price of just 33.3 yuan ($5.25).)

So while Chinese designers, brands, and retailers may not turn to Web3 elements like NFTs to provide a “phygital” value-add for consumers who make real-life purchases to the extent of their global counterparts, there is value in the authentication factor. This is especially true as China’s secondhand luxury market continues to grow, powered by price-sensitive younger millennial and Gen Z consumers. As noted in the aforementioned Jing report, what we can expect to see in China’s evolving, walled-off Web3 landscape is a more utilitarian use of blockchain technology, playing a key role in protecting the IP of works of art or authenticating collectible items or, perhaps, high-end products sold by domestic e-commerce platforms hoping to assuage consumer concerns about authenticity.

Interestingly, Chinese platforms like Taobao Live, Mogujie, and Douyin already excel in the low-authenticity, low curation quadrant of Andjelic’s scatter plot, a fact that is borne out by the way platforms like Douyin make it easy for individuals and larger retailers alike to sell products and attract an audience by way of entertainment and content-commerce. As Andjelic notes, in this particular quadrant, “Entertainment is paramount […] and winners are going to combine this niche seller visibility with item authenticity and entertaining presentation.” Entertainment is already baked into any successful Chinese platform, with top livestreamers having built vast commercial empires by simply being in the right place at the right time and keeping their audiences entertained while they’re being sold to.

Going further, the piece notes that the three key features of decentralized commerce destinations are “authenticity, community, and visibility,” with contributing factors like convenience, consistency, entertainment, and a social component. In China, where authenticity and community are naturally important, two key factors, visibility and the social component, really define the market. Top livestreamers, like the aforementioned Viya and Li Jiaqi along with thousands of others, essentially started from scratch and, via the visibility and support provided to them on platforms like Taobao Live, built millions-strong audiences that trust and buy from these individuals and connect and socialize with other fans. Considering Taobao Live, for one, has offered streamers the ability to sell to their audiences since 2018, Chinese platforms have a strong head start on their western counterparts, which have relatively recently begun offering e-commerce livestreaming and must fight consumer bias against hours-long infomercial-style sales broadcasts.

In China, it could be argued that the form of decentralized commerce pioneered by Taobao Live, Douyin (the more feature-heavy China-market sibling of TikTok), Kuaishou, Bilibili and many others has been the leading form of commerce for young consumers for several years. The fierceness of competition in the China market – which is as true for individual Taobao sellers as it is for brick-and-mortar retailers and e-commerce giants like JD.com and Tmall – means entertainment-infused social selling and livestreaming are par for the course in China even as they remain in their relative infancy in the west.

What Chinese e-commerce currently lacks, however, is true prowess in the high-authentication, high curation quadrant of Andjelic’s graph, a fact that indicates where the opportunities lie for global players. Already, we have seen the likes of Sotheby’s make headway in this segment by way of departments like Sotheby’s Buy Now Marketplace, which offers the immediacy of on-demand purchasing and the credible product authentication that Chinese consumers demand. One big question for China is which platform could ultimately compete with Sotheby’s and others in that high-authentication, high-curation quadrant – offering tightly curated items with unimpeachable (possibly blockchain-based) authentication, a community of like-minded enthusiasts, and plenty of content to keep audiences entertained and engaged.