Supreme's devoted hypebeasts, who can be found lined up outside its New York City store daily, serve as a constant reminder that, when done right, there's something unarguably enticing about drop retail. In a bid to appeal to Gen-Zers, luxury brands in China have been taking a page from Supreme's book by orchestrating their own drops. It’s been serving them well, particularly on digital fronts, according to a recent report from Gartner L2.

The report ranked high-end brands with “the strongest digital performance within the current circumstances, both national and international,” and among them, two brands who experimented with drop retail models made this year’s cut. One is Louis Vuitton, which ranked number one on Gartner L2's list. In February, the French fashion house launched a WeChat Mini Program to host a pop-up shop for an exclusive sneaker collection designed by streetwear icon Virgil Abloh.

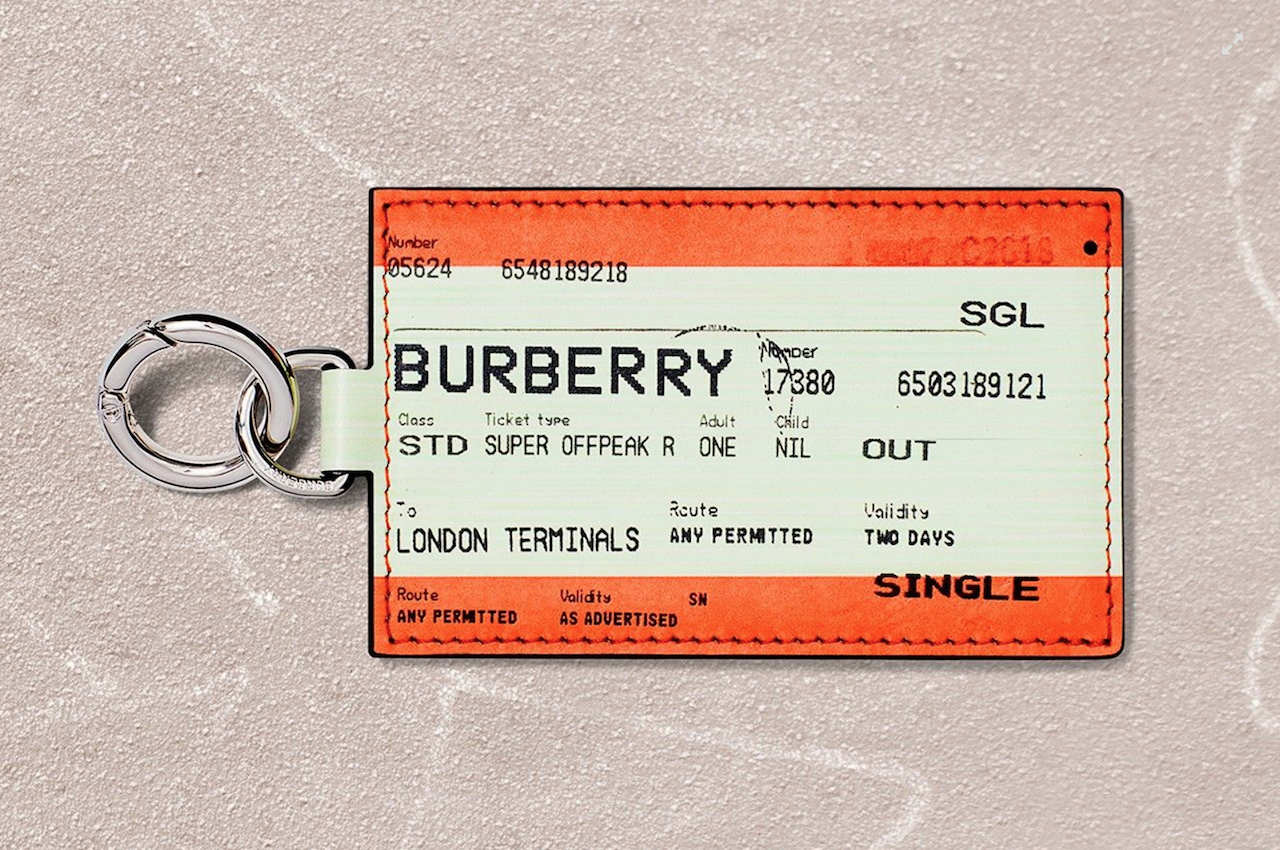

Meanwhile, Burberry, which ranked number nine on Gartner L2's list, was also recognized for its efforts to appeal to young, mobile-first Chinese consumers via their monthly digital “B Series” streetwear drops. Burberry started down this path back in September of last year after welcoming its new creative director, Riccardo Tisci, and generated buzz over the summer months as one of the first big brands to adopt this model. The British fashion brand uses a WeChat Mini Program to release its limited-edition products (they launch on Instagram in the West), and the label fuels anticipation among its Chinese followers by using a countdown clock and push notifications.

While Louis Vuitton and Burberry were the only brands on Gartner L2's top ten list that adopted drop retail in the past year, they weren't the only brands in the industry that opted for its appeal. In January of this year, Balenciaga posted a pink monogram Logo Ville bag for sale on its WeChat Mini Program with few details aside from a link to its e-commerce page. Long before this, LVMH's Rimowa caught the attention of Chinese streetwear lovers with its luggage collaboration with Supreme, which generated buzz on Chinese social media despite the fact that the products were not available to purchase anywhere in the country.

There are signs that this model could be here to stay, at least as long as streetwear culture thrives among young shoppers in China. For now, things look promising, according to Gartner L2’s Luxury China Digital IQ Index 2019 data. It shows that streetwear terms saw a strong 12-percent, year-over-year Baidu Index growth during a one-year period ending in March 2019 (compared to only a 5-percent growth for traditional fashion terms).

“Embracing streetwear and sneakers is a way to stay relevant with the millennial and Gen Z shoppers that are crucial to luxury brands’ future,” said Liz Flora, the editor of Asia Pacific Research at Gartner L2. “Fashion brands’ evolution to meet the next generation’s tastes needs to involve an understanding of not only new fashion trends, but also how this younger generation utilizes digital platforms to gather information and shop.”

In China, WeChat Mini Programs are today’s popular way to execute flash sales, but they're not the only way digital drop retail models are conducted. Moncler turned to Tmall for their limited-time pre-sale of six Moncler Genius collections (with one containing items that were exclusive to the e-commerce platform). Meanwhile, Fendi did a limited pop-up of its FF Reloaded capsule collection on JD.com’s Toplife in tandem with the release of K-pop star Jackson Wang's hit single Fendiman.

Flora notes that in the luxury industry, online is generally a safer avenue than offline for brands that want to try out the drop model, “especially when it comes to items with a high resale value that can spark a buying frenzy among third-party sellers, including China’s daigou agents. Balenciaga learned this the hard way last year when a Chinese daigou agent was involved in a brawl at its Paris store over the Triple S sneaker launch.” (It is worth noting that LV's sneaker collection was, in fact, available at two physical locations.)

While the “drop” is undoubtedly a buzzword for 2019, various versions of this sales model had already been successfully utilized in luxury retail in China. “Instead of a 'drop' where the items are more of a surprise, luxury brands often utilize fashion influencers and celebrities to drive hype online ahead of time and sell out within minutes,” Flora said. Case in point: Mr. Bags worked with Givenchy to promote a limited-edition Mini Horizon bag for 2,173 (15,000 RMB) that sold out in 12 minutes and garnered a lot of attention for the brand.

Of course, it's difficult to predict whether more brands adopting this sales tactic on China's social media platforms will dilute that sought-after allure of exclusivity. But Supreme enthusiasts seem enthralled by more than just the buildup and the hard-to-get mentality — they are also lured in by the brand’s culture. For Burberry, too, it seems that consumers are drawn in by the storytelling around each of Tisci's handpicked products. Ultimately, this just adds to the potential engagement and marketing pull for the brand, which should be a bigger priority than total sales.

However, large luxury brands following the Supreme model are doing so “as it fits into the corporate planning and approval procedures that are needed in that type of business environment,” said Richard Hobbs, co-founder of retail consultancy firm Entrepot Asia. “This does mean that the actual product or collection concept has often been gestating for many months, and often up to a year until the consumer gets their hands on it. The younger, and inevitably more interesting, brands that are appearing are able to move from idea to consumer in a matter of weeks.”

Brands might also gain an edge by embarking on localized, relevant collaborations. “If you are trying to attract a drop friendly audience then it also helps if you are working with designers, brands, or celebrities that resonate with that culture,” Hobbs said. “If the luxury players can deal with the various issues around sign-offs, supply chain, and distribution, this should be a focus, in my opinion.”