As spring approaches in the northern hemisphere, the swimwear category is also approaching its annual sales peak.

According to Euromonitor International's research, the global swimwear market will exceed $16 billion (107.6 billion RMB) by 2020 and is expected to grow to $21.4 billion (143.9 billion RMB) by 2025. Statista's forecast for the industry is even more optimistic: the database predicts that it will grow to about $29.1 billion (195.7 billion RMB) by 2025.

In the US, where the total value of the swimwear sector has surpassed $2.7 billion (18.2 billion RMB), an outbound brand from China has become one of the most popular swimwear labels — with more than 1.05 million followers on both Instagram and Facebook, over one million monthly visits to the company's DTC website, and a 97 percent positive rating on Amazon.

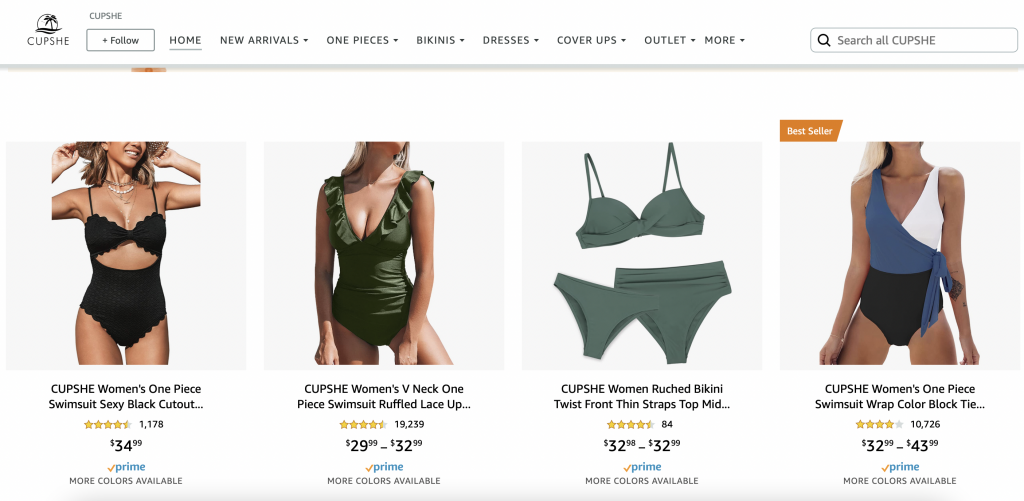

As a leading player in the swimwear category, what makes Cupshe stand out from the crowd in America’s fast fashion market? That is, apart from the cliché of “supply chain advantage,” what other tricks does Cupshe have up its sleeve?

Finding The Right Positioning#

Founded in 2015, Cupshe was initially a fast fashion overseas outfit operating in a wide range of categories, and had not yet found its defining characteristics. During this testing phase, swimwear was only a small part of its many offerings.

Cupshe set its sights on the promising swimwear segment a year later. It began by digging deep into this market through independent research and development, thus establishing clear brand positioning: "quality, stylish, and affordable." With this tagline, the firm has been making inroads into global swimwear — led by its presence in the United States.

According to media reports, Cupshe founder Zhao Liming is a long-term resident of the US and understands American consumption habits and aesthetics. The label’s design team is based there also, which helps the brand stay nimble in capturing current domestic trends.

Unlike Chinese fast fashion e-commerce companies like SHEIN, Cupshe is able to reach a wider audience beyond young Gen Z women: alongside a wide range of styles, it centers the needs of different groups, such as full-time mothers, plus-size women, men consumers, and so on.

Soon, Cupshe, which is deeply rooted in its vertical, will be on a high-speed growth train. In 2018, its global customer base surpassed 10 million and two years later, the business reached $150 million in revenue. Last year, its official software became the most downloaded swimwear shopping APP in the U.S. and the only swimwear APP in the Top 500 shopping APP category.

Two-line Layout: DTC + Amazon#

Aside from its broader target audience, what sets Cupshe apart from other Chinese e-commerce companies is that it has not abandoned its Amazon store while setting up a DTC website.

In an interview with Morning Brew, Cupshe’s senior director of marketing Jessie Han said the group generates 70 percent of its sales from its DTC website, but still gets 30 percent of its sales from Amazon. In terms of channel distribution, Jamie Drayton, senior industry manager for e-commerce at SimilarWeb, explained how Cupshe serves as a great example of a fast-growing young brand that’s balanced its direct-to-consumer strategy with selling on the behemoth that is Amazon. “Cupshe’s managed to grow traffic to their own site by 41 percent year-over-year. This, however, was eclipsed by a 131 percent jump in sales on Amazon.”

Melissa Burdick, one of the co-founders of cross-border e-commerce service platform Pacvue, commented that she prefers to buy on Amazon rather than DTC platforms because of the complicated return processes that are common on the latter. She considers this option an advantage for the firm.

In fact, in terms of service and operations, Cupshe has done well on both DTC and Amazon. Beau Ushay, a marketing consultant, told Jing Daily that it was his partner's positive shopping experience on Cupshe's website that attracted his attention to the brand: “The purchase experience itself was slick, the delivery quick, the packaging looked good, and the product like it should.” He also praised how the handling of return requests is very prompt and rapid, with multiple return options for customers.

Ushay went on to highlight why this was so important. “Buying online is fraught with danger, especially for something so specific and intimate as swimwear. Google ‘online shopping fails’ and you’ll see no end to the frustrating and often hilarious outcomes of impulse purchases from the far corners of the web. Cupshe recognized this and identified a really customer-centrist way to both take the pain out of the purchase journey and provide reassurance if things don’t work out."

Marketing To A Community#

In the United States, the swimwear category itself has an inherent communication advantage since consumers are more likely to share these products. Therefore, the vertical brands in this category are more suitable for social media promotion. As an e-commerce label, Cupshe is no slouch when it comes to this.

According to the data from similarweb, more than half (52.24 percent) of Cupshe's official website traffic from social media comes from Facebook, with the rest coming from YouTube (28.53 percent), Reddit (8.94 percent), Pinterest (5.4 percent), and LinkedIn (2.4 percent). Facebook is obviously the main battleground for its social media marketing, with the business boasting an impressive 1.05 million followers and a total of 1.02 million likes on the platform.

According to Ushay, one of the advantages of Cupshe's social media marketing is the use of customer feedback in its brand story. "Few real-life customers reflect the sizes and shapes showcased in most swimsuit advertising. With the average Australian woman long thought to be a size 14-16, they should be applauded for their realistic representations of their customers. If you’re looking to build attention in a really crowded space, this is a great way to do it."

It is worth noting that in addition to its KOL promotion (the "Ambassador Program") the brand’s website also has a dedicated page called "Cupshe Cares," which is a special page that details the eco-friendly technology used for its iconic digital prints, as well as its high-quality fabrics, ethical workmanship, and recyclable packaging. This aligns with the sustainable consumer mindset, and will help it better integrate into its target market.

Last year, the label announced an expansion into athleisure with the launch of its series "Weekends at the Beach House." The Chinese outbound e-commerce company clearly feels ready to explore new possibilities based on its brand positioning rooted in the beach vacation scene. And, given its expertise and knowledge, it’s more than ready to dive into something new.