Chinese consumers are increasingly e-shopping around the world. According to a study released July 31 by marketing and consulting agency Westwin, 67 percent of Chinese e-commerce consumers had a cross-border purchasing experience last year, a figure that was up sharply from 34 percent from the year before.

On average, China’s cross-border buyers ordered more than once per month from overseas, the report shows.

This rising demand for overseas items has led the country to import 1.5 trillion yuan (220.3 billion) of items abroad in 2017, driving up the transaction volume on cross-border platforms to a total of over 400 billion yuan (58.7 billion), the report shows.

The country’s cross-border e-commerce shoppers are, in general, wealthier than those who only purchase at home. 53 percent of cross-border consumers spent more than 10,000 yuan (1,468) and 15 percent of them spent over 20,000 yuan (2,936) over the past 12 months. In particular, female consumers and those with kids show higher purchasing frequency and spending than others, the report notes.

Among a variety of e-commerce platforms to conduct cross-border shopping in China, Tmall Global, JD Worldwide, and Amazon were favored by residents in China’s big cities. Kaola by NetEase, Suning (苏宁), Vipshop, and Redbook were the go-to places for dwellers in smaller cities. The report also said that “authenticity with guaranteed quality” was the top factor that determined consumers’ choice of the e-commerce platform.

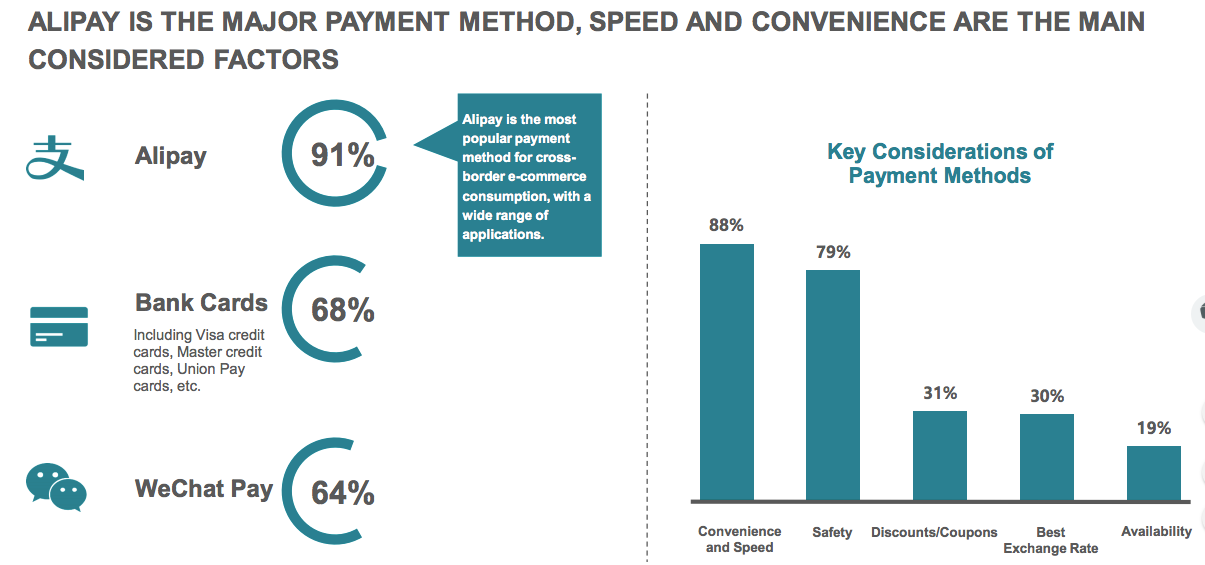

When it comes to settling the orders, Alibaba’s payment solution Alipay was the number one option, with 91 percent of surveyed respondents using it. Bank cards (68 percent) and WeChat Pay (64 percent) came after.

China’s appetite for foreign goods has shown consistency and maturity. 26 percent of surveyed respondents are high-frequency shoppers, who have completed over 20 cross-border orders over the past 12 months.

Cosmetics became the most-purchased category. Female consumers continued to be the main contributor to cosmetics sales, but the male counterpart is quickly catching up. The category of apparel & footwear was a close runner-up, followed by electronic products and food.

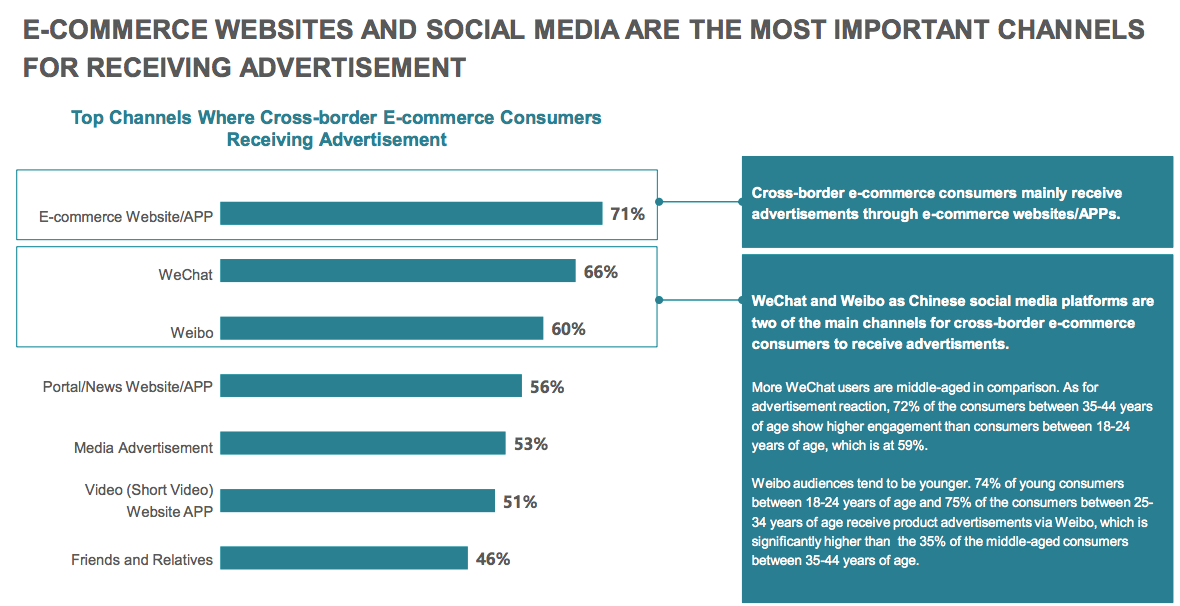

China’s key opinion leaders (KOLs) are the most effective channel (67 percent indicated they look to KOLs to know what to buy) to affect consumers’ purchasing decision, even more important than factors like “product discount” (65 percent), “e-commerce recommendation” (58 percent), and “advertisement/creative events” (38 percent).

Overseas spending#

The Westwin report also examines the purchasing behaviors of overseas Chinese nationals. It uncovers that overseas spending by Chinese consumers, which include spending by outbound Chinese travelers and Chinese overseas residents, rose to 200 billion in 2017, the study shows.

The outbound spending by Chinese tourists alone reached 115.20 billion in 2017, increased 5 percent from the year before. The expenditure for this sector is projected to grow by 4.3 percent to reach 120.25 billion in 2018, the report says.

China’s neighbors Japan (67 percent) and South Korea (62 percent) were the most visited countries last year, followed by the United States (53 percent), Australia (51), and the United Kingdom (47).

The purchasing preference of Chinese overseas tourists has demonstrated a high level of similarity to the country’s cross-border shoppers. Cosmetics category was the most purchased one, followed by apparel & footwear, food, electronic products, and pharmaceutical products.

Bank cards became the main payment method due to the safety concerns. Alipay was chosen by 69 percent of surveyed respondents to complete orders, followed by cash (50) and WeChat Pay (46).