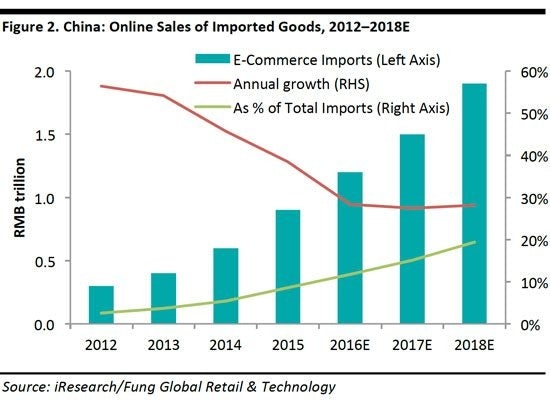

Along with rising disposable incomes and lingering perceptions that overseas products are of higher quality, a growing number of Chinese shoppers are buying goods through cross-border e-commerce. A recent report compiled by Azoya and business consulting firm Frost & Sullivan, titled “The Cross-Border E-Commerce (Haitao) Opportunity in China,” stated that an estimated 125 million Chinese consumers purchased through these channels in 2017. On average, the cross-border shopper spent 5,300 RMB (US848) in 2017, with the total expenditure reaching US105 billion.

The Azoya study found that cross-border import platforms are one of the most cost-effective ways of purchasing overseas products, especially luxury products, with little risk of buying fakes. Even after factoring in a new cross-border sales tax announced in April 2016, the after-tax prices of many products purchased through cross-border channels are lower than those paid on traditional channels.

The growth of cross-border e-commerce is great news for foreign brands, especially for overseas brands and retailers that lack the scale to establish physical operations in China. And even for brands who are planning to launch full-scale retail operation in China, cross-border e-commerce is an excellent means to test the market, allowing retailers to collect and analyze data on Chinese customers, which they can then use to inform their Chinese-market strategies.

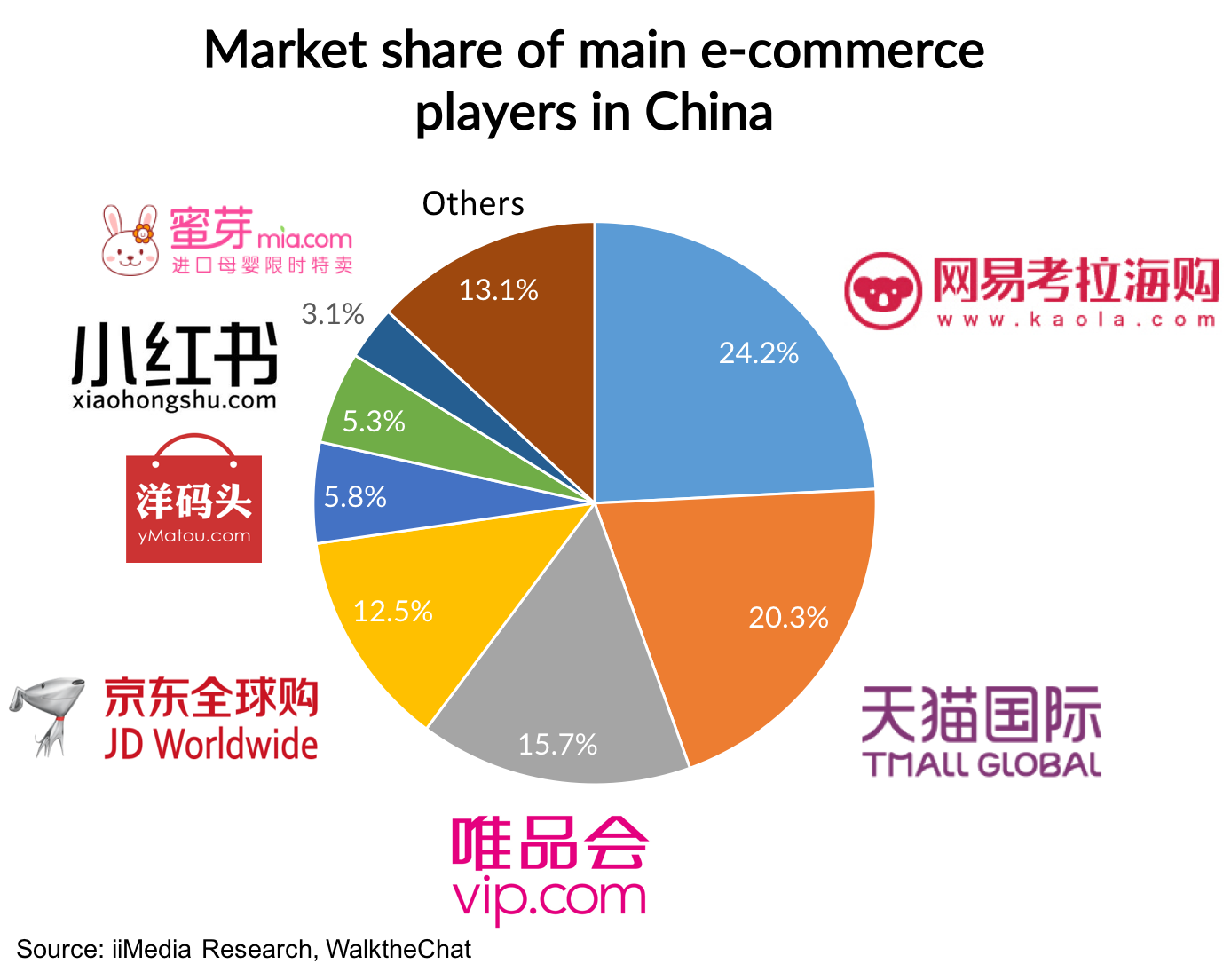

When choosing a platform, brands typically default to Tmall and JD.com, China’s largest and most well-known cross-border platforms, but they're not always the right choice, as they can be costly, have higher application requirements, and swamp a brand with the range of other choices available.

Although smaller than these two e-commerce giants, China has numerous other cross-border platforms that have lower barriers to entry and still have millions of users. Here are four that are well-suited to luxury brands.

1. RED#

With over 60 million registered users, RED (also known as Redbook or Xiaohongshu) is one of the largest and fastest growing social e-commerce apps in China. It is a word-of-mouth marketing platform where consumers can discover and buy international products based on trusted user-generated content, including recommendations and reviews. Its most popular items include foreign cosmetics, beauty supplies, and health products, and they are currently making a push to grow their fashion segment.

RED is truly a hybrid between social media and e-commerce. While it may look a bit like Western social channels such as Pinterest and Instagram, unlike these platforms, e-commerce is a central focus on RED, and users are able to buy products directly from merchants.

The app also has strategic partnerships with many foreign brands. RED is considered an online direct sales distributor. They keep their own inventory which they purchase from retailers, warehouse in China’s eCommerce trade-free zones, and sell directly to customers.

Online direct sales distributors enable international retailers to sell their products in China without registering a company in the country or needing to deal with local regulations and compliance. However, they do require retailers to relinquish some control over their online operations in China.

RED’s built-in influencer network provides brands with direct access to millions of young Chinese females with the intent to shop. Even those brands who decide not to sell their products through RED might still consider running influencer campaigns on the platform.

2. VIP International#

Launched in 2014, VIP International is the cross-border e-commerce sub-platform of VIP.com or Vipshop.com. VIP is currently the third largest e-commerce platform in China, right after JD.com and TMall, with market share of 15.7 percent.

The popular flash sales platform focuses on selling international fashion to Chinese consumers at a discount. Over the past two years, VIP has been working to upgrade its cross-border platform by adding more high-end overseas products to its portfolio and expanding its customer base as well as improving authenticity, selection, price of products, and after-sales service.

Like other cross-border platforms, authenticity is paramount for VIP International, which insists on purchasing products directly from the place of origin. They employ professional buyer groups in 11 countries and regions to guarantee product authenticity from the supply chain and own 12 warehouses overseas and 11 bonded warehouses in China.

3. Beyond#

Established in 2014, Beyond is an up-and-coming cross-border platform that has been profitable since the third quarter of 2017, and is on track to quintuple in size from the year before. Though still relatively small, Beyond’s client list already includes Saks Fifth Avenue, Everlane, DKNY, and Finish Line.

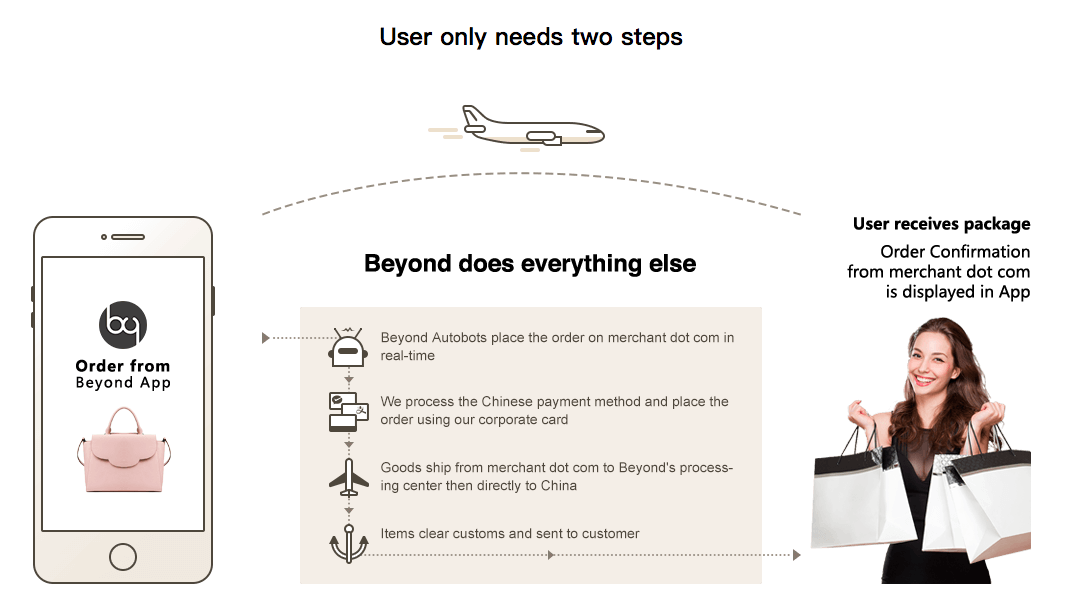

Essentially the platform is a scaled-up version of daigou, or reselling by overseas agents. It helps Chinese consumers buy goods from international brands’ websites and ship them to China. In fact, what you find on Beyond is the same products, pricing, and discounts as the regular U.S. dot com website.

The incentive for Chinese consumers to buy on Beyond instead of the brand’s website is the ability to use Chinese mobile payments, cross-border logistics solutions, and Chinese-language customer service.

Beyond also tries to make things easy for its merchants, claiming that they can get you set up and selling in China in less than three weeks, with no cost upfront. This is a sharp contrast to many of the other cross-border platforms, especially Tmall and JD.com, which require a significant downpayment.

Instead, the company makes money from charging merchants and adding a processing fee on the consumer side. The customer fees are listed as a separate line item to make it clear that the platform doesn’t mark up the goods themselves.

To help promote brands on the platform, Beyond has an in-house content creation team that curates and produces regular editorial content and gives product recommendations, similar to Net-a-porter’s “The Edit”. They also work with a network of external influencers and can help brands with their China marketing efforts.

4. LOOK#

Also focusing on the social commerce trend is up-and-comer, LOOK. This fashion and lifestyle content platform claims to offer products from over 2,520 brands and to have partnered with over 552 KOLs and media. The LOOK app, which allows fashion bloggers to post content and build their own online stores, offers a true ‘look now, buy now’ experience, and has over 252,000 monthly active users.

Besides the LOOK app, LOOK also partners with top WeChat influencers, drawing on LOOK’s brand connections and technology to help them create their own WeChat mini-program boutiques. Gogoboi’s popular store, Bu Da Jingxuan, is powered by LOOK technology.