RED, the app that helps Chinese users find and buy foreign luxury products, launched a Weibo campaign on June 6 that promises to beat the prices of its competitors.

The app’s huge popularity among young, female, Chinese consumers has quickly made the campaign one of the top trending topics on Weibo, where it has attracted over 22 million viewers and generated 24,000 comments.

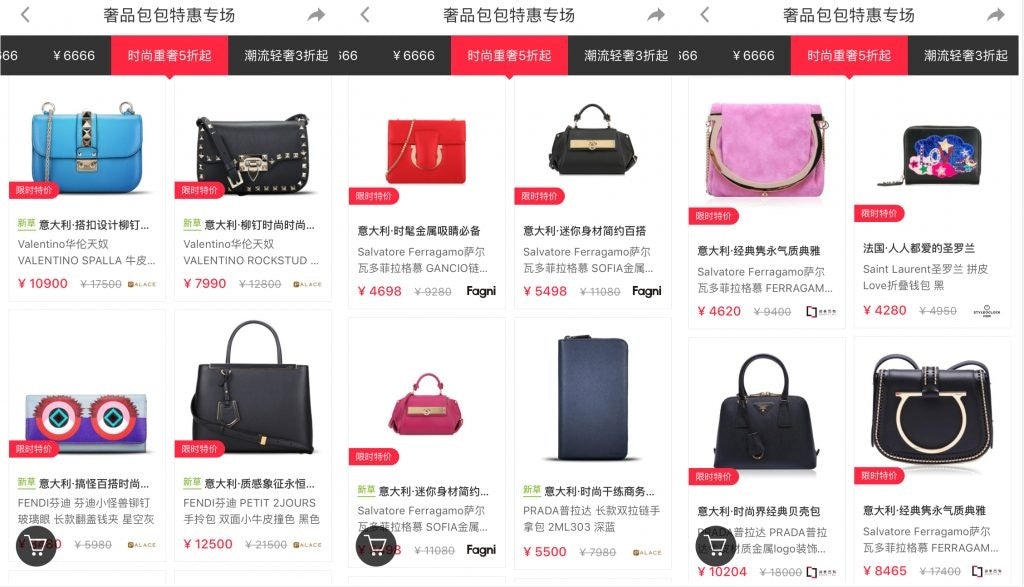

During the life of the campaign (which is still on), if customers can find a better deal than any they find on the app, whether it's for a Fendi handbag or an eye shadow from Guerlain, RED will pay the difference if its bought on the app.

Chinese consumers hoping to reap rewards for their findings, are required to post their discovered deal on Weibo with a photo as evidence and tag RED's official account with a hashtag bearing the Chinese name of the campaign: “yi gui jiu pei" ("pay the difference").

Many Weibo users have participated in the campaign thus far. For example, an account named “Dou Dou” tagged RED in a post on June 6, writing, “Hey, I found that Clarins's Toning Lotion, which is sold on Jumei, is RMB 60 cheaper than the one on yours. Please keep your promise to pay the difference.”

The above user compared RED’s Clarins offering with another cross-border e-commerce player Jumei International Holding, which is a Chinese e-commerce firm founded by young Chinese billionaire Leo Chen. Jumei specializes in beauty and skincare brands, which has made it a major competitor of RED in recent years. JD.com, Taobao stores and some other domestic e-commerce sites are also referenced by RED’s customers when comparing prices.

RED, which was founded in Shanghai in 2013 by Mao Wenchao, a Stanford MBA graduate and former Bain consultant, combines “e-commerce” and “social media” features that are attractive to female consumers between the ages of 18 and 35. These consumers not only want to purchase luxury goods overseas but also hope to share their shopping tips and learn from the purchasing experiences of others.

The unique "e-commerce + social” business model has made RED a huge success. However, when the Chinese government enforced a new tax policy that raised the import value-added tax (VAT) and consumption tax in April 2016, the whole cross-border e-commerce sector began to suffer.

Chinese consumers now have to pay more taxes than they did before for luxury goods they buy from foreign countries. That's why pricing is a crucial point for domestic e-commerce operators who sell foreign goods.

According to the introductory remarks of the campaign on its official Weibo account, RED hopes the current campaign will highlight its competitive pricing advantage.

“After four years of development, RED has the confidence and ability to offer low prices to consumers,” said Mao Wenchao, RED’s CEO when he was interviewed by Chinese domestic media about this campaign.

“First, the social media community that we build in the app provides us with data to accurately calculate the demand for each product, improving the inventory turnover rate,” Mao said, “In addition, we have built our international logistics team and overseas warehouses that lower our costs.”

In 2016, according to one report, the total number of cross-border Chinese buyers, including but not limited to RED, reached 41 million in 2016. As of the end of September 2016, the registered users of RED, alone, exceeded 15 million.