Key Takeaways:#

As the world’s largest textile manufacturer, China is home to an abundance of flexible supply chains for the apparel industry. However, this agility has turned the country into a hotbed for the knockoff economy.

Rising KOL talents gain increasing social influence and recognition thanks to their social platform posts. But the flip side is that these stylish images of hero products often give counterfeiters ample resources to plunder.

Entities need to put more effort into building their brand image and initiate education around their design inspiration and brand values to raise consumer consciousness around intellectual property.

Every week, Instagram shows us that emerging brands are getting knocked off by big-name brands. Until recently, the opposite was true in China; counterfeiters became experts at copying the big luxury names. Now, the tide is turning, and local profiteers are turning to social media to copy emerging designer names.

Virgil Abloh’s “three-percent” approach is the latest acknowledgment of the hardships in controlling IP within the fashion industry. The artistic director of Louis Vuitton's menswear collection has a theory proposing you only need to alter an item by three percent to make it new in the eyes of the law — an “open secret” in the creative industry. Now, as more designers take to platforms like Weibo to vent their frustrations, a controversial civil lawsuit lasting two and a half years has rocked the domestic fashion industry.

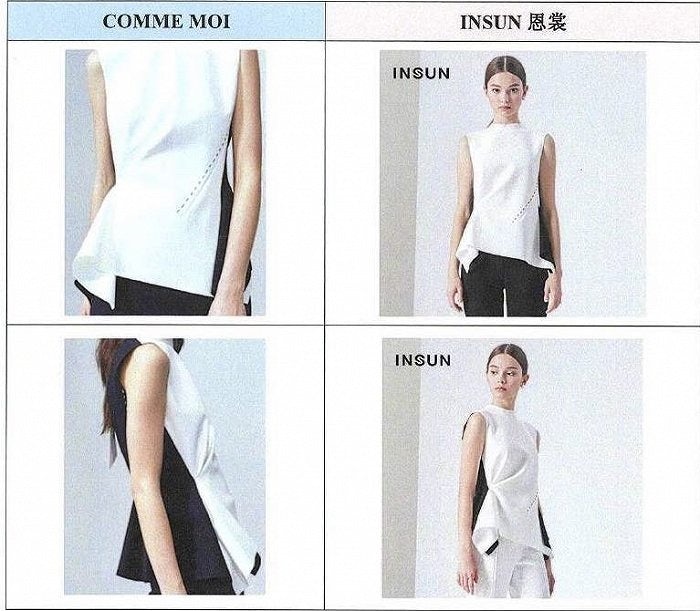

The copyright dispute between local designer brand Comme Moi — founded by Chinese supermodel Lyu Yan — and Yinger Fashion Group — a local fashion conglomerate based in Shenzhen — finally reached a verdict last month. The incident was initiated in March 2019 after Lyu accused several brands owned by Yinger of copying Comme Moi’s designs on Weibo, and she demanded the other party stop plagiarizing her work.

In response, the Yinger group sued Lyu and her brand’s parent company, Shanghai Shini Commerce Company, for slander and unfair competition/compensation to the tune of 1.54 million (10 million RMB). The final judgment found that the designer brand must revoke its claim against Yinger and pay the company 460,000 (3 million RMB) in compensation.

This case is unique in that brands smaller than Comme Moi are usually not even capable of taking big companies to court. Yet, these copyright disputes among local industry players still happen daily. According to a quick look on Taobao, copies of Shushu/Tong’s beloved bow tie earrings, Calvin Luo’s classic belt blazer, or Ming Ma’s signature dress with tulip prints have been best sellers on the marketplace, but at lower price points.

In addition to public e-commerce platforms, private domains like WeChat are primary marketplaces for trading counterfeits of big-name designers like Comme des Garçons and smaller ones such as Kaiy Xiao. This shift is now sabotaging the young designer brand ecosystem by taking customers away from designer brands and diluting their brand value chains.

Given this predicament, Jing Daily has looked into this crippling issue while highlighting the challenges for smaller brands and how they can fight back.

The obstacles for designer brands#

As the world’s largest textile manufacturer, China is home to an abundance of flexible supply chains for the apparel industry. However, this agility has turned the country into a hotbed for the knockoff economy. When it comes to the piracy of fashion products, there are many types of copycats: In addition to selling counterfeits with an identical look, which is the best-known practice, copying iconic patterns and illegal licensing are two other major infringing tactics.

Speaking to Jing Daily, Central Saint Martins graduate and Lane Crawford Scholarship-winning designer Ming Ma said that “some retailers have not reached a partnership agreement with us due to their store image being inconsistent with our brand. Yet, they still manage to sell our products.” These illegal products are priced slightly lower than the legal ones, which often misleads customers who are not intending to buy unauthorized products or fakes. As Ming added, these infringements cause damage not only to brands but also to legal stockists.

While there are solutions for preventing this illegal conduct, emerging brands often have limited capital to invest in intellectual property protection. If they did, they could take advantage of the initiatives offered by China’s leading e-commerce players, as the big luxury players do. In fact, Alibaba and JD.com have invested in blockchain technology to protect their products’ original design and content by tracking origins and preserving digital data.

With the cost and risk of counterfeiting products by leading luxury houses rising, high-end homegrown designer brands have unfortunately become new targets. Compared to giant luxury houses, these niche players and independent designers own less capital and manpower and cannot afford to take on IP protection disputes. As it stands, they have struggled to afford IP protection tools offered by e-commerce platforms, let alone a department dedicated to dealing with legal infringements.

Is there a piracy paradox in China?#

The role of KOLs cannot be overlooked when scrutinizing China’s knockoff economy. Rising talents gain increasing social influence and recognition thanks to their social platform posts, particularly on Little Red Book. However, there is a flip side to these celebrity endorsements: These stylish images of hero products often give counterfeiters ample resources to plundering.

Another issue arises when top-tier KOLs sell counterfeits of emerging designers to their loyal followers via their e-shops. These products, which KOLs often stock in their online stores, keep in step with the latest fashion trends and copy iconic silhouettes and prints from established or emerging designers. But these counterfeits are priced more accessibly — a typical way to monetize social followings. This activity can upset fans and designers alike.

Counterfeiters who can also dupe KOLs demonstrate excellent brand awareness and market recognition, Ming said to Jing Daily. In fact, the current state of fashion reflects the concept of the “piracy paradox,” which argues that the fashion industry “counter-intuitively operates within a low-IP equilibrium in which copying does not deter innovation and may actually promote it,” according to professors Kal Raustiala and Christopher Sprigman.

However, the copycats, inspired by a designer's fame and market value, ironically puts them in an unfavorable position, given China’s social and e-commerce ecology. For instance, immediately after Rui Zhou was announced as one of nine LVMH Prize finalists, knockoffs of her designs appeared on Taobao and WeChat Moments.

In other countries, smaller names are likely to be embroiled in potential cyber disputes, with many calling their IP ownership into question or suspecting them of driving traffic for brands when they are merely defending their legal rights.

Taking action to safeguard against counterfeiting#

In light of this complicated and challenging market environment, local creative communities and fashion intelligence agencies are joining forces to assist homegrown brands and talents. Recently, TUBE Showroom and BOND on BUND co-sponsored a roundtable forum to explore intellectual property protection issues for independent designers.

Zemira Xu, the founder of TUBE Showroom’s parent company, DIA Creative, says brands have been more aware of trademark registration and filing lawsuits against counterfeiters over recent years rather than merely calling out such incidents on social media.

“As many local designer brands have their trajectory on broader attention and larger market shares, [DIA] is in a unique position to encourage brands to be more vocal and rational when dealing with this critical issue,” said Xu to Jing Daily.

Additionally, she pointed out that entities need to put more effort into building their brand image and initiate education around their design inspiration and brand values to raise consumer consciousness around intellectual property. From a customer perspective, this will help them to distinguish counterfeits from real brands. “If no brand raises this issue, how can consumers realize the complications that brands are faced with?” Xu asked. And in the long run, a stronger brand image and equity will power labels to be more resilient to fight against fakes and achieve sustainable growth.