Whether it’s watching Dior’s beauty director Peter Philips touching up a model’s makeup in Chengdu, or being able to obsess over the latest trench coat at Burberry’s runway show in London, or a celebrity having an L’Oreal makeover backstage at the Cannes festival, thanks to livestreaming, fans have been able to experience all of the above — and much more — on their phones.

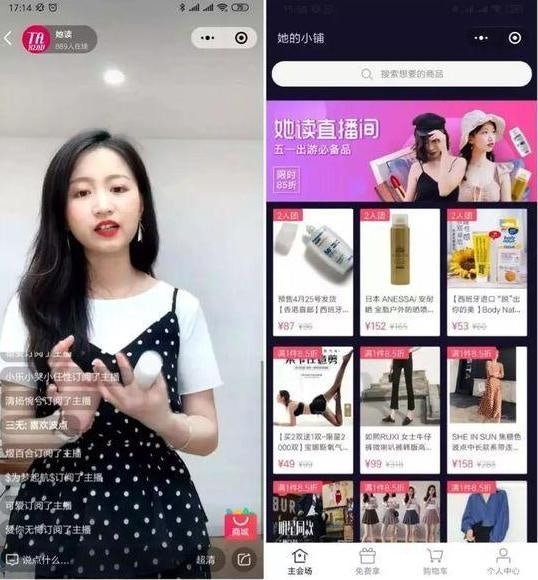

Now, latecomer Tencent officially opened up livestreaming on WeChat in early March. It invited a few select WeChat accounts, including “Hibetterme (女神进化论)” and “She read (她读)” to test livestreaming on April 21st. Viewers could tune in through the Mini Program or purchase via the WeChat mini-mall online. The results were impressive. Within two hours of livestreaming, “She read” had more than 11,915 people tuning in and 1,228 orders, grossing 28,000 (190,000 RMB).

This soft launch proved a success for Tencent’s move into livestreaming, a field dominated for some years now by top players such as the NY-listed shopping app, Mogujie; the livestreaming platform, YY, and Alibaba’s livestreaming platform Taobao. The poster child of Taobao livestreaming is Li Jiaqi, better known as the “Lipstick Man,” who became famous for selling over 15,000 lipsticks in five minutes. Jiaqi’s success, however, wasn’t overnight. In fact, it took two years of livestreaming to build the trust of his fans. Meanwhile, WeChat maybe late to monetize this feature compared to Taobao, but they are building on the trust shared between WeChat influencers and their fans, not by putting influencers' face forward, but with long-form analysis and savvy opinions.

We spoke to a few top fashion influencers on WeChat, who have not experimented with the newly-offered livestreaming feature. One told us anonymously that he is prioritizing making short videos instead, so he can focus on quality rather than quantity, which is harder to achieve livestreaming, as there are more uncontrollable factors. Another, Anny Fan, who has over 300,000 fans on WeChat, said she is open to trying it out, perhaps using it as a channel to talk with her many fans, who already use WeChat on a daily basis. It’s true that instant communication is attractive for bloggers to develop closer bonds with their fans, with WeChat, viewers can livestream on the Mini Program and interact with the host via bullet comments (弹幕), but they can’t tip the host or access paid content like other livestreaming platforms offer.

But livestreaming, as a tool, can grant a sense of democracy to the industry, which is refreshing to see. However, for luxury brands, who normally like to control every aspect of their brand image, livestreaming this can be a difficult tool to control. Adding that in China, livestreaming is transaction-driven, and synonymous with “cheap goods” or “eager to sell ” — the exact opposite of how luxury brands want to be perceived. For this reason, the screen can’t deliver the same sense of discovery and experience that an in-person store visit can. So is livestreaming still for luxury brands?

Perhaps, one of the biggest benefits is the data brands can harvest from each session. We spoke with the Lanton Chen, CEO of the agency MoWin Digital Holdings, who handles the social e-commerce for “She read (她读).” (They are responsible for connecting e-commerce data and behavior back to a proprietary CRM system.) According to Chen, they were able to identify potential customers, who click through to watch the livestream, but did not buy. Then, within 48 hours, the company automatically set up a WeChat template message to be sent via Official Service Account to entice viewers to close the deal.

Similarly, in their first livestreaming attempt via WeChat last year to sell their makeup, Dior collected some interesting data — perhaps their next target users — that top views were female, 38 percent of which are post-90s, and mainly from non-first-tier cities like Chengdu, Guangzhou, and Shenzhen.

Another thing luxury brands should be aware of is the return rate. The nature of instant interaction is impulse shopping. Jing Daily has learned from experts that the return rate could range from 15 percent to 50 percent, with strong evidence that the higher the prices are, the higher the return rate is.

So could WeChat livestream be a shortcut for brands to sell? The quick answer is no. It’s simply another channel for brands to leverage to their advantage and be creative with. The definite answer is young luxury shoppers demand transparency, which is something brands can’t avoid to deal with, whether livestreaming or not.