The tastes of Chinese luxury shoppers are changing rapidly as the country itself is undergoing a dramatic economic and political transformation. In 2018, luxury brands face the question of how Chinese consumers' mentalities and behaviors will evolve.

Taking into account upcoming political and legislative events, the latest report issued by Mintel China uncovered 5 key trends for brands to expect. Jing Daily selected the top three trends that have unique implications to the luxury industry, and applied our takeaways on how luxury brands could align their strategies accordingly to fit consumers’ changing demands.

1. Consumers Desire Greener Purchases#

Because of worsening environmental pollution in China, Chinese consumers have become increasingly aware of the benefits of living green, not simply for egalitarian purposes, but for their own happiness. According to the report, consumers are more likely to purchase ethical brands at a premium price. 58 percent of surveyed consumers indicated that they are willing to pay more for ethical brands, and 58 percent of respondents agree that buying ethical products make them happy.

Industry observation:

A fashion group leading the recent green movement in China is Kering. Kering recently launched a WeChat mini-program called My EP&L (Environmental Profit & Loss), an environmental impact measurement tool. By choosing the type of material, source of the material, manufacture region etc, consumers can learn about the environmental costs behind their fashion purchases, and can then make ethical choices based on the calculated cost. The lower the cost is, the more environmentally friendly the product is. With increasingly green-minded Chinese consumers, this tool can provide an additional metric to assess the price tag of a luxury item.

2. Consumers Desire a Way to Relieve Societal Pressure#

The report also said that increased social stress is driving China's younger generations to demand alternative ways of relaxation. Chinese culture's emphasis on academic and social achievement puts pressure on individuals by comparing them with their peers. As a result, young Chinese want to flee to a virtual world to escape from reality and desire a more playful way to interact with their physical surroundings.

Industry observation:

With innovative use of retail space, luxury brands can provide a gateway for Chinese consumers to take a short break from reality. Brands can apply the traditional notion of retail therapy like extravaganza shopping, but also seek to enrich consumer experiences. Active athleisure brand Lululemon provides a good example with its strong background in experiential retail. The brand invites consumers to join group yoga and meditation activities as part of their regular retail store strategy to attract loyal fans.

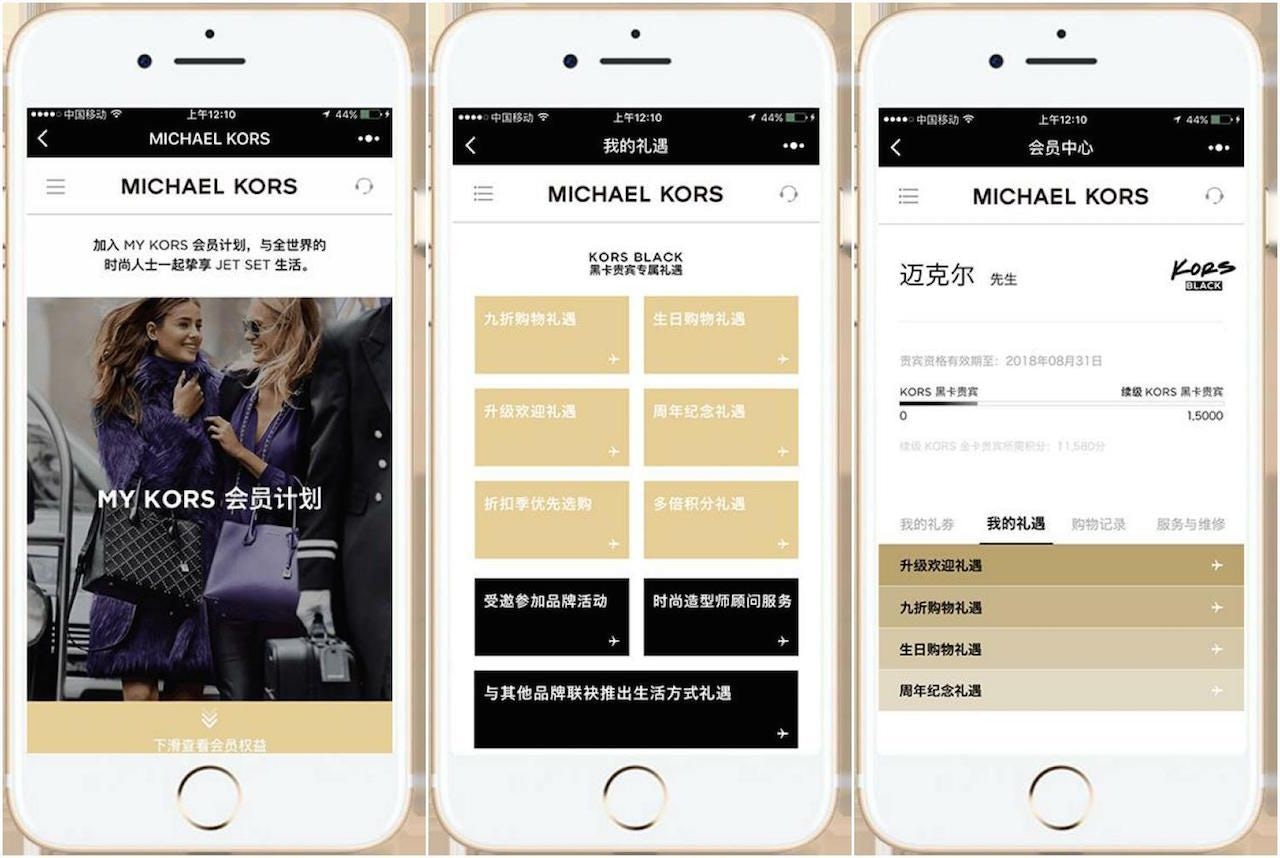

3. Mobile Interaction Will Become a Must For Consumers#

With many new changes stimulating innovation in the industry, brands need to pay attention to some ongoing trends such as interaction on mobile platforms. Consumers are embracing mobile for the convenience it brings, whether it’s about posting on social media, watching live-streaming and videos, or spending on m-commerce. Brands who do not have an easily accessible mobile platform will be seen as incompetent by Chinese consumers in 2018. Mintel research shows that mobile platforms are where consumers live and breath 24/7. 87 percent of Chinese consumers in tier 1-3 cities used mobile payments in 2017, up from 69 percent in 2016. What's more, virtual reality (VR) and augmented reality (AR) will increasingly integrate with mobile, allowing greater convenience and efficiency for consumers.

Industry observation:

Luxury brands who have a weak mobile presence in China will face serious challenges. Even if the luxury industry is not traditionally a pioneer in digital spaces, Chinese consumers have become accustomed to the idea of doing everything on mobile and consumers’ digital experiences will affect the value of a brand's image. In some instances, consumers have complained that their experiences on a brand’s mini-program were not ideal and actually discouraged their attempts to further engage digitally. Moreover, these digital experiences left them with a bad impression of the brand as a whole. Another example of this finding is our recent report, which uncovered the grey practice of sales associates using WeChat to communicate with their clients, further reflecting consumers’ desire to infuse their in-store shopping experience with mobile usage.