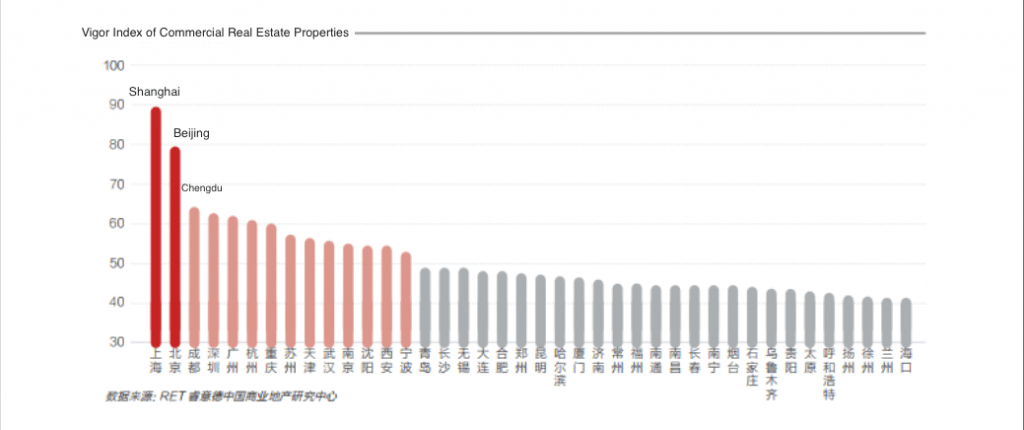

China’s luxury market has been recovering since the second half of last year, and luxury brands need to better identify potential growth markets to leverage this recovery. A recent report co-released by China’s commercial real estate researcher RET, Deloitte, and Nanyang Technological University studies the vigor index of China’s commercial real estate properties, which is based on the indices of retailing, lifestyle, shopping malls, and consumer purchasing power. The report indicates that accessible luxury goods consumption is gaining momentum and discusses the strengths and weakness of the consumption structure in China’s commercial hubs. Here are Jing Daily’s takeaways from this report.

Accessible Luxury Brands Are Gaining Momentum#

China is becoming the next gold mine for accessible luxury brands, a term coined by consultancy Bain & Co to describe brands such as Coach, Kate Spade, and Michael Kors.

In fiscal year 2016, Coach opened 14 stores on mainland China. That year, Coach’s sales in the Greater China region grew three percent in dollars and seven percent in constant currency. Mainland China was the major force that powered this growth, offsetting the continued sluggishness in Hong Kong and Macau. Furla, an Italian accessible luxury label, opened nine direct-sale stores and four franchise stores during the same period.

What drives the growth in this luxury segment is a younger and more affluent base of consumers—an emerging young middle class—who are now buying to reward themselves rather than to gift to others, according to the report.

China’s 1.5 tier cities, a real estate term coined by Jones Lang LaSalle that refers to China’s thriving commercial hubs that have yet to attain the development of cities like Shanghai and Beijing, have gained more attention from accessible luxury brands.

Absolute Luxury Brands Are Cautiously Expanding#

The overall domestic luxury market in China began to pick up in the second half of 2016. Absolute luxury brands—high-end labels in the sector—are expanding cautiously, as evidenced by frequent shop opening and closing operations, which resulted in a slight net increase in the number of stores last year.

Among first-tier cities, one Louis Vuitton store and one Burberry store were closed last year in Shanghai. However, four new boutiques including Bottega Veneta, Gucci, Cartier, and Ferragamo opened in Guangzhou.

Luxury brands ramped up their expansion in 1.5 tier cities. Xiamen, Changsha, Chengdu, Zhengzhou, Wuhan and other 1.5 tier cities all witnessed the opening of new luxury stores last year.

Shanghai and Beijing Are Still Leading#

The best way for a brand to make a splash in China is still through Shanghai and Beijing, where purchasing power is strong and the market is mature with a balanced structure that covers absolute luxury goods, accessible luxury goods, and lower-end brands, which means brands at every rung of the ladder can find their target demographic.

Both cities set the benchmark for other cities and act as weather vanes pointing in the direction of trends, as they are the location of the Chinese fashion and media industries. Therefore, for new brands, the road to conquer the Middle Kingdom likely starts from Shanghai and Beijing.

Chengdu is China’s Dark Horse#

Although Chengdu’s purchasing power is lower than that of Shanghai, Beijing, Guangzhou, and Shenzhen, this southwestern city has a balanced consumption structure similar to Beijing and Shanghai. It has surpassed first-tier cities Guangzhou and Shenzhen in overall commercial real estate performance; becoming a fashion center in the western part of China.

Several reasons cause luxury brands to highlight Chengdu in their expansion agenda. Chengdu is the most important city in southwestern China. Sichuan Province, whose capital is Chengdu, has a strong luxury consumer base. Furthermore, the number of residents in that province with at least RMB 10 million (approximately 1.5 million) in investable assets grew from 50,000 to 100,000 in 2016.

Other Chinese Cities That Luxury Brands Need to Explore#

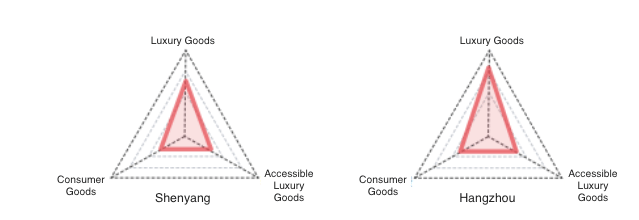

The cities of

Hangzhou#

and

Shenyang#

are preferred by absolute luxury brands more than accessible luxury brands. Data from Hangzhou Bureau of Statistics shows that GDP per capita in Hangzhou was 18,025, reaching the level of high-income countries by the World Bank's definition. Luxury brands’ preference to Shenyang is owing to the city as one of the few commercial hubs in the northeast region.

The luxury goods market of

Shenzhen#

is rather weak because it is right next to Hong Kong, and residents in Shenzhen often go to Hong Kong for luxury shopping.

Guangzhou#

does not have much of an accessible luxury market. Together with Wuhan and Ningbo, Guangzhou is where accessible luxury brands don’t have much presence. Make no mistake—Guangzhou is a relatively wealthy city, but this does not translate into high demand for luxury goods. The city is a big manufacturing hub for clothes, shoes, and bags. Residents are used to purchasing good-quality outfits with good deals, depressing demand for luxury fashion.

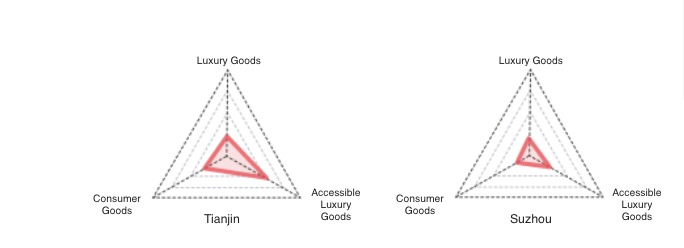

The affordable luxury markets in

Tianjin#

and

Suzhou#

are thriving, with strong consumer spending. With an already strong consumer base for accessible luxury goods, people in these two cities might demand more expensive luxury brands in the future.

Wuhan#

is worth taking a closer look at, as there is a lack of distribution of retail brands in the central region of China. Retail brands in Central China have less presence than in the western and eastern regions. Wuhan, with the highest retail index in the central region, has great potential to grow its accessible luxury market. In the coming years, several major large shopping developments will open, and the Wuhan market will likely increase its demand for luxury brands.