Even though the late Virgil Abloh famously stated that streetwear was dead back in 2019, the extent to which it has infiltrated mainstream fashion today proves otherwise.

In China, local streetwear brands are thriving, and global brand collaborations are fueling their growth. International powerhouses like Nike, Adidas and Asics are increasingly tapping domestic players like Randomevent, Melting Sadness, Roaring Wild and Attempt to connect with Chinese streetwear fans.

Due to its soaring popularity, Chinese sportswear label Anta Sports even overtook Nike in annual revenue in China for the first time in 2022, reflecting the country's evolving fashion landscape. It is therefore the ultimate moment to take a deep dive into consumer trends and movements there.

On April 18, Collabs & Drops invited sneaker product manager Kenneth Huang and GQ China’s Lysander Zhang to discuss the state of China’s streetwear scene. Titled China: The Streetwear Conversation, here are the three takeaways from the webinar.

Gorpcore Is Just One Of Many Trends#

Brands cannot generalize a nation as huge as China. One of the leading takes was that the outdoor hiking aesthetic known as gorpcore is just another trend within the multifaceted realm of streetwear.

As Huang highlights, Japanese “city boy” aesthetic, the “Westernized fit” of basketball-inspired looks, Chinese design languages, as well as high fashion looks — influenced by the fact that China remains the world’s second largest consumer of luxury — all contribute to China’s streetwear culture.

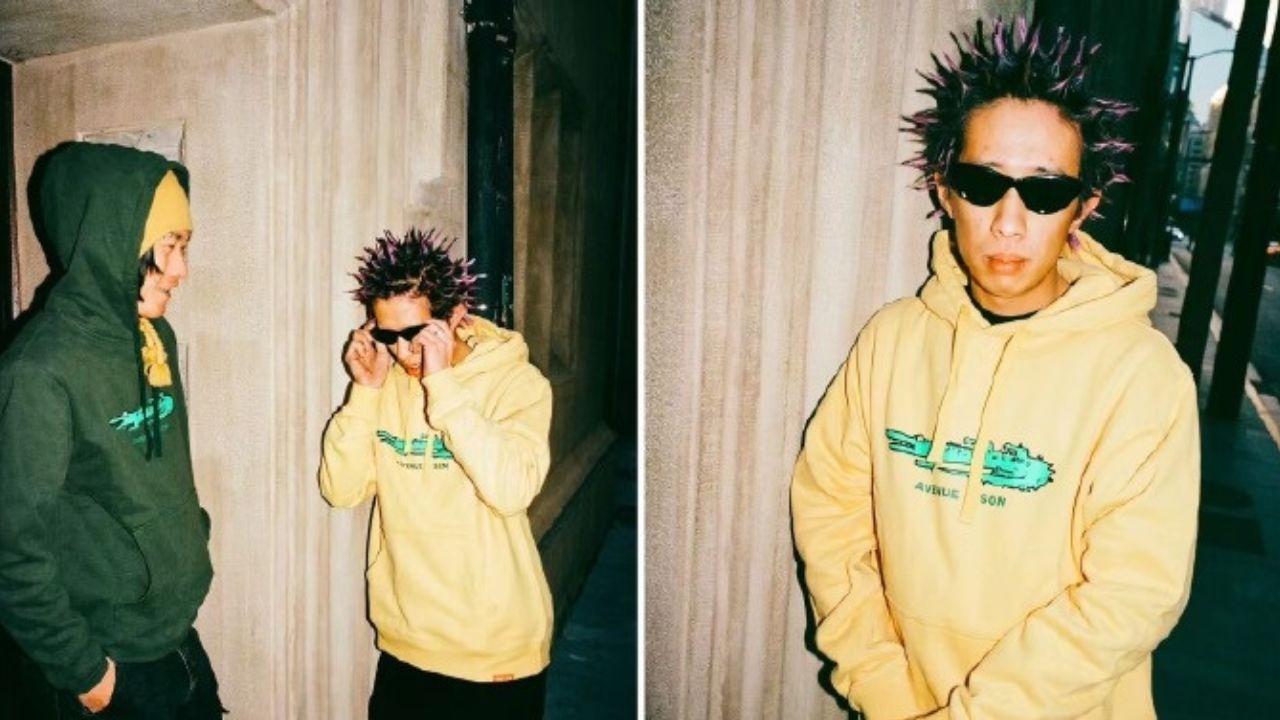

Adding to that, Zhang also referenced the Yabi subculture, representing Chinese underground music scenes, as well as the rising popularity of the CleanFit.

Social Media Rules The Roost#

Zhang also noted that through social media, there is an eclecticism of identities exposed to Gen Z, so they often take different influences to create their own styles.

“All the young people want to show their unique sense of style through their appearance, through the way they live, through their clothes,” says Zhang. “For example, in Shanghai there is vogueing, which breaks the boundaries of sexuality, and [those consumers] wear whatever they feel comfortable.”

However, as these subcultures become more mainstream and relevant in China, Huang points out a sense of lost authenticity in the purchasing process.

In reference to China’s booming KOL-culture, he said, “The top [of the influencing chain] should be authentic, but even they are being bought by brands now. I think streetwear is having a really difficult moment of real authenticity [in China].”

The Masses Aren’t Aware Of Streetwear History#

According to Huang, “The spending power is a lot faster than the cultural developments.” While shoppers in Europe or the U.S. generally have an understanding of streetwear’s origins, those in China tend to be influenced by a small group of consumers who know the cultural relevance of what they are purchasing.

“It’ll take some time for China to get there and evolve the individual’s own taste,” added Huang. “The development of streetwear trends such as gorpcore has moved so much faster than the way people digest culture on a time spectrum.”

For more on brand collaboration, check out Jing Daily’s weekly Collabs and Drops newsletter — a weekly analytical lowdown on the latest news. Sign up here.