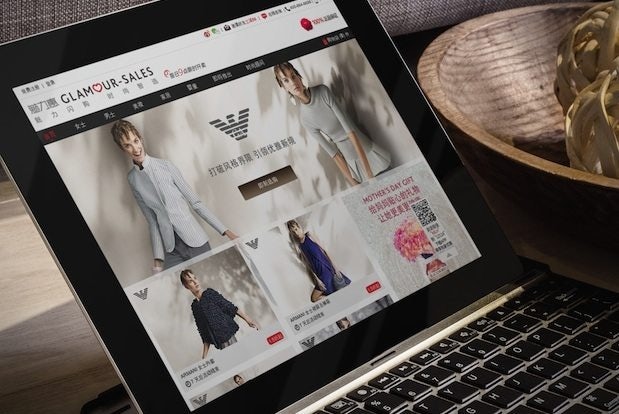

Luxury flash sales site Glamour Sales lost Neiman Marcus and gained Chow Tai Fook as investors this week. (PlaceIt)

Chinese luxury flash sales site Glamour Sales may be losing a major shareholder in Neiman Marcus, but jeweler Chow Tai Fook still sees major potential in the company’s ability to lure bargain-hunting Chinese shoppers.

After scaling back its China e-commerce venture last year, Dallas-based Neiman Marcus announced this week that it is selling the 44 percent stake it held in Glamour Sales over the past two years. While details of Glamour Sales’ buyback were not disclose, Neiman Marcus originally purchased the stake for $28 million. Neiman Marcus has undergone significant changes over the past year—in May 2013, it announced that it was closing down its China warehouse, and in September, the company was sold altogether.

The withdrawal from Glamour Sales was prompted by “substantial losses” that ensued when the site attempted to sell full-price items, according to The Wall Street Journal.

The problem was that Chinese shoppers didn't want to pay full price, said Olivier Chouvet, co-founder and chief executive of Glamour Sales, which is buying the stake back at a price it won't disclose. "Chinese consumers are going online to get a good deal. If there's no motivation on price, you can't convert them," said Mr. Chouvet.

However, it looks like all is not lost for the discount e-tailer. Hong Kong jeweler Chow Tai Fook announced yesterday that it is teaming up with London asset management firm Investec Bank PLC to invest a combined $65 million for an undisclosed stake in the company. “Chow Tai Fook Enterprises is synonymous with luxury and success for all Chinese, and we are looking forward to dramatically growing Glamour Sales together,” said Chouvet about the deal.

Going forward, Glamour Sales would do best to focus on discounts rather than full-price goods, since China’s online luxury shoppers are showing high demand for lower-priced items. A recent study by consulting firm KPMG found that cheaper prices are the top purchase driver for Chinese consumers to purchase luxury online, with 74 percent of respondents citing price as their reason for buying.