The watch industry is more reliant on digital than ever before as Chinese consumers take to their phones to research their wristwear. Digital Luxury Group released a tool that measures brands' traction on Chinese social media just in time for Swiss watch show Baselworld 2018. Chopard ranked number one at time of writing.

The rankings on DLG's "China Word of Mouth Index" are updated daily to reflect a watch brand's word-of-mouth performance on WeChat, Weibo, and Baidu. The score is calculated based on the percentage of posts about luxury watches that mention the brand. Chopard, for example, took more than 16 percent of the "share of voice" across the three platforms during the opening day of Baselworld. On WeChat alone, Rolex was ahead, with more than 25 percent of posts about luxury watches referencing the brand. Longines and Omega came second and third in the WeChat rankings, with 13 percent and 11 percent respectively.

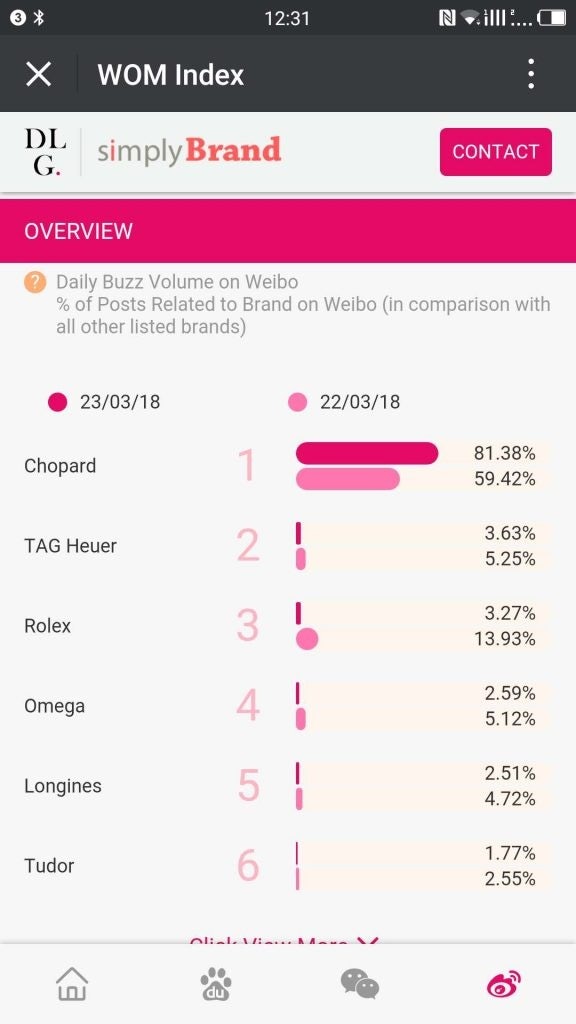

Looking at Weibo rankings on the opening day of Baselworld, it's clear why Chopard came out on top overall. The brand achieved nearly 60 percent of the share of voice on the platform with posts featuring Chinese celebrity singer Roy Wang.

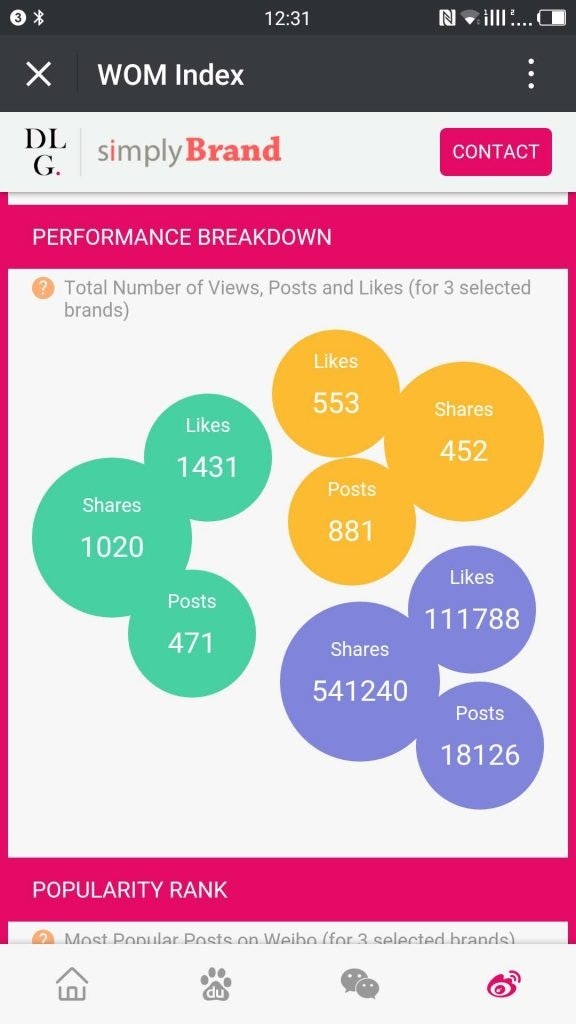

Users can also dig deeper by selecting three watch brands from a list on the index to compare their share of voice, total number of views, posts, and likes on WeChat and Weibo, and the most popular posts on the two social media platforms. The data helps watchmakers and marketers measure and track how well their social media tactics are actually working, how their message is resonating with consumers, which channels are working best for their message, and whether social media buzz actually translates into search engine traffic.

While social media plays a major factor in watch brand marketing in China, Swiss watchmakers are also seeing a major shift in the composition of traffic coming to their official websites. Chinese consumers have surpassed those from the United States as the largest group of visitors, making up 21 percent of the total traffic, compared to 15 percent from the U.S., based on DLG's analysis of 120 million visits.

But the DLG’s WorldWatchReport Digital Analytics Benchmark suggests that luxury watch brands are ill prepared to fully take advantage of this shift in traffic. According to the report, “most brands have yet to develop a fully satisfactory experience on their platforms.” For example, a user in China has to wait three times as long as a user in America for a webpage to load on the average Swiss watchmaker’s official website.

Swiss watch exports to China rose 44 percent year on year in 2017, which bodes well for the industry. Leaning more heavily on China also poses risks, however. DLG CEO David Sadigh warns in the report that the “Global watch brands that do not manage to generate desirability in China will find it hard to sustain their business in the long run.”

Generating desirability, DLG says, partly depends on improving the experience for Chinese consumers online. Aside from trying to make full use of WeChat’s potential as an online-to-offline CRM and marketing tool, it also includes adding more engaging features on their official websites like a store locator and tailored content for Chinese users. Less than half of the sites DLG surveyed included a store locator with a map for customers.

"We didn't realise the speed at which millennials would take to buying cars or watches online," said Jean-Claude Biver, head of LVMH's watch business, in an interview at Baselworld.