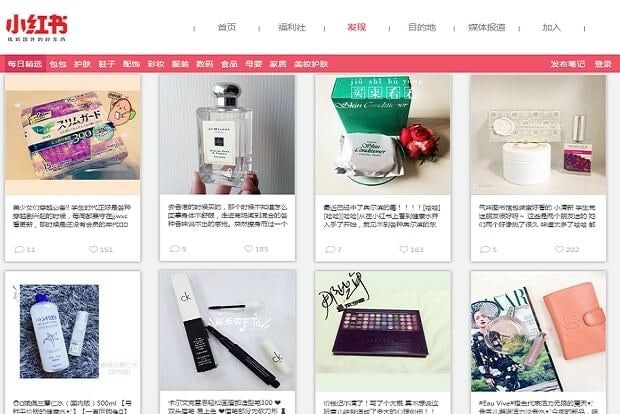

The product reviews section of Red.

The term “Little Red Book” in China may conjure up images of Red Guards shouting Mao slogans, but one tech startup is hoping to make today’s Chinese consumers associate it with something completely different: online shopping for overseas luxury goods.

Called Xiao Hong Shu (Little Red Book) in Chinese and simply “Red” in English, the company just raised over $10 million in its series B round and is riding on surging waves of demand for imported goods and social media usage in China. Its estimated 15 million users have been hooked to the cheaper overseas goods and community atmosphere.

Red provides its users with a platform to learn about and share shopping tips, deals, and experiences from their trips abroad. Users can browse through lists of the most popular brands for a category, and through products on brands’ exclusive pages. They can share pictures of products they have purchased, displaying them in a Pinterest-like interface with commenting and liking features.

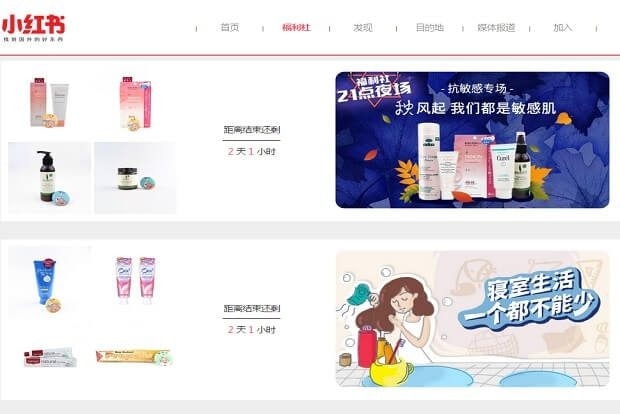

Red also allows consumers to buy directly from the site, featuring items with the most user shares. Skimming through Red’s daily selection of user posts on its website, luxury brands such as SK-II, Chanel, Givenchy, and Bulgari pop up. In another section of its website is a list of flash sales, including packs of instant Korean noodles.

Thanks to high Chinese import taxes that often push up costs for sellers, Chinese consumers often buy luxury products abroad—with an estimated 76 percent of their luxury purchases made outside of China last year.

Another reason Chinese consumers tend to buy luxury products abroad is the large amount of counterfeit goods in the domestic market. Daigou (代购) sellers go abroad to buy products and sell them in China for prices far below the domestic cost, but many unauthorized sellers dupe consumers with fakes. Chinese e-commerce giant Alibaba’s Taobao and Tmall platforms have struggled with problems detecting fakes on their websites. And an iResearch report released this past May found that quality is the most important factor for Chinese online shoppers. Consumers want the real deal and are willing to put in the extra effort to go abroad to shop.

The flash sales section of social e-commerce platform Red.

Red also provides specialized apps to help shoppers when they go overseas to shop in-person. “One of the big reasons Chinese travelers go abroad is to shop, and that isn’t true for other countries, especially Western countries,” said Charlie Custer, editor at Tech in Asia, over the phone. “It is one of the few apps that has a cultural side to it.”

There are currently Red-affiliated apps separate from the original specifically for Hong Kong, USA, Korea, Japan, France, Taiwan, Thailand, Singapore, and Germany, according to Red’s website. Besides the features from the main app, these apps include country-specific information on currency, language, store locations, brands, and more.

Red has also been following a trend among Chinese e-commerce competitors to give users a more social experience versus just shopping, with “its focus on user sharing and its community, which is already substantial,” wrote Custer in an article earlier this summer. Alibaba has its own social platform and JD has partnered with WeChat. Red gives users a more personalized feel, sifting through fellow shoppers’ reviews and photos. The social aspect may also draw users in even more than the actual shopping. “You might go in the app not even planning on buying anything, but still look around,” Custer said.

Co-founder and CEO Charlwin Mao says that while there are many e-commerce platforms that sell goods, Red is unique because it analyzes its user data to determine what it will sell. For example, Red users on average open the app more than 50 times a month and are on the app for 130 minutes or more. Red looks at the number of orders, user comments, and likes to predict what its users will like, which Mao says is more important than simply listing lots of products on its site.

However, as social media and e-commerce continue to converge in China through platforms such as WeChat, which allows in-app purchases and soon stock trading, there may be a degree of social media fatigue from the array of new platforms. “The risk with something like Red is that it’s a separate social experience and separate social platform,” Custer said. “You need some way to compel others to come to the platform and stay there.” For an app like to Red to succeed, there have to be incentives for consumers to make the effort to participate in another social network.

One way Red is convincing its users to return is its model of allowing users to generate their own content and interact with each other. For example, at TechCrunch Shanghai 2015, co-founder and CEO Charlwin Mao mentioned that there were generally two kinds of leader-type users in the Red community.

“First, some of the people in the community follow the account of vendors, and share good offers and events to their peers,” Mao said. “Second, young opinion leaders in our platform are like celebrities. They travel around and go shopping, which influences their peers.”

While Red has a website, it is also following the e-commerce and social media trend of focusing heavily on mobile. The proportion of internet users in China on mobile increased to 88.9 percent, or 594 million people this past June, people according to the China Internet Network Information Center. Chinese consumers are on mobile all the time, at home and abroad, for everything from booking vacations to sharing shopping photos. Red has seized onto this trend as mobile usage continues to grow.

Looking to the future of e-commerce in China, Custer said Red fulfills a very specific niche, but won’t be able to compete with companies that have bigger market shares such as Alibaba and JD. “The pattern in China five years ago was to copy a service and obliterate them with superior marketing resources,” Custer said. “But now they’ve moved more towards acquiring those companies or partnering with them.”