Cashing in on outbound Chinese travelers is a challenge these days. Research in recent years has shown that the appetite for outbound travel is still strong and that people are traveling more frequently. But Chinese tourists are spending less than before. That means the top priority for brands, online travel agencies, and other cultural institutions is to adapt (and quickly) to this changing travel consumer trend.

With that in mind, travel and luxury industry veterans gathered at the Cross-Border Retail Growth Forum at Asia Society in New York City on November 8—via the tech-solution provider YouWorld—to discuss the latest Chinese global traveler trends.

Meet the experience-seeking tourist 2.0#

Outbound Chinese travelers have evolved a few times, according to the co-founder of China Luxury Advisor, Renee Hartmann. Trends used to feature “Tourist 1.0,” meaning Chinese travelers who liked to travel on group tours, often at a low price and run on a rushed schedule. However, in recent years, Chinese outbound travelers are becoming “Tourist 2.0s”: in other words, experience-seekers who would rather embark on self-guided, independent tours (road trips to national parks, stays in five-star hotels, or foodie tours).

Thrill-seeking Chinese millennials, widely known as the cultural connoisseurs in that country, are trendsetting these independent tours. “We are seeing millennials particularly wanting to collect souvenirs,” said Hartmann. “They are wondering, 'What stuff I can get that's not in China?’”

Discovering new experiential travel destinations#

A lot of new international destinations have been quick to cater to these new interests, one of which is museums. Managing Director of Tourism Market Development at NYC & Company, Makiko Matsuda Healy, remarked that local museums in New York have shifted to position themselves as more of a travel destination, where visitors can not only enjoy exhibitions but also experience fine dining in the museum’s restaurant or hunt for special gifts in the museum’s shops. And it’s likely this interest will grow, according to Healy. In 2017, New York City welcomed 1.038 million Chinese visitors—accounting for nearly 8 percent of all international visitors.

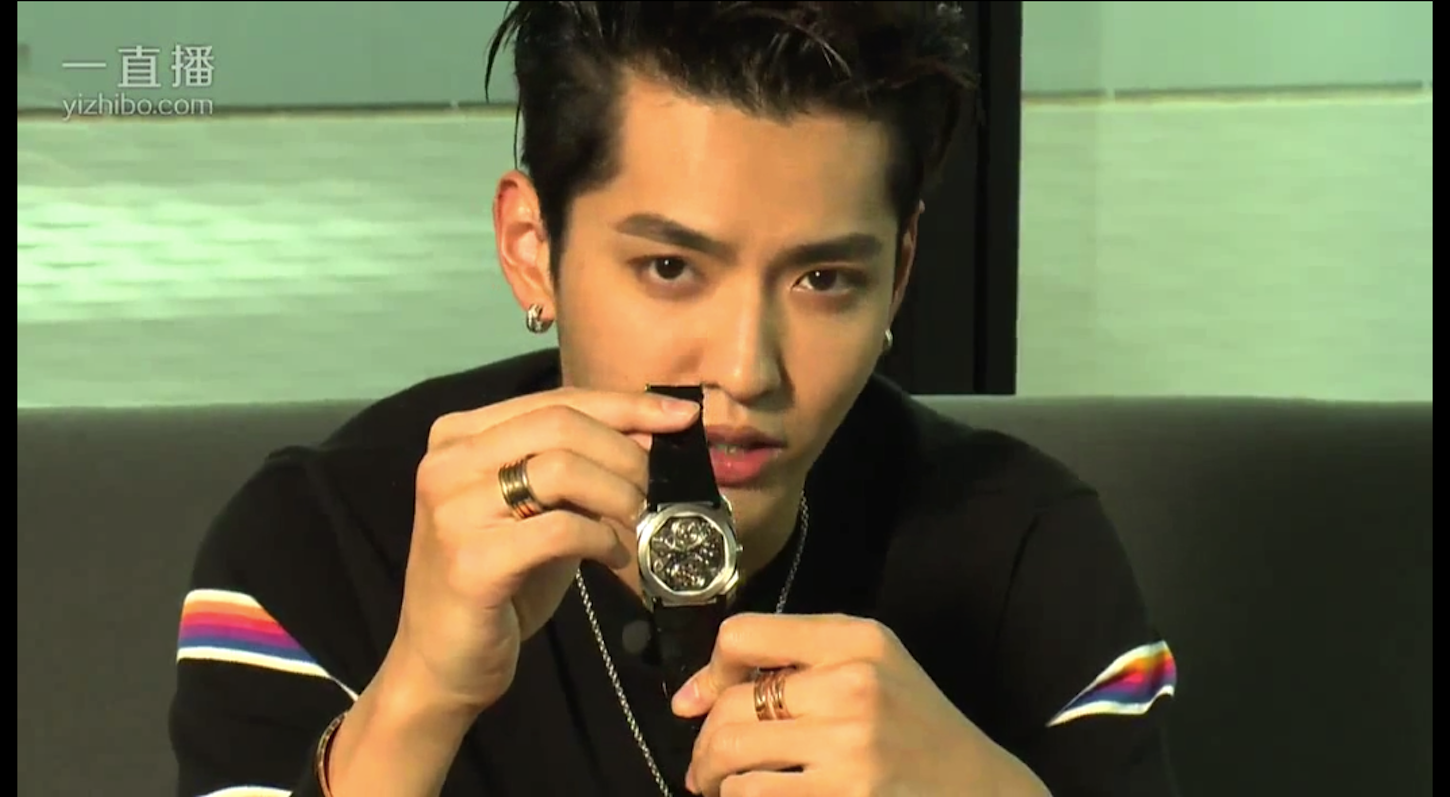

Live streaming to showcase experiences#

Live streaming is becoming a good way for brands and destinations to showcase their experiences, and it’s helping to get many institutions onto Chinese travelers' to-do lists. “Showing what’s behind the scenes is the key to live streaming,” said Hartmann. Her agency once helped a museum’s curator live stream an exhibition after hours, and the result was a fascinating “insider’s” point of view of a destination that reached thousands of potential travelers. And if you want proof of live streaming’s success as a marketing tool, Hartmann told us that WeChat—the chat tool that’s home to Chinese consumers before, during, and after their travels—is experimenting with live streaming ads and VR technology.

Discount incentives still help trigger spending#

A little incentive always encourages shopping, said Business Head of APAC and America at Ctrip Global Shopping, Jason Chen. Discounts are still the biggest draw for most luxury shoppers. The Ctrip Global Shopping platform, introduced in 2015, is a key part of the Ctrip Financial Services Business Unit that focuses on in-store cashback, discount, and VIP reception services for Chinese tourists. Chen said sometimes the in-store rebate can reach 2 percent, but not every retailer is willing to offer a discount in order to draw more Chinese travelers – high-end luxury brands in the U.S., in particular, are reluctant to participate. But in Japan, he noticed retailers were more open-minded, as well as "China-ready." Almost every beauty counter in Japanese department stores, for instance, has Chinese translation services available, he said.