Hollywood movies such as The Hangover fuel great enthusiasm among Chinese millennial tourists to visit Las Vegas. However, it’s not necessarily the blackjack tables or slot machines that this significant demographic segment with great consuming power is heading there for—rather, shopping and Cirque du Soleil tend to be greater draws to Sin City.

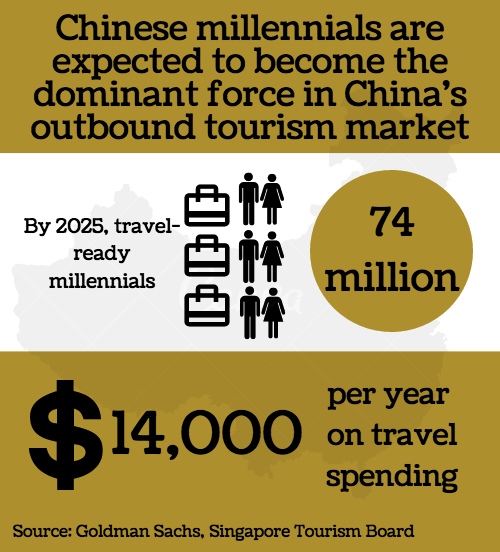

Chinese millennials, also known as Generation Y or post-80s and post-90s by Chinese marketers, are expected to become the dominant force in China’s outbound tourism market in the coming years. A 2015 report written by Goldman Sachs estimated that the number of travel-ready millennials would grow to 74 million by 2025, and this segment is likely to spend upward of $14,000 on travel each year, based on another study commissioned by the Singapore Tourism Board.

A piece of good news for Las Vegas: these educated, affluent, and technologically proficient Chinese young people view the city as the most popular destination within the United States for a leisure travel experience, according to a recent survey conducted by YWS Design & Architecture, a Las Vegas-based hospitality company. RTG, a consulting firm, also ranked Las Vegas as the fourth most popular U.S. destination among affluent Chinese tourists this year. However, YWS’s report noted, similar to its American counterparts, young Chinese have thus far shown a marked lack of interest in traditional gambling activities or slot machines compared to others.

“Gambling is just an experience to me, not my goal of coming here,” said Xin Long, a Chinese millennial who studied in Britain and now is working in the education industry in China. She just visited Las Vegas for three days in early November this year. During her trip, she won around US$80 by gambling in her hotel’s casino. Winning money, though, did not motivate her to continue the game, as she explained, “I don’t want to waste my money on it, as there are so many interesting things to do in Las Vegas.”

Another factor that possibly causes young Chinese to gamble less is that they do not see gambling as an investment. “I am just testing how lucky I am. I will not spend too much money. I don’t count on it to gain wealth,” Yilun Dai, a 27-year-old Chinese man working in the financial industry in Shanghai, told Jing Daily, explaining why he did not go big on gambling during his recent trip there.

The general lack of interest in gambling among Chinese millennials is not helpful for the city’s declining gambling sector, as they are expected to make up a big part of travelers to Las Vegas. Even though the overall revenue of the casino industry there has recovered to the pre-recession level in recent years, the contribution from the gambling sector has been shrinking. Nevada Resort Association’s statistics showed that gaming accounted for just 34.9 percent of casino revenue in 2015, compared with a 41 percent stake in 2007 as restaurants, shopping, and meeting events become more popular.

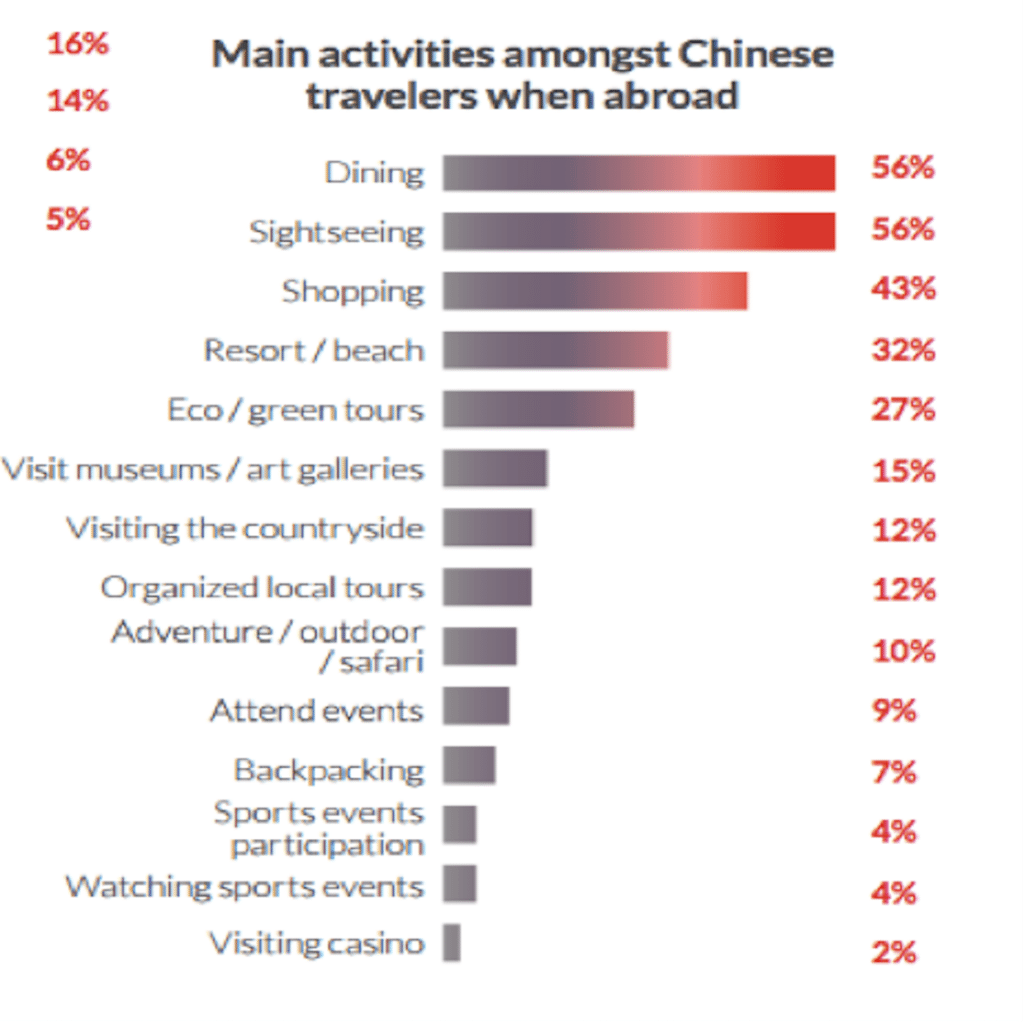

So where do Chinese millennial travelers spend money in Las Vegas? Chinese millennials are generous spenders in a variety of non-gaming activities, including shopping, sightseeing, and dining, as shown by YWS’s report in 2015. This finding is consistent with results discovered by Hotels.com, where it listed dining, sightseeing, and shopping as top three things to do among Chinese travelers when they travel abroad. Only 2 percent of respondents indicated visiting a casino was their main goal.

Huge shopping demand will continue among Chinese overseas travelers in the near term, despite the fact that Chinese currency has depreciated against the greenback by more than 5 percent since 2016, and there is a possibility of further decrease after Donald Trump won the U.S. presidential election. Long said she found that the luxury price differences between the U.S. and China markets are still quite huge. She bought a Coach handbag at half the price of that from Chinese stores in Las Vegas’ outlets.

Currently, Chinese people’s spending on leisure activities remains low at 9 percent of per capita expenditure, versus 16 percent in Japan and 17 percent in the United States, according to Goldman Sachs’ estimation. The low figure presages great potential to expand. Thus, Goldman Sachs believes, in the next decade, leisure activities, such as fine dining, resorts, and safaris, will make up for a huge portion of spending by Chinese overseas travelers.

Though Goldman Sachs’ report did not specify the contribution that is about to be made by Chinese millennials to this market, there are reasons to believe this demographic segment will play a huge role in it. First of all, unlike U.S. counterparts, a lack of student loan debt gives them higher consuming power once they start to work. Secondly, most Chinese millennials who have the ability to travel abroad are from urban regions and the only child in their families. Their reliance on parental support for things such as real estate and cars means they spend more on entertainment and going out than American and European peers, according to a recent CBRE study.

Su Hang, for example, is in her 20s and hails from the city of Harbin. As the only child in her family, her parents supported her education in the United States and were quite generous about her travel budget. On her first trip to Las Vegas, she spent a lot on eating in fancy restaurants such as Bellagio and the Four Seasons, relaxing with a spa at her resort hotel Circus Circus, and seeing the famous “O” show.

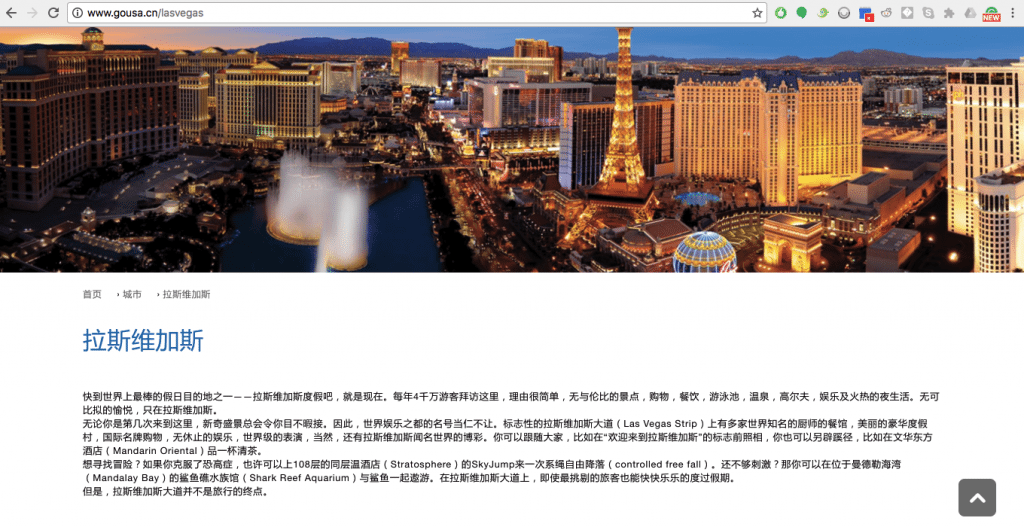

Businesses and government in Las Vegas have already sensed the growing appetite for leisure activities among Chinese millennials recently. The American tourism agency has long been branding Las Vegas as the best vacation destination around the world, as shown in its Chinese marketing materials online. They highlight their fancy restaurants with top-notch chefs, resort hotels with a full list of services, shopping malls filled with a wide variety of international luxury brands, and entertainment activities. The description of the casino scene only comes after all of these items.

American tourism agencies have long been branding Las Vegas as a top vacation destination among Chinese travelers.

Las Vegas has seen an increase in businesses catering to the interests of Chinese tourists, such as the Chinese-themed Lucky Dragon resort. Meanwhile, Hainan Airlines will soon launch a direct flight between Beijing and Las Vegas in anticipation of an increasing travel demand among Chinese people to the city. Non-Chinese focused businesses are also getting serious about serving Chinese visitors. For instance, many of them opened up high-end Chinese restaurants, including Blossom at Aria, Jasmine at Bellagio, Fin at Mirage, Hakkasan at MGM Grand, and Wing Lei at Wynn Las Vegas.

Decades ago, resort hotels and shopping malls were built to provide extra services to travelers who came to Sin City for winning big money. That has been transformed as many international travelers arrive with these things in mind as the main attraction, not a secondary one. With the expected enormous influx of Chinese millennial tourists who are lukewarm about the gambling activities, Las Vegas is likely to further play down the part that once earned its fame.