Despite big market stresses in the property sector and rising caution due to an economic slowdown, China retains its status as the holy grail for luxury brands. But the relentless focus on this vast consumer market requires nuanced targeting; one segment that remains somewhat under the radar is Chinese men.

This is by no means an insignificant set: in terms of online luxury purchases, men surpassed women last year according to Deloitte. In fact, they now account for 44 percent of all luxury spending in the country, as reported in The Chinese Male Luxury Consumer 2023. This study, released on Thursday by consumer marketing agency Hot Pot China and London-based trend forecaster The Future Laboratory, has identified six consumer types that will determine the path of the mainland’s luxury market for men.

“That China is the future of luxury is undisputed,” said Jonathan Travers-Smith, founder and CEO of Hot Pot China. “Yet much focus to date has been on the female consumer, overlooking a hugely influential consumer group: China’s male luxurian.”

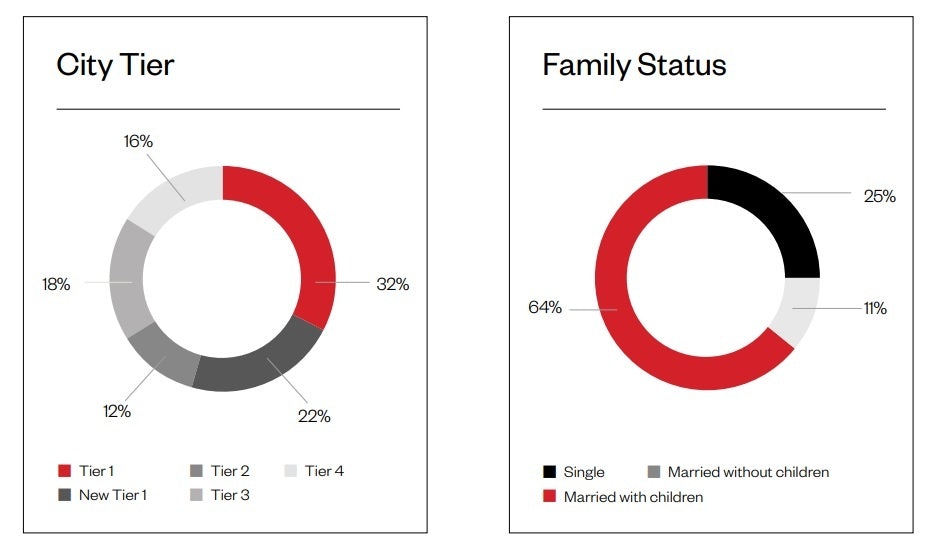

During COVID, a dynamic male consumer has emerged due, says the report, “to the accelerated conversion to online luxury purchases” as well as a swelling middle class across Tier 2–4 cities. The latter has seen an increase both in spending power and appetite for luxury. Chris Sanderson, co-founder of the strategic foresight consultancy The Future Laboratory, commented that “the pandemic has revealed new, unique luxury mindsets in China.”

The full spectrum#

To explore these mindsets and to capitalize on both their similarities and differences, Hot Pot China conducted a survey of 530 men who buy luxury earlier this year. To differentiate and understand their buyer behavior better, the agency included low, low-mid, mid, and high earners between the ages of 18 and 50.

The wider findings are good news. While 36 percent of all respondents stated a reduction in income from November 2021 to April 2022 — partly an impact of COVID — half of all those surveyed claimed they would spend the same amount on luxury in the next 12 months, while 20 percent said they would spend more. Not surprisingly, 32 percent of these latter consumers represent an older, higher-income group.

Long queues due to revenge spending in luxury malls upon their reopening after the lockdowns in Shanghai, Guangzhou, and other major luxury hubs confirm an eagerness to get back to normal. This demand for luxury has been seen worldwide, and Bain & Company is optimistic that the global luxury market could reach 335 billion (2,392 billion RMB) by the end of 2022, growing at 10-15 percent over 2021.

Breaking men down#

Core to the report — and possibly of most use — is that men shopping for luxury in China can be put into six distinct categories:

Luxury Novices#

(17 percent of respondents) are typically between 18 and 35 and mostly live in Tier 3 and 4 cities across China, with low-medium incomes (the report divided incomes as follows:

low-mid#

: gt;33,600-84,000 (gt;240,000-600,000 RMB) and

mid-high#

: 84,000-lt;126,000 (600,000-lt;900,000 RMB).

Luxury Hobbyists#

(14 percent of respondents) tend to be older than novices, aged between 35 and 50. While they are wealthier individuals, they are typically less regular shoppers.

Luxury Aspirants#

(19 percent of respondents) are the most diverse by age, ranging from 18 to 50, as well as geography and income bracket and perceive luxury as having an influence on their social status. However, they were most impacted by COVID in terms of spending ability.

Luxury Loyalists#

(22 percent of respondents) have a similar profile to aspirants but they have now “made it” — such that luxury is part of their everyday lives. They own up to 20 luxury items.

Luxury Junkies#

(14 percent of respondents) are young 18-24-year-olds on low- to mid-incomes, often from Tier 3 and 4 cities. Though similar in demographic to novices, they are very knowledgeable about the luxury market.

Luxury Elites#

(14 percent of all respondents) are the most prolific buyers for whom luxury has become an everyday need. They tend to be older, mid-high earners living in Tier 1 and 2 cities.

Identifying the consumer segment this way enables houses to lock in on specific behaviors of each group. For example, according to the report, luxury

novices#

are keen to prioritize luxury goods as part of their daily apparel, to show social status and wealth, while

hobbyists#

buy more definitive names like Rolex watches or LV bags.

Loyalists#

are more active buyers, opting for daily-use luxury products such as shoes. They actively follow trends and know what they want to buy.

Aspirants#

are more likely to opt for high-value watches to showcase their wealth whereas

junkies#

are very willing to engage in emerging luxury trends because they see labels as a way of expressing their individuality and personal tastes. The

elites#

are in a different league, buying luxury goods on impulse to add to large existing collections.

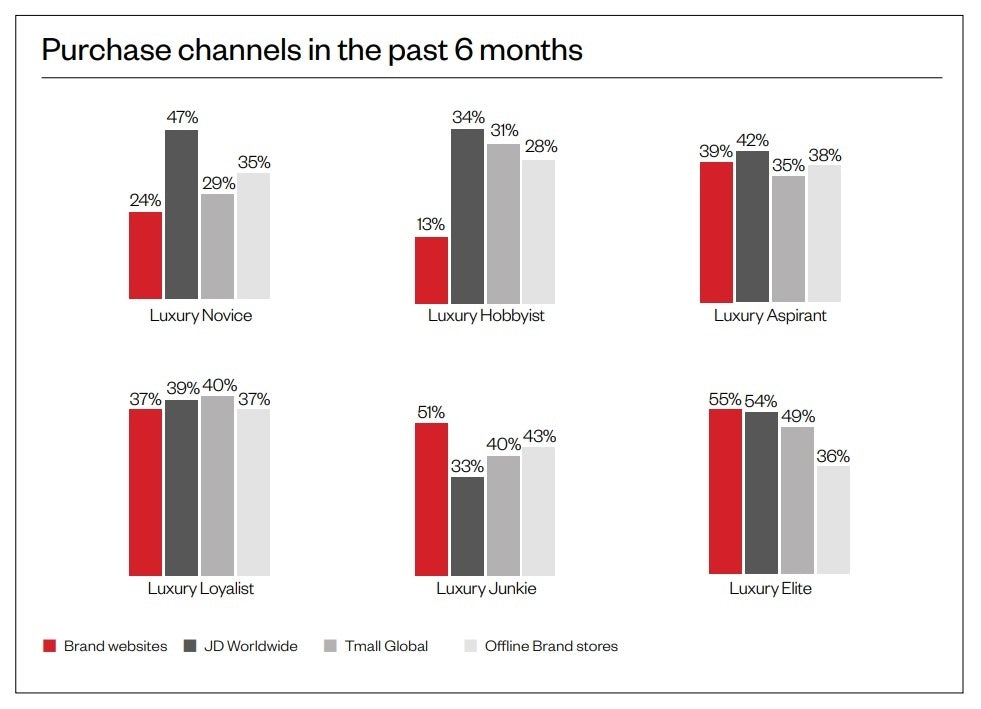

The report offers some interesting personal insights from individuals who fall into the categories above. Datasets for each of the six also reveal their preference for shopping channels: the

elites#

are skewed to brand D2C websites (55 percent) while JD Worldwide had traction across all the typographies.

Junkies#

had the biggest appetite for offline physical stores.

Regarding digital, the report stated: “For shoppers who have previously been hesitant to buy luxury goods online due to concerns over product authenticity and difficulties returning the goods, JD Worldwide, Tmall Global, and own-brand websites provide relatively safe solutions. Since these platforms do not pay import tax, the retail price makes their goods more competitive, drawing consumers to their online stores.”

Alongside this, the release also examines the second-hand luxury market, collaborations, luxury designers, the adoption of new technologies, and how NFTs and luxury are interacting. There is plenty of food for thought on how to approach this customer group.

Given that Bain & Company says that half of Chinese luxury spending will take place in the home domestic market by 2025, and Équité points to China accounting for 50 percent of the global luxury market by 2030, better targeting of the undervalued men’s market makes sense.