China’s e-commerce boom over the past decade is gradually turning the Middle Kingdom into a country filled with people who identified themselves as “hand-choppers." The term may sound like it derives from Ridley Scott's latest thriller. But term simply refers to online shopping addicts who promise to chop off a hand if they continue to buy things they don’t need.

Hand-choppers may laugh self-deprecatingly, but the underlying change in consumption habits in China is by no means that easy.

Singles’ Day: Where Everything Starts#

Singles’ Day (光棍节) should actually be called “Double 11” (双十一) because that’s how Chinese people refer to the shopping festival. While couples celebrate and shop for each other on Valentine’s Day, the bachelors/bachelorettes liven up their lonely lives with shopping sprees on their own day.

Chinese e-commerce giant Alibaba first kicked off the festival ten years ago on its marketplace Taobao and then on Tmall. Since then, the event has evolved into a national consumption festival, smashing historical records year to year.

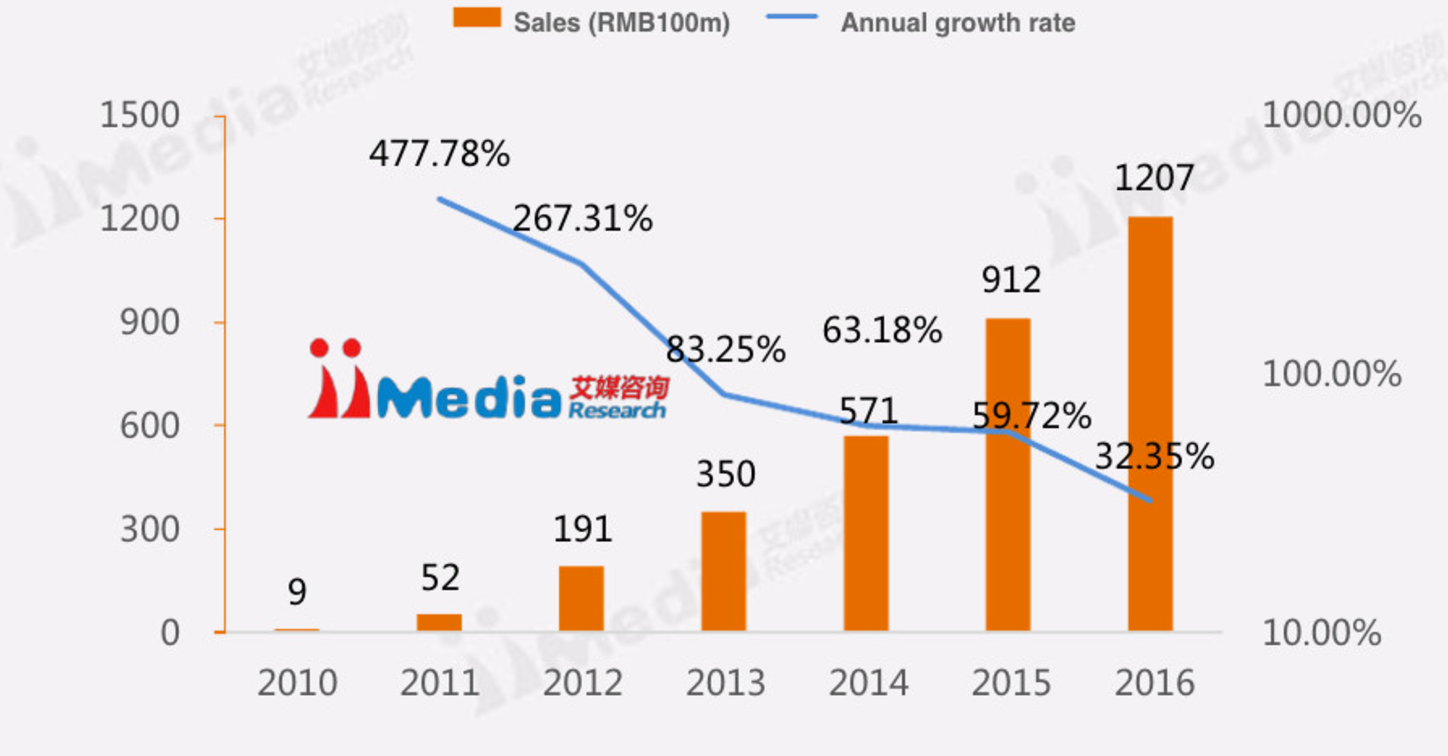

In 2016, retailers on Alibaba’s platforms recorded RMB 120.7 billion (around US17.8 billion) worth of gross merchandise volume (GMV) in the 24-hour shopping festival, up 32 percent from US14.3 billion one year earlier. These figures easily eclipsed the US2.74 billion generated online during the Black Friday sales in the U.S. last year.

Although Alibaba launched Singles’ Day, the Chinese e-commerce juggernaut is far from being the single power behind the shopping festival culture in China. Every e-commerce platform in the country has joined in to take a piece of the pie.

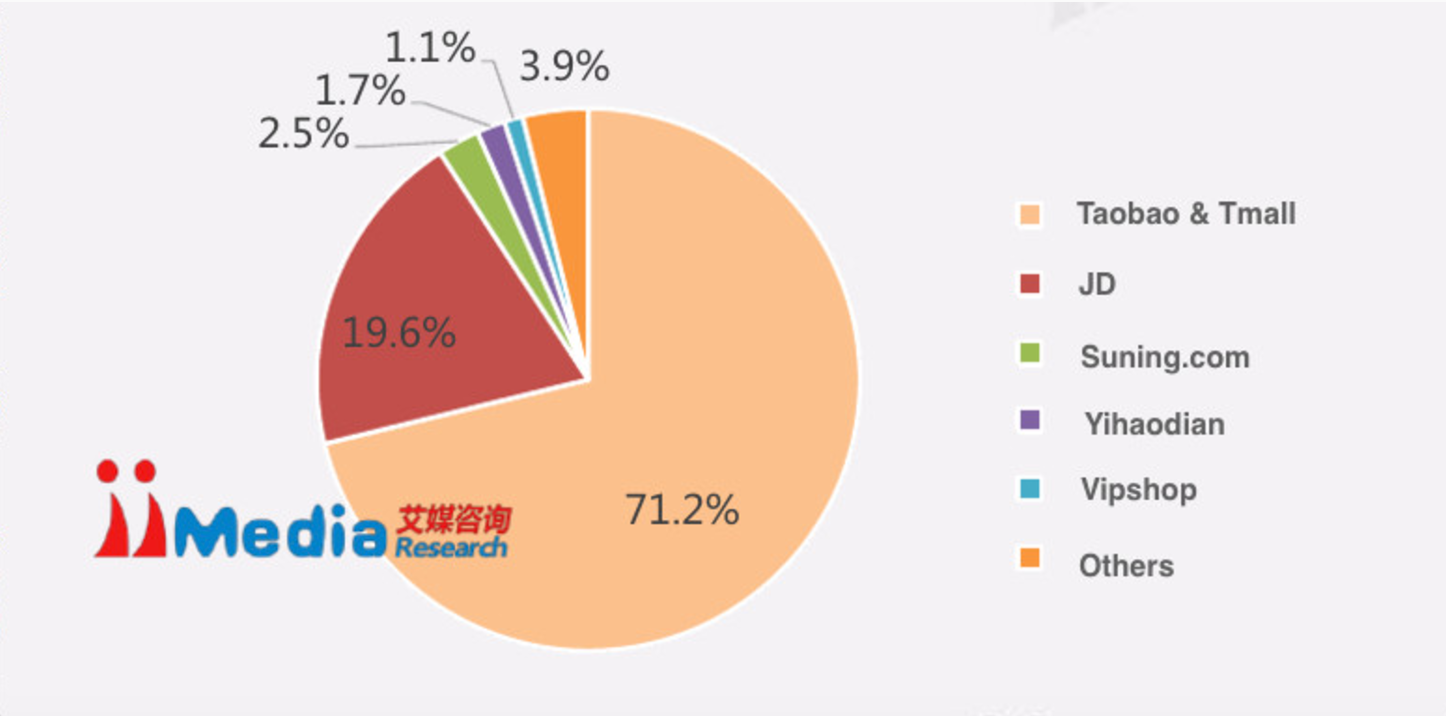

In last year’s Singles’ Day, Alibaba’s retail marketplaces Taobao and Tmall still accounted for 71.2 percent of the country’s total sales, RMB 169.54 billion, according to a report from research institute iiMedia.

Alibaba’s top rival JD took 19.6 percent, while other e-commerce competitors Suning.com, Yihaodian and Vipshop taking smaller, single-digit shares.

So important to its business is Singles' Day that Alibaba even went so far as to trademark a number of related terms in 2014, including including 双十一 (double-eleven), 双十一狂欢节 (double-eleven carnival), and 双十一网购狂欢节 (double-eleven online shopping carnival), raising concerns that the company would use its ownership of the term to claim ownership of the holiday. However, this now seems more a defensive move as the company has not enforced its rights to these terms.

From Monopoly to Oligarchy#

As China’s e-commerce platforms are jumping on the Singles' Day bandwagon, more companies are trying to replicate this success by creating shopping festivals of their own.

Different from Singles' Day, with its quirky, organic origin, most of the upcoming festivals are created as anniversary celebrations: JD’s 618 for June, 18, Jumei’s 3.1 for March 1, Suning.com’s 818 for August 18, and Vipshop’s 128 (December, 8). Even LeEco, not known for its e-commerce business, launched a shopping festival for their e-commerce arm LeMall.

With so many festivals available, China’s shopping obsessives don’t have to wait until November 11 to come around. Now they can take advantage of shopping festivals all year round.

Understandably, passion for a single event will ebb. Even Singles’ Day’s annual growth rate is slowing down. The YOY GMV growth rate of Singles' Day slumped from over 477 percent in 2011 to 32 percent last year.

Among a series of shopping holidays, JD’s shopping festival 618 is becoming one of the largest in the country. For this year’s JD 618, the company eliminated JD from its title in an attempt to turn it into a national festival for everyone.

After years of development, the original draw of discounts is gradually losing its charm among China’s affluent customers who place higher value on the quality and the brand of the products. Festivals that want to stand apart from the crowd have to address a combination of factors from branding, product quality, logistics, brand partnership, and more. This is also why Alibaba is turning what was once a one-day event into a weeks-long celebration with lead-up events from partner brands, technology roll-outs, and a celebrity-filled countdown gala.

A version of this post first appeared on Technode.