Editor’s note#

: Daigou are a problem for many major luxury brands, helping Chinese shoppers circumvent local pricing by purchasing abroad and sending back to China for a profit. For smaller luxury brands without a presence in China, however, they can be a way to outsource their sales and marketing.

This story was first published on Jing Travel.

How do you “solve” cashing in on Chinese tour groups, Chinese independent travelers, daigou, and booming e-commerce in China? It might seem like a tall order, not least given the vast differences not only between Chinese e-commerce and Chinese tourists, but differences between different types of Chinese travelers as well. In Australia, there’s a company which argues that it has done just that.

AuMake, an Australian Securities Exchange (ASX) listed company, has positioned its entire business around Chinese tourism in Australia, and to an extent, Chinese e-commerce. Positioning itself as the one-stop solution for brands that hope to cash-in on China’s price-conscious travelers, the company has an answer for every challenge the market has to offer. Tour groups? Sure. Independent travelers? Their customers too. Daigou? Absolutely. Sales in China to encourage repeat purchases without customers even returning to Australia? Why not.

It might sound overly optimistic at best, but AuMake has convinced investors that it has a sound business model and a bright future. When listing on ASX in October 2017, the company raised AU6 million (US4.7 million), and it completed fundraising of an additional AU14 million (US11 million) in January 2018. With the funds raised so far, it has acquired several Australian brands, relocated its headquarters, and opened a flagship store in Sydney’s CBD. With the US11 million raised in January, it intends to grow its retail network to 20 stores before the end of 2018, and develop its own brands.

In an ASX announcement, the company details its strategy along five pillars, each addressing one market “need” and/or one type of Chinese consumer in Australia. To the company, it’s all about distribution. “The true value in the Australian market lies in ownership over the distribution network to sell to China rather than a single brand,” Executive Chairman Keong Chan said in an official statement.

- Flagship stores in “high traffic CBD areas” that cater to wealthy, young, Chinese independent travelers

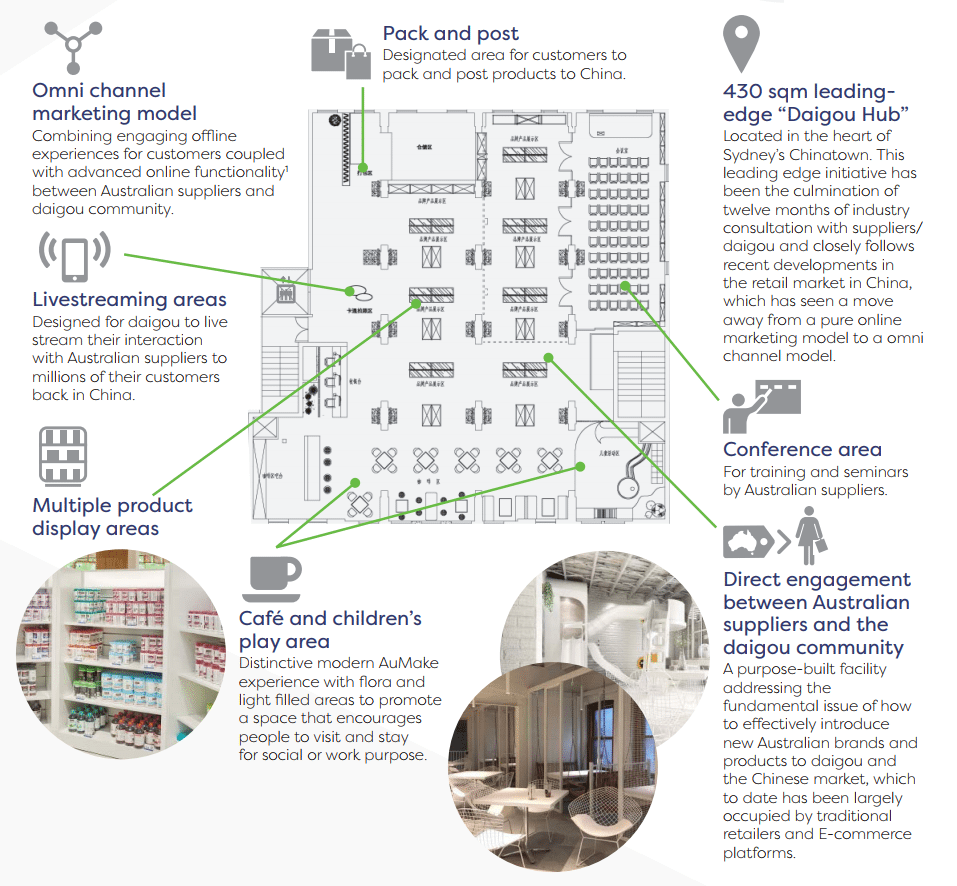

- Daigou hubs that better address daigou needs

- Warehouse showrooms that serve tour groups and bulk-purchasing daigou

- Retail store network in Chinese communities to support the other “pillars”

- WeChat sales in China to facilitate repeat purchases directly from China

While “flagship stores” and retail stores in Chinese communities are perhaps nothing out of the ordinary with retail sales to Chinese tourists, it’s in dealing with Chinese daigou where AuMake provides an interesting case study of how to properly address the daigou phenomenon in a way that could benefit both daigou traders and local brands.

Just earlier this month, AuMake launched its first purpose-built “daigou hub” in Sydney, a 4628-square foot retail location that addresses plenty of recent buzzwords in Chinese commerce: omnichannel, live streaming, and verifiable authenticity. The daigou hub features a purpose-built live streaming area for daigou traders where they can interact with suppliers in front of a live audience in China, and quite likely also showcase products that they intend to resell. For daigou traders who intend to not physically go back to China with products acquired, the “hub” also features a “pack and post” area where they can prepare and send packages to their customers in China. The facility also hosts a conference area where Australian suppliers and brands can demonstrate their latest products and offers to potential distributors, i.e., Chinese daigous.

In many ways, the whole facility is designed to facilitate the practice of daigou for daigou traders in Australia, as well as provide Australian brands with a straightforward way to interact and profit from Chinese daigous. Add trends such as WeChat, live streaming, and online-to-offline to the mix, and you have pretty much ticked off every box on the Chinese travel retail checklist.

According to AuMake, the launch of the dedicated daigou hub was a resounding success by all units of measurement. The company claims that 70 Australian suppliers, 150 daigou, and 730,000 live stream viewers attended the launch last week. Just a few weeks earlier, it attracted 500,000 viewers to an inaugural 1.5-hour live stream that showcased the company, its future, and its branded products.

It seems clear that AuMake has convinced investors that it has a winning recipe on its hands, but it remains to be seen if its sophisticated approach to daigou and Chinese travelers will resonate with the most important parts of the recipe: daigou traders and Australian brands. With 40 percent of its sales coming from WeChat already, it may end up competing with the very same daigou traders it’s trying to satisfy. And for Australian brands, a full embrace of gray-market Chinese daigou trading may seem too off-brand, not least for luxury brands that are keen on both being on good terms with Chinese regulators and keeping a consistent, high-end, brand image.