China's "New Collectors" Play Important Role In Contemporary Art Market#

One of the biggest shifts in the global auction market over the past three years has been the emergence of mainland Chinese collectors as some of the world's top buyers of fine art, wine, watches and antiquities. Though the country continues to produce more aspiring collectors every year, instrumental to the growth of the Chinese collector market has been a handful of "super-collectors," ultra-wealthy buyers who spend millions every year amassing huge collections of traditional and contemporary Chinese art. Championing their own artists and pushing prices for modernist Chinese painters like Zhang Daqian and Qi Baishi -- as well as contemporary artists like Zhang Xiaogang, Zeng Fanzhi and Yue Minjun -- into the millions of dollars, the appetite of these super-collectors for art saw the modernists, Zhang and Qi, surpass Picasso and Warhol to become the world's most valuable artists at auction in 2011 despite low name recognition outside of China. Aside from pushing up prices for Chinese artists, perhaps the most interesting role played by Chinese super-collectors is their ability to shape the buying habits of new, small-scale collectors. New collectors less well-versed in Chinese art typically follow high-profile collectors like Liu Yiqian and his wife Wang Wei (who will open their first private museum in Shanghai this November) and auto mogul Yang Bin. This week, the Wall Street Journal profiles Yang Bin, noting that Yang's influence among his wealthy network of friends is emblematic of the way super-collectors play the role both of buyer and taste-maker within China. From the article:

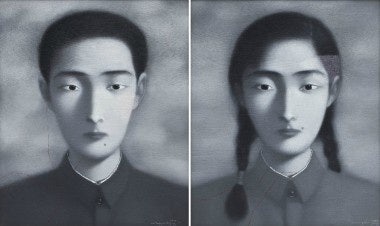

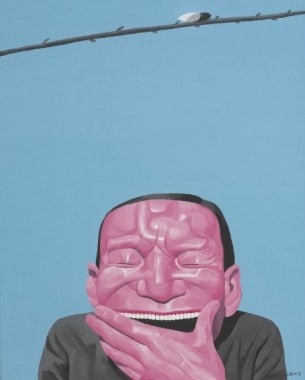

Mr. Yang, age 54 and one of Beijing's biggest car dealers, is emblematic of the new wave of Chinese collectors: Over the past decade, he has collected nearly 1,000 artworks by contemporary heavyweights like Chen Yifei, who paints women in romantic interiors, and Zhang Xiaogang, known for haunting family portraits. Mr. Yang's art choices are closely tracked by the region's top collectors and dealers. He has financed the opening of a pair of edgy art galleries in Beijing, one of which is managed by his wife, Yan Qing. Last year he began importing and reselling collectible wines like Bordeaux. (He keeps most of his own 30,000-bottle collection stored in a cellar outside town.) The collectors in his broader circle include Qiao Zhibing, a nightclub owner based in Shanghai. Mr. Qiao is outfitting his four-story karaoke bar, Shanghai Night, with conceptual sculptures by Ai Weiwei, sleek photographs of Champagne-drinking partygoers by Yang Fudong and paintings of men in suits and smiling face masks by Zeng Fanzhi. Behind Mr. Qiao's cashier's desk looms Beijing artist Ji Dachun's large painting of an eyeball.

... "It's not enough in China to be wildly wealthy," says Meg Maggio, director of Pékin Fine Arts, a Beijing gallery specializing in contemporary art. "

For all these guys, it's about building a beautiful way of life—they want the nice objects, the good wine, the whole package

."

While the influx of new, completely "green" collectors has raised eyebrows in China, as buyers without the means to buy works from blue-chip Chinese artists have, in some cases, pushed up prices for less established artists to unsustainable levels, the desire among aspiring collectors to invest in art to diversify away from real estate or the stock market is fueling the emergence of many art products. As Artvest noted this week, Chinese investors have started at least eight art funds in recent months, in the hopes of buying top-quality artwork and reselling at a profit. Considering there are only about 20 such funds elsewhere in the world, the WSJ points out, this is an important development, and something to keep a close eye on. This will be particularly true if influential collectors decide to start their own funds, and get their wealthy friends involved, in 2012. Tweet Follow @JingDaily