Ever since Jimmy Choo officially went up for sale in late April, there's been a swirl of speculation over who might pick it up. American accessible luxury labels Coach and Michael Kors have been noted runners as has the Qatari royal family's investment fund Mayhoola for Investments (which owns Anya Hindmarch, Balmain and Valentino). Also a reported contender is Guo Guangchang the billionaire chairman of Chinese conglomerate Fosun International.

The Chinese site Fashion Note originally reported, and later confirmed to Jing Daily, that Guo, whose wealth is estimated by Forbes to be 6.1 billion and who has been dubbed "China's Warren Buffett," had an interest in the company.

"I think Jimmy Choo would be open to anyone who pays a premium to the current valuation that I think is the main hurdle,” said Luca Solca, the head of luxury goods at Exane BNP Paribas when asked by Jing Daily about the possibility of Guo being a bidder.

"My impression is that, given the valuation," Solca added, "private equity (PE) and industrial acquirers in Europe are not likely."

When reached for comment, Fosun declined to respond.

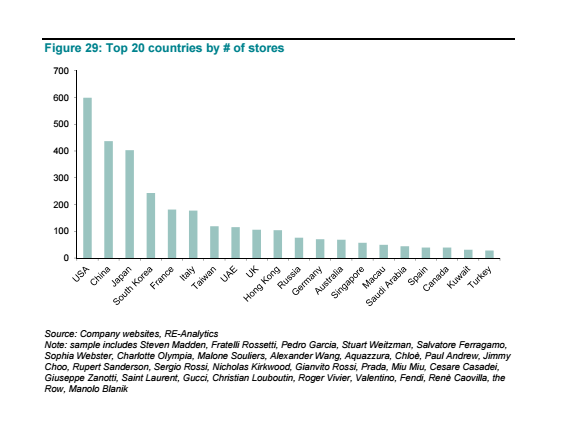

One of the latest BNP Parisbas' investment research reports also indicated that analysts would not expect a long line of potential bidders for Jimmy Choo. The same report by BNP Paribas shows that following the United States, China has the most stores for women's shoes.

Guo disappeared for a week in 2015, due to his participation in an investigation by the Chinese police that was said to concern his "personal affairs."

In 2016, China drove Jimmy Choo's sales growth in the Asia Pacific region to 19.2 percent, according to company's annual report. And the Shanghai-based Fosun has already shown an interest in a wide array of investments from entertainment to real estate, so adding a luxury shoe designer would not be the farthest stretch. The Chinese conglomerate was also behind one of the country’s biggest overseas buying sprees in recent years: it has acquired the French luxury resort chain Club Med, and has taken a stake in Cirque du Soleil and the Greek luxury label Folli Follie.

Some major Chinese domestic publications such as Sohu recently explored the possibility of a Chinese buyer. Sohu wrote on April 25 that even though many investment analysts have said that luxury conglomerates such as LVMH or Kering Group would be best-suited to buy the brand, one shouldn't underestimate the ability of Chinese investors to step in this time, given the brand's bright prospects in the market.

The high-end shoe designer Jimmy Choo co-founded his namesake fashion label with Vogue accessories editor Tamara Mellon in 1996. The brand was put on the map by Carrie Bradshaw the fictional leading character in "Sex and the City." After listing it on the London Stock Exchange in October 2014, Jimmy Choo started to boost its China presence by opening physical stores there. In January 2016, the Financial Times reported that the company was one of the highest performers in the luxury sector, and this was during a time when the country was in an economic slowdown. In 2016, its global revenues went up 14.5 percent thanks to the strong performance in China.

As a potential buyer, Guo still faces a number of powerful possible competitors for the bid such as Coach and Michael Kors, who the Western media have been pegging as likely suitors. On May 15, Women’s Wear Daily reported that Michael Kors might have shifted its focus to Jimmy Choo after Coach snapped up Kate Spade in a recent headline-making deal. A spokesman for Michael Kors declined to comment on the prospect of acquiring Jimmy Choo when contacted by Jing Daily.

Earlier in May, The Telegraph also revealed that Coach, Michael Kors’ main rival in the U.S., has its eye on Jimmy Choo for a billion-pound deal.

As the Chinese luxury market has recently become much more sophisticated than ever and consumers there buy up almost half the luxury goods annually, there perhaps is no better time for Jimmy Choo to find a Chinese buyer.