Demand Of New Chinese Collectors, Auction House Ambitions, Know No Boundaries#

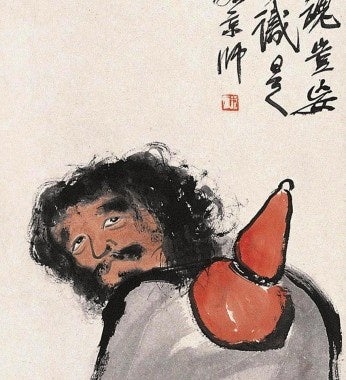

China auction favorite, Qi Baishi was the second-highest grossing artist of 2010, trailing only Picasso

More flush with cash than ever due to the massive buying of new Chinese collectors in recent years, domestic Chinese auction houses like China Guardian and Poly are now setting their sights on new, far-flung markets like London and New York. As Jing Daily noted earlier this year, with international powerhouses like Christie's and Sotheby's restricted to operating only in Hong Kong, Chinese auction houses have intensively sought to develop their ability to procure better art from blue-chip Chinese contemporary artists, as well as antiques and traditional art, promoting some artists more popular with newer Chinese collectors, alongside others who are internationally collected and exhibited.

This week, the art blog Eclecticism takes a look at the current state of "transition" in which Chinese auction houses now find themselves, suggesting that the transition is interesting "because the Chinese art market has until now been a very nationalistic business." From the article:

If the opening of a branch in London means that Guardian will attempt to bring Chinese art to the global art economy (and here it is important to make a distinction between China's national artists and international stars), this is a very interesting shift away from China's economically isolated art market. Another interesting question to ask is whether the traditional Chinese art forms - especially those incorporating calligraphy - will find an audience in Europe.

Until now, most of the Chinese art that has been brought to the market was mainstream art that conforms to the ambitions of international modernism, and which is, as Iain Robertson puts it, "flavoured (for sale) with Chinese characteristics." In other words, the art from the national Chinese market is something very different from the Chinese art meant for export, and it remains to be seen how the market will react to it.

The article goes on to suggest that a China Guardian with international offshoots could look to specialize in "the kind of modernist Chinese art that is already favored in Europe," and run two independent businesses there, each with a different focus. Looking next at Guardian's main domestic competitor, Poly International Auctions, and reiterating the Chinese government's "strong influence on the country's national art economy," Eclecticism questions whether Poly's rumored upcoming IPO (previously on Jing Daily) is a sign that Beijing may be loosening its grip on the art market:

[However, this is curious because it] contradicts the academic predictions that China will focus more and more on its internal economy - unless the sale figures meant that Chinese collectors were buying 'back' Chinese art from Sotheby's.

More than anything, this article brings up interesting questions of what kind of influence an international China Guardian or Poly could realistically have on the global market for Chinese contemporary art. Most likely, Guardian and Poly would have little luck trying to sell Western collectors on "blue-chip" Chinese artists they prioritize, over internationally recognized blue-chips. As such, we'd expect to see these Chinese auction houses playing it relatively safe in cities like London, Paris or New York for the first several years (if they do, in fact, open locations there), sticking to artists collected by ultra-wealthy buyers in China as well as overseas: the likes of Zeng Fanzhi, Liu Ye, Cai Guoqiang and Zhang Xiaogang.