Chinawood Global Services Base Includes New Film Financing Fund#

With buzz around "Hollywood co-productions" building in China, and the number of these co-productions -- whether with American, Australian or European companies -- increasing by the year, Chinese investors (and even cities) are looking to get in on the action in a big way. Following the wrap of the second Beijing International Film Festival this past weekend, this week the Hollywood Reporter writes that Seven Stars Entertainment, run by businessman Bruno Wu (husband of Oprah-like television presenter Yang Lan) and the government of Tianjin's Binhai New Area have mapped out ambitious plans for a sprawling facility "dedicated to East-West co-productions." Tentatively named the rather unsexy "Chinawood Global Services Base" (华莱坞电影产业园), investment on the complex is estimated total around US$1.27 billion, of which nearly 40 percent will be put toward a new film financing fund that should go some way in helping foreign studios crack the market.

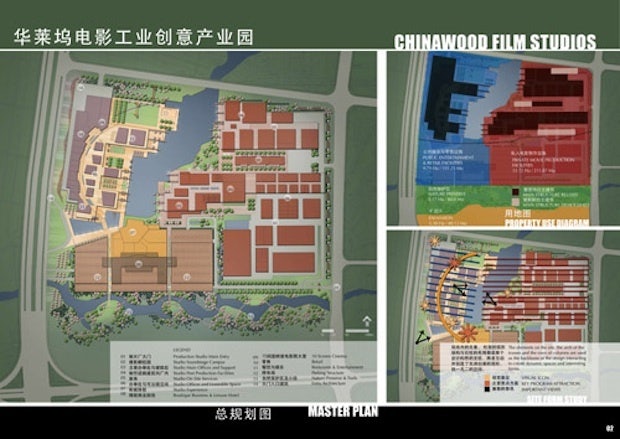

Slated to cover an area of 800,000 square meters (8.6 million square feet) and include "a large number" of financial, technical and creative companies, Chinawood -- if it does indeed materialize -- will be one of China's largest film entertainment and media hubs.

From the Hollywood Reporter:

Co-productions can be extremely attractive for Western film companies, since they are exempt from a strict quota limiting the number of outside films allowed into China to 20 a year.

Chinawood's mandate is four-fold: Film financing platform (roughly 35 percent of the $12.7 billion will be set aside for this purpose), co-production service center, a dedicated center for 3D conversion and distribution and marketing services.

The initial build -- comprising of 35,000 square meters -- is nearing completion and will be open in October.

"With the East Asia film market on course to be worth $10 billion by 2015 and catch up to North America, it is crucial, as well as inevitable, that we offer the productions and services to facilitate substantial cooperation between the two territories," Wu said.

This film project isn't the first we've heard in recent months from Bruno Wu. In February, the Chinese private equity firm Harvest Alternative Investment Group and Wu's Sun Redrock Investment Group announced a partnership on a US$800 million fund aimed at studio and English-language movies. As Variety noted at the time, the “Harvest Seven Stars Media Fund” plans to invest in three main areas: M&A for “niche” private companies that can grow in Chinese and Asian markets, operations (building a media distribution and marketing platform across Asia), and film content. Seven Stars Entertainment, parent company of Seven Stars Film Studios, has a 50 percent stake in the group.

Despite restrictions on film imports, which are -- very slowly -- loosening, and notoriously heavy-handed censorship on the part of Beijing authorities, the opportunity is clearly there in China’s fast-expanding film market. Last year, the Motion Picture Association of America said that the number of cinema screens in China are expected to grow from around 6,200 in 2011 to over 16,000 in 2015, and forecasts box-office receipts in China to swell from US$1.5 billion in 2011 to around $5 billion in 2015. Looking to cash in on the country’s expanding market and sidestep film quotas, we’ve seen several co-production companies form in recent years, both from the US as well as Australia. Last August, the Hollywood production house Legendary Entertainment announced plans to create a US$220.5 million production joint venture with the Chinese powerhouse Huayi Brothers Media Corp. aimed at making one to two “major, event-style” films per year for a global audience, starting in 2013. Though the deal remains on hold and will, presumably, fall through, the high-profile nature of the two companies involved indicates that both Hollywood and Beijing are keen to better tap Chinese and, in terms of Beijing’s goals, international audiences.

Most recently, Disney and DMG Entertainment of Beijing announced plans to co-finance and distribute the third installment of the “Iron Man” franchise, with DMG chief executive Dan Mintz saying that, with “Iron Man 3,” DMG was going to “talk to the whole world but try to infuse Chinese elements,” and last week James Cameron's Cameron Pace Group said it will set up a China headquarters in Tianjin to promote 3-D technologies among Chinese filmmakers, broadcasters and game designers.