China's luxury market: slowing, but still growing. (Quentin Shih)

The Economist Intelligence Unit (EIU) just released a report on the state of the luxury market in Asia, and when it comes to China, the assessment is optimistic. The country's luxury market growth may have been in slowdown mode since 2012, but it’s still faster than that of the United States and Europe, and likely see massive benefits from rising incomes in the years ahead.

According to the report, there are two reasons for the deceleration in the growth rate of personal luxury sales from 30 percent in 2011 to 8 percent in 2012: the slowing economy and the clampdown on official extravagance. The expected growth rate is between 6 and 8 percent this year—a number which remains slower than previous years, but is likely to beat the rates for the United States, which saw 5 percent growth in 2012, and Europe, which only clocked in at 3 percent.

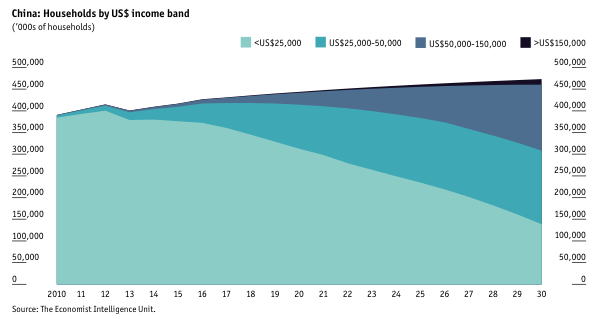

The main story of China's luxury industry, according to the report, is in the long-term numbers. The EIU predicts the number of households making US$150,000 to rise from 225,000 in 2013 to 12.7 million in 2030. This enormous increase does not even begin to take into account “grey income,” which cannot be easily quantified, yet “accounts for a large proportion of spending power in higher income bands.” These numbers look especially promising, says the report, considering the fact that the government is shifting its economic policy to focus on consumption rather than investment, which should also lead to an increase in spending.

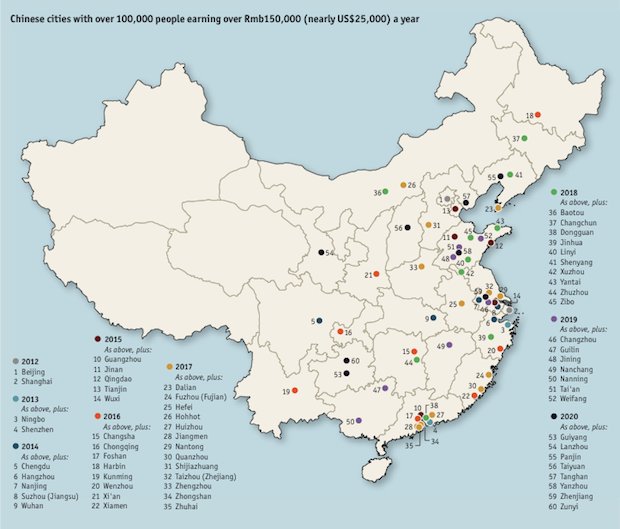

The report also emphasizes the importance of lower-tier cities to China’s luxury growth, highlighting the fact that China has 207 cities with an urban population of more than one million people that will be seeing a rapid rise in incomes in coming years. This will pose challenges for luxury brands, which will need to streamline the quality of service amidst broad expansion.

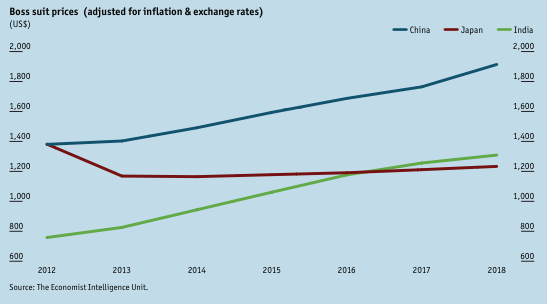

Another main finding in the report was that rather than serving as a major impediment, high luxury tariffs and taxes are actually creating a "no-lose" situation for luxury brands, which are "simply reaching Asian consumers in Dubai, Paris, or New York, instead of Delhi or Shanghai." In addition, high prices in Asia have actually led brands to enact "cross-border pricing parity"—not by lowering prices in China, but rather by raising them abroad. Prices are actually expected to rise rapidly in China over the long term. For example, the EIU calculated the expected rise in price of a Hugo Boss suit over the next few years, which is likely to affect global prices as well:

The full report, which covers all of Asia, is available for free download over at The Economist.