Burberry's Tmall shop.

While many luxury brands across the world have embraced e-commerce wholeheartedly, some historic labels like Chanel and Hermès are holding out on selling their goods online for fear of cheapening their image. This may be a useful strategy for Europe and North America, but according to a new report by Exane BNP Paribas, high-end brands that aren't online in China are losing out.

The results of the firm's survey of over 5,000 Chinese luxury consumers find that “ostrich” brands—or those that are sticking their proverbial head in the sand when it comes to embracing the digital luxury market—need to “wake up” to the reality of the way Chinese luxury consumers shop.

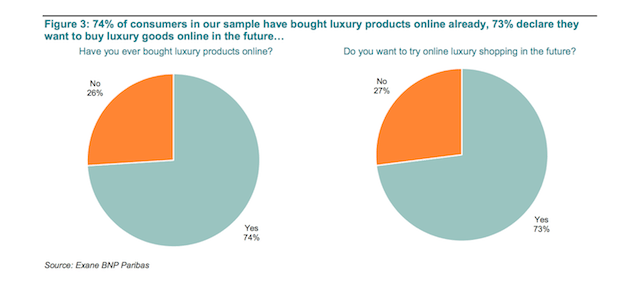

“European luxury brands that think they are not online in China, in fact have thousands of products offered under their name” on the gray market, says the report, and “putting one’s head in the sand is not going to make the problem go away.” The report finds that a staggering 74 percent of all Chinese consumers have bought luxury products online, and 73 percent want to buy online in the future. A total of 40 percent buy luxury online more than five times a year, while 35 percent said they’re going to increase their online luxury shopping.

Unsurprisingly, young, tech-savvy Chinese consumers are driving this trend. Among those under 25 years old, a total of 94 percent want to buy online in the future, and 88 percent in the 25-34 age group wish to do so.

Thanks to the comparatively high China price of luxury goods, the survey respondents’ main purchasing factor is finding a cheaper price—which is certainly encouraging the flourishing online gray market. A total of 48 percent of respondents said they’re buying online for price, which is likely the reason behind the fact that 35 percent have bought through daigou channels and 45 percent opt to buy through Chinese platforms. For now, only 13 percent buy through international websites and 7 percent buy through brands’ own online shops.

That being said, the report finds that many consumers are willing to shell out for big-ticket purchases online. A total of 39 percent of all women and 54 percent of men surveyed spend more than 5,000 RMB (US$805) per purchase, while 11 percent of men and 7 percent of women spend more than 20,000 RMB (US$3,221).

There are several key actions brands can take to respond to these trends. One of the most obvious policies is to find a quality channel for reaching Chinese consumers through e-commerce. Chanel and Hermès have a right to be wary about diving into the world of online shopping, since brands should carefully choose platforms that Chinese customers trust—100 percent of all consumers surveyed said that authenticity is a criterion for choosing an e-commerce site, while 70 percent said it’s their major concern.

For those that don’t want to take the e-commerce plunge yet, a strategy is still needed to handle the plethora of gray-market sellers found online in China (which harm brand reputation a lot more than a branded online store). The report found that the brands with the smallest number of gray-market items on Tmall include Burberry, Tiffany, Cucinelli, Loro Piana, and Louis Vuitton, while those with the most are Armani, Swarovski, Longines, Gucci, Ferragamo, and Coach.

There are several ways brands have gone about handling the gray market—Louis Vuitton signed an agreement with Alibaba in 2013 and has been cooperating with the site on taking down fakes (which are often disguised as daigou items in scams), while Burberry’s decision to open an official Tmall shop in 2014 resulted in the removal of many unauthorized sellers. Others like Chanel and Prada slashed their China prices to cut down on demand for imported goods, while conglomerate Kering took a much more litigious route by filing a lawsuit against Alibaba in May over the sales of fakes on its platforms. Whatever actions brands take, whether it’s setting up an online shop or working to preserve exclusivity, the main key is to avoid the “ostrich” approach that lets sketchy Taobao merchants hijack their reputation.