Key Takeaways:#

- China’s ongoing scrutiny of tech firms has expanded rapidly from a focus on antitrust and data privacy to cover gaming, celebrities, fan culture, and much more — all with implications for international luxury brands.

- It appears increasingly likely that brands will be hamstrung about what they can say, where they can say it, and who they can get to say it for them in China.

- The intensity of Beijing’s efforts suggests that more regulation is on the way, perhaps targeting displays of luxury lifestyles to a degree not seen since the early days of Xi Jinping’s presidency nearly a decade ago.

The Chinese luxury market remained a rare bright spot for many global brands over the last 18 months, but it now finds itself in a tumultuous place as the fourth quarter of 2021 approaches. Beijing began the year with an antitrust-focused crackdown on domestic tech giants and moved to an emphasis on tightening controls over data security, roping in the biggest names in tech including Alibaba, Tencent, Meituan, and Didi.

As noted in the recent Jing Daily and Wunderman Thompson Intelligence report, Transcendent Retail: APAC, the government’s scrutiny is spreading more broadly to the platform economy, with new rules issued in February 2021 by the State Administration of Market Regulation specifically targeting tech firms, and numerous reports of fines being levied against companies for anti-competitive practices. And while these moves are unlikely to dislodge any of the giant players, they will require such players to work much harder for future growth, rather than relying on their market power.

Vey-Sern Ling of Bloomberg Intelligence told Wunderman Thompson Intelligence, “Alibaba, Tencent, Meituan, Pinduoduo, and JD.com have already signaled plans to increase investments substantially in the coming year. This means sacrificing profit to benefit users and merchants, driven by a need to compete in a different way.”

Since the launch of Beijing’s tech crackdown earlier this year, the Chinese government has turned its attention to a wider range of concerns, and these have major implications for international luxury brands. Increased regulation of sectors where luxury brands have invested heavily in marketing to Chinese consumers over the past year, such as livestreaming and gaming, indicates that brand optimism in using new online platforms may have been somewhat premature. And what that means is that we may be set for a 2022 in which luxury marketing in China gets a lot more boring, with brands hamstrung about what they can say, where they can say it, and who they can get to say it for them.

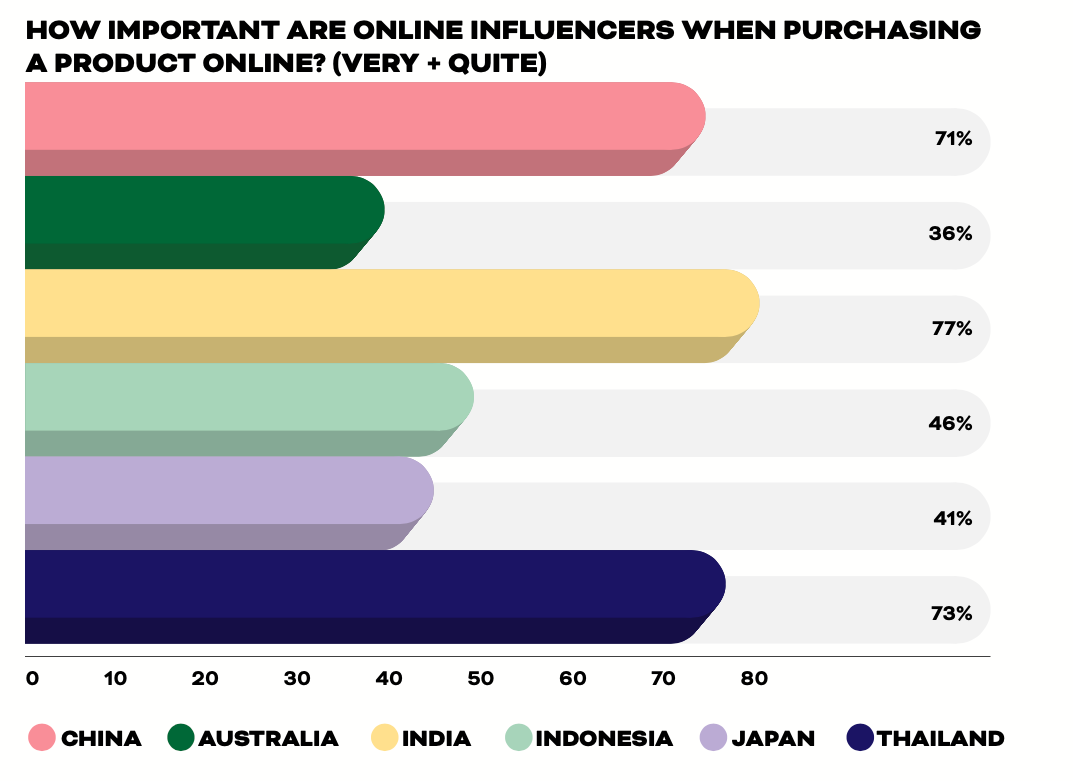

Chinese consumers rely heavily on online influencers and celebrities to help make purchase decisions. With Beijing regulators putting celebs and influencers under the microscope, international brands need to be extra careful in who they choose to work with. Source: Transcendent Retail: APAC

Some of the latest initiatives offer a glimpse into how stricter regulation could impact luxury brand strategy in the Chinese market in the months ahead. Earlier this month, Chinese authorities announced a ban on “sissy men and other abnormal aesthetics” on TV, encouraging broadcasters to “promote excellent Chinese traditional culture” instead. These moves also include a ban on idol competition shows, hitting global brands who leveraged their sponsorship opportunities to reach and influence China’s millennials and Gen Z audiences. In cracking down on these types of competition shows, Beijing is putting its foot down in an attempt to put the brakes on China’s intense “fan culture,” the subject of an ongoing crackdown.

In the latest salvo, fourteen of China’s biggest social media, video, and music platforms — including Weibo, Douyin, Bilibili, Kuaishou, Xiaohongshu, iQiyi, Tencent Video, and Youku — have issued a joint declaration on “self-discipline,” vowing to promote a healthy online culture and deemphasize their reliance on data and traffic to promote content.

These concerted efforts indicate that Beijing’s war on celebrities and influencers has only just begun, and luxury brands could very well see their planned marketing efforts for the next year come under the microscope depending on who they are affiliated with. The recent cancellations of popular brand ambassadors Kris Wu, Zhang Zhehan, and Lucas Huang following their respective scandals, multiple controversies surrounding actress Zheng Shuang, and mysterious removal of top actress Zhao Wei from the Chinese web indicate that choosing the right influencer or spokesperson is a minefield for major brands.

A key concern for any luxury brand active in China should be the likelihood of a crackdown on displays of luxury lifestyles, previously seen in the early days of Xi Jinping’s presidency nearly a decade ago. Xi’s targeting of lavish gift-giving and expensive purchases among government bureaucrats sent shockwaves through China’s luxury market at a time when major global brands saw the country as a crucial growth driver. According to regulators, the recent rules against idol programs and “abnormal aesthetics” on television are designed to address problems like wealth flaunting and celebrity worship and cultivate respect for morality.

Meanwhile, China has seen a long-term consumer shift towards support for local brands, which came to a head earlier this year when global giants names like Nike, Burberry, and H&M found themselves embroiled in the Xinjiang cotton controversy, boosting sales of local players such as Li Ning. Since then, further actions by regulators indicate that higher-end brands could find themselves in sticky situations in the year ahead.

Notably, Toronto-based Canada Goose was recently fined RMB 450,000 (approximately $70,000) for allegedly misleading consumers about the materials it uses in its popular down jackets. Although the moves are widely considered to be part of broader punitive moves against Canada in response to the country’s detainment of Huawei CFO Meng Wanzhou, they indicate that luxury brands will need to check and double-check the language of their marketing collateral lest they find themselves caught up at the receiving end of bad press and a symbolic, but still annoying, fine.

What all of this means for the year ahead is that luxury brands will need to be extremely careful about what they say in China and who they hire to say it for them. As in previous years, a sensitive geopolitical environment means that brands could find themselves caught up in boycott scenarios at the drop of a hat in 2022. And with international travel still off the agenda for Chinese tourist-shoppers, the domestic retail market remains key to driving sales. Right now, Beijing arguably has more power than ever to crack down on luxury brands that say something they don’t like (or hire someone they don’t like) in their marketing.

Just as brands invested more in virtual idols to leverage the ACG community while avoiding potential controversy caused by real human influencers, perhaps luxury brands will accelerate innovation in the areas of VR and AR in China or invest more in long-form brand films. So although the marketing landscape in China could get a lot more homogeneous and boring in 2022, it could also foster new innovations that brands could very well end up rolling out worldwide, making the headaches ultimately worth it.