In 2017, China’s e-commerce sales passed the one trillion mark. China’s e-commerce market grew 2,000 percent from 2009 to 2016, surpassing e-commerce sales for the United States and the United Kingdom combined. U.S. online sales grew 150 percent in the same period.

Both demand and supply have buttressed this explosive growth. The growth of disposable income and consumption coincided with a digital revolution driven by rapid digital infrastructure development. The gap left by the absence of strong nationwide offline retailers to cater to the meteoric rise in spending was swiftly filled by rapid growth in digital infrastructure. Mobile Internet penetration soared from 25 percent in 2013 to 68 percent in 2016.

The e-commerce giants have decoded what it takes to build trust in a largely trust-deficient market with a preponderance of counterfeit products. Speaking at the World Economic Forum in Davos in 2015, Alibaba founder Jack Ma said that for e-commerce, the most important thing he had to work on in his 14 years with Alibaba was building trust.

Let’s look at six key ways e-commerce platforms have built trust with Chinese shoppers.

1. Building Legitimacy and Credibility#

Marco Gervasi, author of the book East-Commerce, said in an interview with us that the first thing Chinese shoppers want to know is if the seller and the product are legitimate. Price is not a problem, he said. The most important thing is knowing that the product is solid.

Tmall and Taobao have been heavily criticized for selling fake goods in their early years. There are still fake goods scandals arising from China's 315 Consumer Rights Day on March 15. So it is not uncommon for brands to add brand authenticity certificates, even on the brand’s official Tmall store.

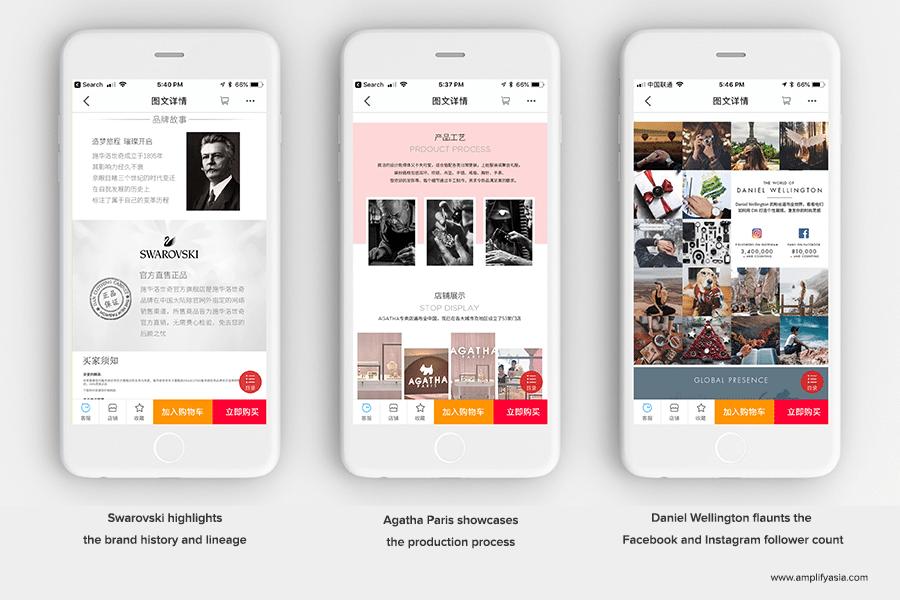

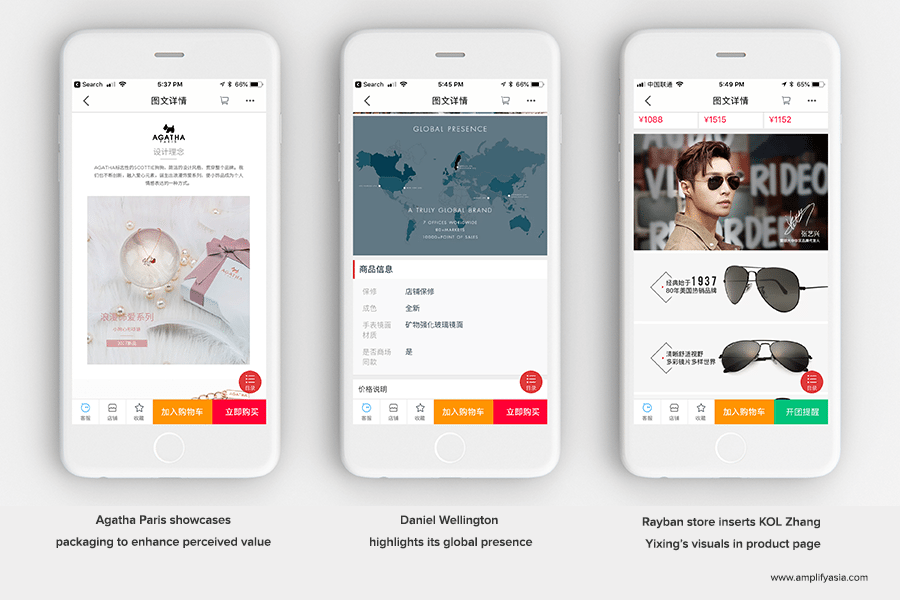

Another common practice is to include images of international street storefronts to the product page. That emphasizes the global authenticity of the brand. Even the vanity numbers of social media accounts like Instagram and Facebook are thrown in to establish the brand’s global credibility.

2. Ensuring Peace of Mind and Giving Control to Consumers#

About 10 years ago, China accounted for less than one percent of the global e-commerce market. Today, its share is 42 percent. China’s e-commerce now handles more transactions per year than France, Germany, Japan, the United Kingdom, and the United States combined.

Much of the credit for this revolution goes to the e-commerce providers who have been able to put Chinese shoppers at ease when buying online.

A no-questions-asked 7–14 day return policy proactively eliminates shoppers' pre-purchase anxiety about getting stuck with an order. This addresses two of the most common concerns in buying clothes online—size and fit. Viviana Shi, Content Manager at Puma China, told us that “size return is one of the most frequently reported reasons for returns.”

Instant gratification is the name of the game for online shoppers. A strong logistics setup that offers next-day delivery or for the customer to choose when an item will arrive helps keep consumers hooked.

Long customer service hours are also important. Chinese shoppers expect to be able to instantly get on a call or chat with an agent (a surrogate for interacting with a salesperson at a brick and mortar store), even late at night, and often hope they can negotiate a sweetened deal or preferred delivery terms too.

3. Educating the Customer#

Relative to more developed markets, Chinese consumers are still maturing. It is quite common for a consumer to order four or five pairs of shoes from Tmall and end up buying only one. When a shopper orders a pair of Balenciaga sandals in the West, he or she already knows what the product looks like. “The curiosity about what a product actually looks like is much higher in China,” says Gervasi.

Chinese product pages do not assume that the shopper knows the product. They are a way to educate consumers about products they haven’t seen before. Product pages in China “are probably three to four times as long as the international ones,” said Jean-Paul Schmitz, CEO of AsiaAssist, the e-commerce partner for European brands entering China. “In general, a product page contains details such as post-purchase care instructions, certificate of authenticity, product guarantee information, usage guide, and many more photos than just the standard three to four angles,” he said.

4. Brand Building and Enhancing Perceived Product Value#

Speaking at the Condé Nast Luxury Conference earlier this month, Angelica Cheung, editor in chief of Vogue China, emphasized the dizzying speed at which flash-in-the-pan trends can go through an entire cycle of discovery to popularity to triteness in the matter of just a few days for the connected Chinese consumer. Shoppers often go to Tmall to discover new brands rather than as an ultimate purchase destination. Given the short cycle between discovery and purchase, it becomes critical for brands to work on brand building and brand associations on the product pages of their stores.

Some of the ways brands do this are by detailing the extensive production process, highlighting the country of origin, including the latest brand campaigns, and using KOL shots. Also, at times, they’ll share the brand’s values and positioning statement right on the product page.

5. Creating Social Proof#

Research by Krishna Savani, professor at the Nanyang Business School, has shown that the link between consumer preference and the choices they make is not always strong. People do not always choose what they like most. He found that the link is considerably weaker in Asians than in North Americans. In Asia, an individual’s choice is based much more on social obligations, situational demands, social norms, and role expectations. Asian consumers are more likely to choose products on the basis of what they perceive would likely impress others, as opposed to what they actually prefer.

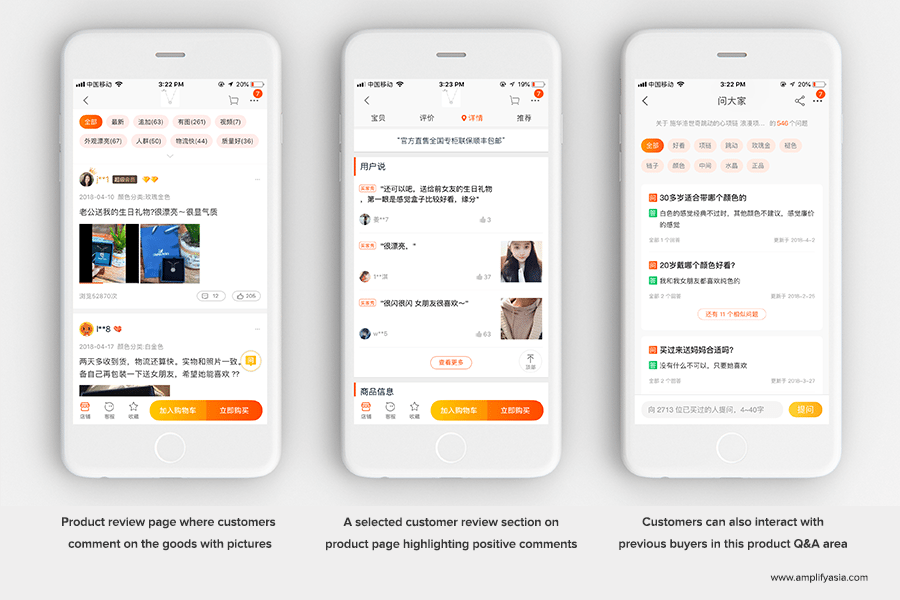

In this context, product ratings and user reviews take on a more significant meaning in China. The comfort that other people “like me” found the product up to their expectations reduces commitment anxiety and nudges consumers to add the product to their cart.

The review sections in China are very comprehensive, notes Dominiek Pouwer from TMO Group, a Chinese e-commerce agency. Advanced review features such as pictures, likes, and comments from other users make the importance of reviews high and influential. Most shoppers will check the ratings and reviews, resulting in more popular or well-reviewed merchants and products gaining more traction.

6. Enriching and Humanizing the Shopper Experience#

Chinese people are still quite used to shopping in a market where the element of interaction with the shop owner is integral to their experience. Everything in modern retail emerged in China over just the past 20 to 30 years. What may seem like a very cluttered product page on Taobao replicates offline marketplace dynamics. Chinese e-commerce is best described as a discovery-driven energetic chaos where shopping is an adventure.

Gervasi added in his interview with us that while Amazon’s mantra is to give all the information up front to the shopper in order to avoid a need for human interaction, Chinese e-commerce culture promotes interaction, recognizing it as a necessary step toward conversion that, in the process, makes e-commerce more human.

In China, people add many more products to their shopping carts or saved lists than people in Western markets, said Schmitz. It is easy to retarget these people, he said, as long as they have your product in their shopping carts. The real challenge is keeping shoppers inside a brand store since Tmall has created multiple links that consumers can very easily be pulled into. Short attention spans don't help, either. Building an engaging and rich UX design becomes paramount to keeping shoppers in a store and building enough stimulation for consumers to save a product or add it to their shopping basket.

Preeti Kumar is the founder of Amplify Asia, which partners with international brands for their China entry strategy and digital marketing operations. Evelyn Ke is a marketing entrepreneur and the lead strategist at Amplify Asia.