If you are unfamiliar with Chinese streetwear labels like Randomevent, Sankuanz, and Roaringwild, you probably haven’t scrolled through YOHO! or Nowre. Churning out the latest on the Mainland’s local fashion scene for their under-30 readership, these media titles know exactly what makes Chinese streetwear lovers spend their cash.

And streetwear is luxury’s hottest category in China. Market researcher Nielsen and Chinese e-commerce platform OFashion found that, between 2015 and 2020, Chinese spending on streetwear increased four times more than any other fashion.

As well as reporting on the latest streetwear news from its primary title, YOHO! has grown to become a media brand in its own right. Since launching in 2005 (along with its sister vertical YOHO!Girl), it has dropped collaborations with the likes of Angel Chen, and its popular trade show, Yohood, co-released projects with Justin Bieber’s Drew House, Daniel Arsham, Jon Burgerman, and Medicom Toy just to name just a few.

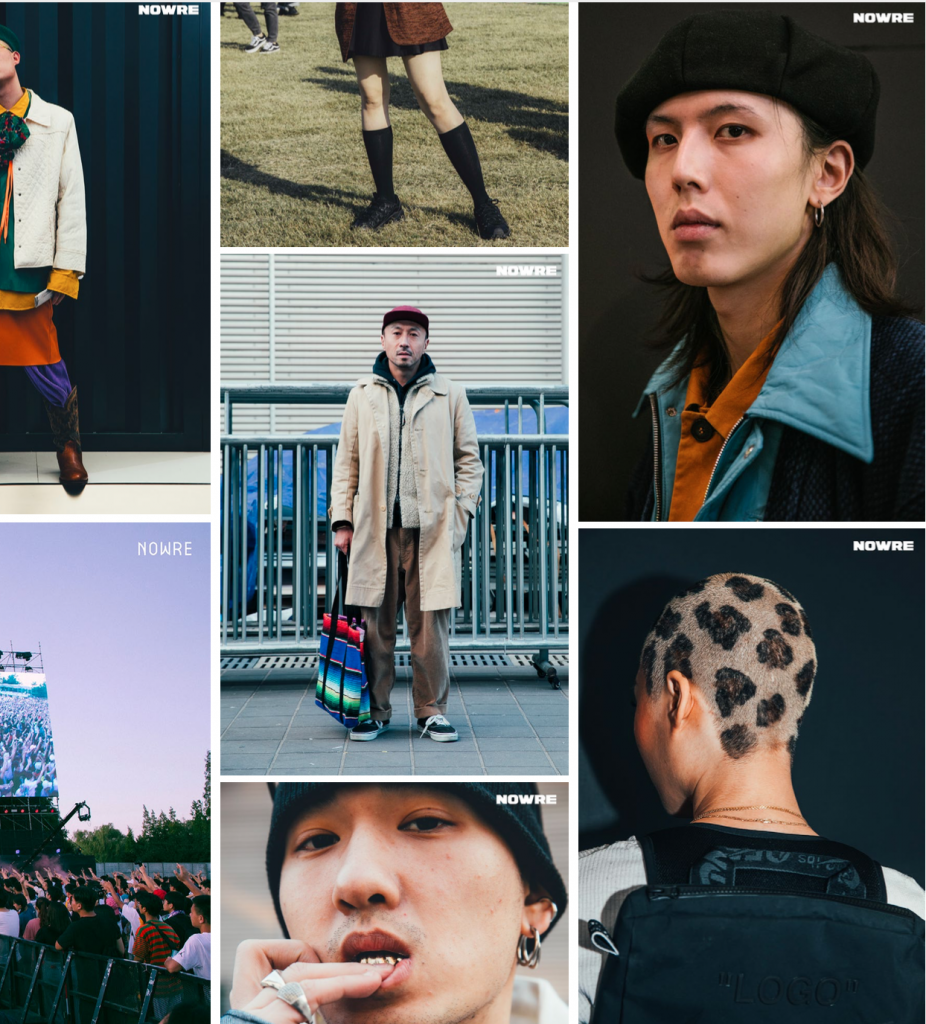

Nowre, on the other hand, is newer to the game. It launched in 2014 but has become a favorite for its impressive, up-to-the-minute news on local and foreign brands. In fact, China-focused news makes up a hefty 60 percent of the title’s content, and 90 percent of its readers are under 30 years old.

To put it simply, Nowre co-founder Peter Zhong and YOHO! editor-in-chief, Memphis, communicates with China’s next generation of luxury spenders every second of their days. That's why Jing Collabs & Drops decided to have a quick chat with them about Gen Z, collaborations, and the state of China’s streetwear culture in 2022.

Co-Founder of Nowre, Peter Zhong#

How do you think Chinese consumers have transformed in their approach to streetwear?#

For my parents’ generation, overseas stuff was always way better as the market wasn’t very open in China. Even my generation is very influenced by the culture from overseas and has gotten very attached to that culture and prefers overseas products. But Generation Z doesn't think like that. They think China has products that are on the same level as those from overseas. That suddenly changed over [recent] years.

I think that, for China’s Gen-Z consumers, it's more about self-expression. They have a clear identity. They know what they want. So I think that how streetwear is communicated has changed throughout the years.

Do you think influencers are important to China’s Gen Z?#

I think the influence is there, but it doesn't come from a singular source. When I was growing up, the media was the source of information, but from the media, now there is like, you know, the decentralized media, the bloggers, the Key Opinion Leaders [KOLs].

When we started, the media was still very centralized. But you know, now we represent streetwear or street culture [in the way] Vogue represents fashion. The media landscape has changed, one title has so many different outlets, and the influence on consumers has changed too.

How would you describe China’s streetwear consumers?#

They have developed their identity more compared to the previous generation. Back then, there was a more head-to-toe approach to styling. Now, people like a Louis Vuitton jacket, but sneakers might also be popular. It's more focused, I would say, and is more challenging for brands now because there is less loyalty and attachment to the brand itself. It takes more effort to gain a following.

What’s the state of streetwear collector-culture in China right now?#

We have passed the peak of sneaker collectors. I think it's more like, you know, five to seven years ago. I would say there's still a decent amount of sneaker collectors and the so-called "hypebeast" generation. But I think it is still slowly dying down. Same as hip hop: Everyone's listening to hip hop and rocking a pair of sneakers. In China now, when you walk down the street, there are a lot of kids rocking the limited-edition stuff. Sneaker culture is dying down because it has trickled down to the masses already.

You cover collaborations a lot at Nowre. Do you think brands should be considering collaborations when trying to conquer the China market?#

I'll say that it has been overused a little bit. Every brand is collaborating, but there are still some brands that have created meaningful collabs. It’s a good business opportunity.

Some collaborations happen outside of China, and brands try to bring them into China, like two foreign brands collaborating, for example. And they might have a certain eye for the Chinese consumer, and they want to do it in China. That's cool. And that is what brands have always been doing. There's a formula, right? But I think there is a trend that the Chinese consumer is pushing the brands to collaborate with someone they recognize or some upcoming Chinese brand to have some representation that sits on the same level as any international collaboration.

Editor in Chief of YOHO!, Memphis (小财)#

How would you describe Gen Z’s consumer habits in China?#

Well as we are targeting ages 15 to 25, we learn about youth a lot. We’ve found that those guys are so rich, they don’t care about price. The only thing they care about is whether something’s cool.

Right now, Guochao is cool. Local brands and techniques are huge right now. This generation thinks China is number one in the world; they don't care about the US or Europe. They think we have the best of everything.

So do you think collaborating with local brands is a good way for foreign ones to enter the market?#

Yes, a lot of brands are working on that right now — especially brands that are trying to re-enter due to controversies. You know, they try and enter the market by helping local brands.

How do you think streetwear has changed in China since you first entered the industry?#

I mean, the primary thing we need to talk about is the influence of social media. They gather a lot of opinions from the influencers. So when they dress or wear something, if they believe that guy is cool, everything he wears is cool.

What differences are there between Gen Z in China versus the West, would you say?#

The main difference that I see is consumer habits. Just like I said before, the Chinese Gen-Z consumers don't care about price right now. But when I went to Los Angeles, the Gen Z there didn't care about the brand. They don't care that much about the price either but won't pay a lot of money.

Do collaborations sell well in China?#

Yes — they are especially good for brands who want to enter the Chinese market right now. Consumers prefer collaborations with local-based brands or designers. Roaringwild and Randomevent, for example, have collaborations coming out every one or two months.

For more analysis on the latest collaborations, sign up for the Collabs and Drops newsletter here.