Ask any sneakerhead in China, and chances are their style vocabulary was ruled by globally familiar names like Nike, Off-White, and Yeezy — until a few years ago, that is.

“When I started collecting sneakers in the early 2010s, the whole buzz was about big names in the industry like Nike and Adidas. The notion of collecting sneakers from Chinese brands did not exist,” said Mengyi Xia, a 28-year-old sneakerhead based in the southeastern city of Xiamen. “Till now, most of the Chinese brands’ sneaker launches were imitations of international sneaker hits. They don’t plagiarize the design literally, but they follow what global brands are doing, say to imitate a particular shape,” Xia continued.

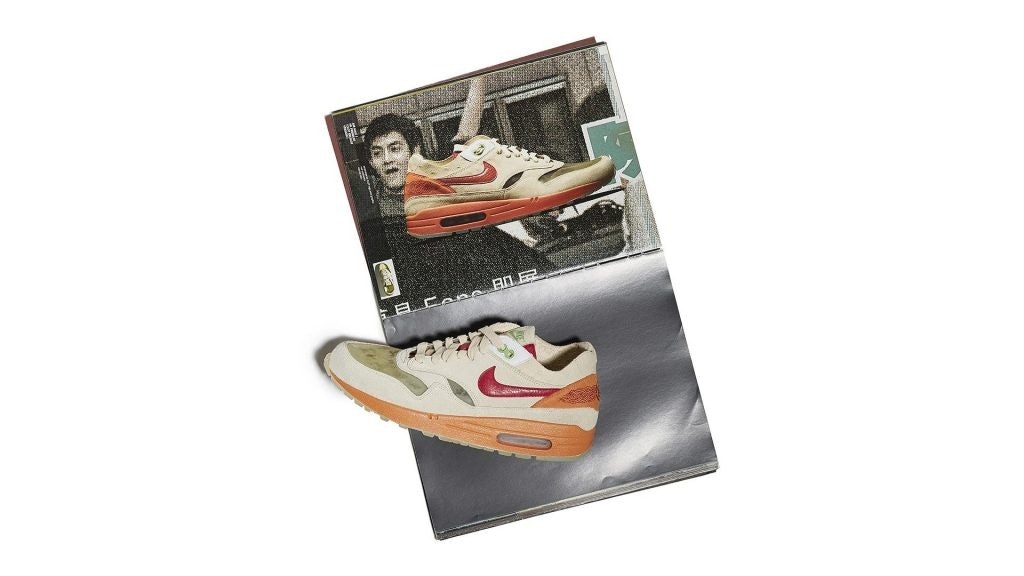

Things started to change around 2020 when the pandemic drove China’s young consumers deeper into comfortable shoes and Guochao, or patriotic consumption. The first Chinese sneaker to hit Xia’s radar was Nike’s Chinese acupuncture-inspired Air Max 1 collaboration with CLOT, the HK-based streetwear brand founded by Edison Chen and Kevin Poon. “It was big news among us sneakerheads, but it was a rare example. Then, in the past two years there was a boom of collaborations with Chinese design names,” added Xia.

The Chinese market’s lucrative growth potential kickstarted not only a collaboration craze but the rise of tech players in the space. Poizon, a Chinese analogue to US sneaker marketplace StockX, counted around 100 million monthly active users in 2021, and local research firm iiMedia predicts that China’s sneaker market will reach 30 billion by 2025.

With the rise of Guochao, domestic businesses were quick to rise to the opportunity. In 2018, local sportswear giant Li-Ning made its global debut at Fashion Weeks in New York and Paris to launch its sneaker line. Meanwhile, the brand’s rival Anta Group acquired a host of established international names like Fila, Salomon, and Descente to enhance the group’s footwear portfolio.

Heritage-inspired elements were the first elements brands tapped into to win over China’s increasingly patriotic youth. Since 2018, Li-Ning has designed sneakers inspired by Zen philosophy, Yin Yang, and Shan Shui, a Chinese landscape painting style. Similarly, Anta launched sneakers boasting motifs like the traditional Chinese luck symbol Koi fish, the terracotta army, Beijing’s Palace Museum, and zongzi, a traditional Chinese glutinous rice dumpling.

Across the globe, sneakers have become a way for shoppers to express personal style. In China, that sense of identity is inextricable with national pride. According to a recent report by the 21 Century Institute of Economic Research, 43 percent of the post-1995 generation respondents said they had a strong preference for international brands that collaborate with domestic businesses, as compared to those that don't.

“Sneakers were historically popular among the American Black communities, and they saw sneakers as a vehicle for making a unique mark in the mainstream culture. Now the young generations in China are trying to do the same. They want to show that they are proud of their Chinese identity with sneakers,” said Ricki Cai, a Shanghai-based sneaker merchandising manager.

But Yang Xin, a former sneaker designer for Anta Group, cautions against treating these heritage-inspired patterns and motifs as a panacea. “The core of the sneaker culture lies in subcultures, not identity politics,” Yang told Jing Daily.

“The reason that Chinese sneakers have taken off the past few years is [thanks to] the nationalist narrative. All of a sudden, every brand is doing sneakers with dragons, ancient monument signs, and all sorts of traditional symbols. But this does not actually create any culture around the product. From my point of view, this Guochao sneaker trend of relying on Chinese national pride feels a bit empty, and it probably will not last long,” Yang explained.

As China’s streetwear market matures and sneakerheads become more sophisticated, brands imitating Western trends or slapping traditional Chinese motifs on designs will fall behind. To stay apace with consumers’ evolving tastes, a new wave of local sneaker brands is focusing on original design and subculture-inspired cultural imprints.

Equalizer, a sneaker brand founded in 2021, is part of this cohort. The brand has earned a niche but loyal audience by collaborating with China’s indie music artists. Meanwhile, Melting Sadness, a streetwear label founded in 2016, features street art themes in its sneaker collections. In 2020, the brand collaborated with Adidas to release a line of pop color sneakers that still sell for some 40 percent above their original value on the resale market.

For international brands, collaborating with local niche labels has also proved a shrewd way to appeal to local sneakerheads. In 2019, Vans launched a capsule with four Chinese streetwear names: Attempt, Myge, Randomevent, and Roaringwild. In 2022, the American sneaker house Saucony also spearheaded a collaboration with Costs, a Shenzhen-based sneaker store.

Although these streetwear names aren’t as recognized among China’s mainstream consumers as the likes of Nike and Adidas, they’re a targeted path to loyal shoppers in the segment. The point is to create an aura of niche, original style, not just saleable merchandise.

For both international and domestic brands, generating winning media moments will distinguish the winners from the laggards. “The real power of today’s sneaker business is in its cultural impact,” said Yang Xin. “No brand has been able to create iconic moments such as Michael Jordan’s Nike jumps in China so far. And no capsule collections or limited-edition styles could even get close to that.”