Tapestry#

Mainland China proved challenging for Coach owner Tapestry in the three months leading up to December 2021. The market’s COVID-related headwinds towards the end of the year led to mid-single-digit growth versus the same period in 2020. This fell short of performances in North America (up over 35 percent) and Europe (up over 10 percent).

However, against the same quarter pre-COVID, the country is still ahead of these other regions, with growth of almost 35 percent helped by Coach’s strong position in the affordable luxury segment.

Of the 2.14 billion Tapestry achieved during its fiscal second quarter 2022 (up 27 percent), about 1.5 billion came from Coach, 500 million from Kate Spade, and 116 million from shoemaker Stuart Weitzman.

Tapestry CEO Joanne Crevoiserat put the record results in the holiday quarter down, in part, to a transformation program which has emphasized growth in China. “We are a different company than we were just 18 months ago,” said the CEO in a statement.

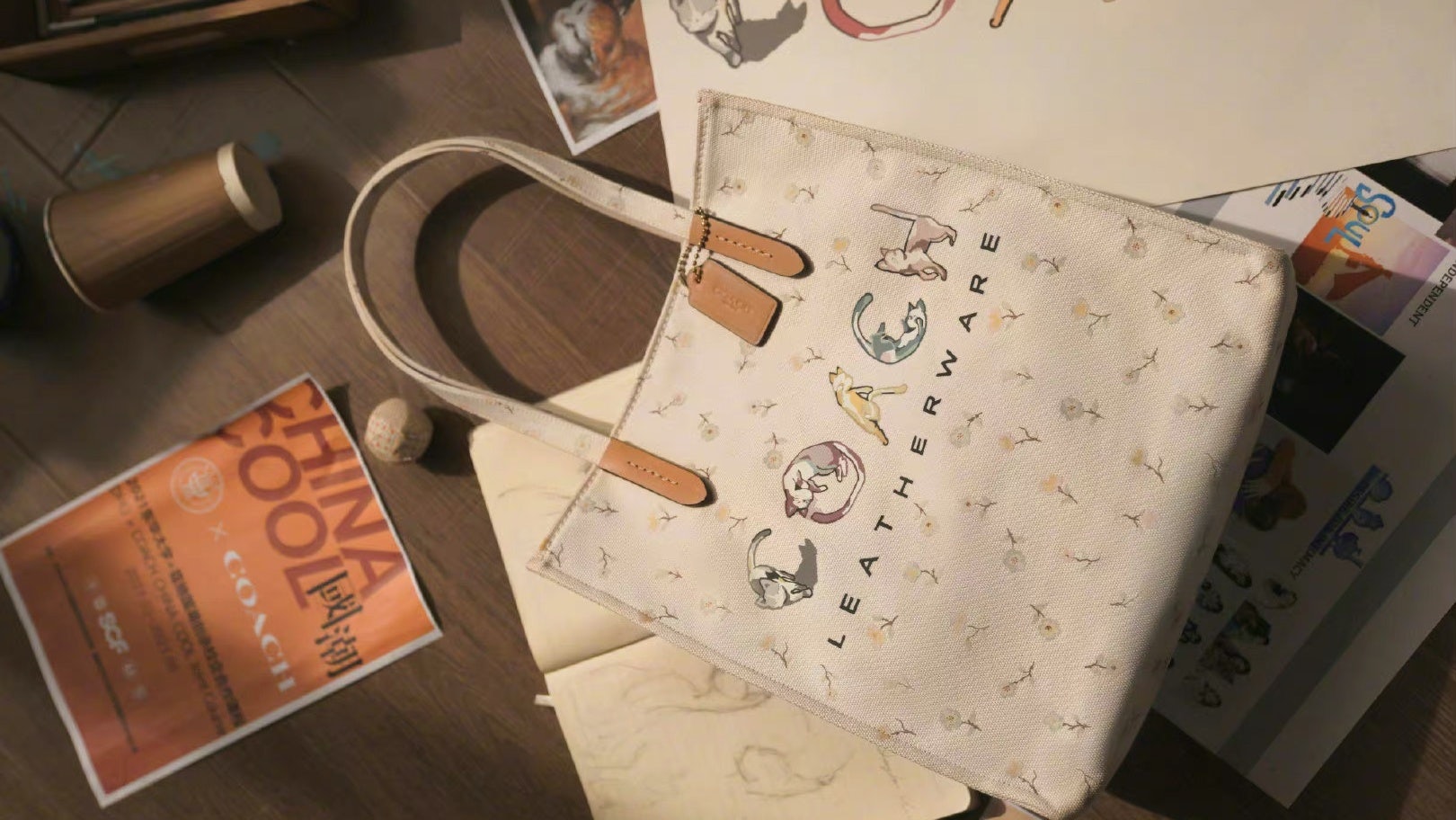

China remains a target for Coach, where strategic policies — such as capitalizing on market trends of the emerging middle class and a focus on increased digitalization — are being stepped up. Coach derives 22 percent of its sales from Greater China, so lifting brand awareness will be prioritized through investment in dedicated capsules and marketing activations.

Tapestry stock was stable through February but, like the whole market, it took a tumble due to the war in Ukraine. Over the past month the shares are down 18 percent and over the past year they have fallen by 25 percent.

Hermès#

Ready-to-wear/accessories took a bigger slice of Hermès revenue last year, pushing the segment up to a full quarter of their €9 billion turnover in 2021 (from 22 percent the year before). Those gains came largely at the expense of the French luxury house’s biggest product group of leather goods and saddlery, hit by production constraints. It fell from 50 percent in 2020 to 46 percent last year, while demand for new bags like Della Cavalleria, 24/24, and the Hermès classics remains high.

Therefore, the category rebalancing is probably temporary. It did not prevent overall sales from surging by 42 percent last year (at constant exchange rates) while recurring profitability reached a record 39 percent of revenue.

The performance was led by the Asia-Pacific region (excluding Japan), up 45 percent, and by the Americas, up 57 percent. However, versus 2019, Asia Pacific was untouchable: marching ahead by 65 percent, driven by Greater China, Australia, and Singapore. Non-Japan Asia now accounts for almost half of all Hermès sales.

Chinese buoyancy was helped by a new store opening in Shenzhen Bay as well as renovations at Shanghai Plaza 66, in Suzhou and Ningbo, and at Beijing China World. Further openings and expansions for 2022 include Taikoo Li Qiantan in Shanghai and Heartland 66 in Wuhan.

Hermès stock was down over the past month by 15 percent but over 12 months it has seen gains of 19 percent.

Farfetch#

The global online platform for luxury fashion reached a landmark in 2021 by achieving its first year of adjusted EBITDA profitability of 1.6 million on annual revenue of 2.3 billion, up 35 percent.

There was a slowdown in fourth quarter growth to 23 percent, but Farfetch founder and CEO José Neves was happy with the performance. In a statement he said: “This positions us for an incredible 2022 focused on continuing to lead the online luxury fashion industry, growing faster than the runner-ups.”

Farfetch has positioned itself as a “connector” between the curators, creators, and consumers of high-end fashion. Their marketplace (or digital platform) boasts extensive selections of in-season luxury lines from over 1,400 sellers and it generated 1.4 billion last year. Supply from both multi-label retailers and e-concession partners continued to increase year-over-year to total stock units of nearly 10 million in Q4 2021.

“Post-pandemic… we are positioned to emerge stronger than ever, delivering strategic value to brand partners and an unmatched proposition for consumers,” said Neves, who is now focused on capturing greater market share and pumping up profitability.

Among the showcases that kept consumers coming back were the Balmain x Netflix collaboration coinciding with the release of the movieThe Harder They Fall; Burberry’s outerwear campaign utilizing Farfetch’s capabilities to feature models dressed with digital assets; and Zegna’s Working With Words film series in collaboration with Port Magazine.

The London-based business also announced the acquisition of luxury beauty destination Violet Grey in January 2022, ahead of a diversification into beauty on its marketplace later this year. Also in January, through its New Guards platform, Farfetch launched storefronts for Off-White, Palm Angels, and Ambush with the Tmall Luxury Pavilion in China.

In February, New Guards expanded its brand portfolio by signing agreements with the Authentic Brands Group to become the exclusive partner to curate, create, and bring to market Reebok’s luxury collaborations. It will also become a core operating partner for the company across Europe and a distributor of premium Reebok products in the United States, Canada, Europe, and some other markets.

Despite these initiatives, Farfetch shares have remained subdued. Last month they were down 35 percent, and over the past year they have slipped by 77.3 percent.