China was the top gold jewelry buyer in 2017, according to the GFMS gold survey, the annual global gold market report by Thomson Reuters. Even though Chinese consumers’ demand is still high in global terms, Chinese millennial consumers demonstrate a very different taste toward gold from their elders.

Data from consultancy firm Metals Focus showed that in the first half of 2017, Chinese gold jewelry sales fell 3.6 percent over the same period last year. Both GFMS and Metals Focus observed the consistent decline of the demand for gold by Chinese.

Metals Focus attributed this “winter period” to the structural changes that the local market is experiencing: Products with a better design have gradually replaced the traditional 999 gold. Analysts also observed a similar trend at the recent jewelry exhibitions in Hong Kong and Shenzhen, where buyers seemed more interested in pearl and gem and less enthusiastic about 999 gold or 24k gold.

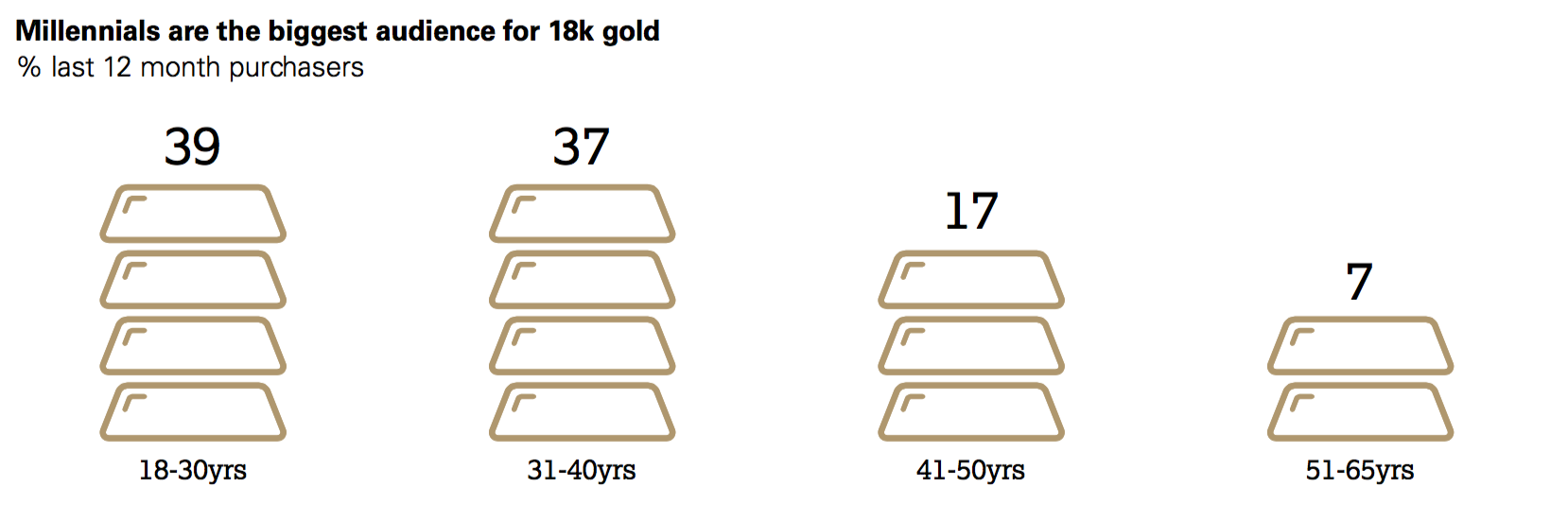

“Younger consumers continue to pull away from the traditional 24K gold,” according to the report, China's Jewellery Market New Perspectives, released by World Gold Council in December 2016, and the trend will dominate the Chinese gold jewelry market in the future.

"The idea of gold accessory is very outdated. My mom still buys a gold necklace as my birthday gift, but I never wear it,” said Yiyang Wang, a 26-year-old graduate student in Beijing. "The heavy gold is too cheesy," she reasoned.

The traditional gold consumption is being challenged by young Chinese consumers who desire exclusivity and individuality.

According to the report by World Gold Council, 18k jewelry is a new favorite for this generation, owing to the low entry cost and the broad array of designs. For luxury jewelry brands, this new trend indicates that further growth opportunities lie in the lower-karat product segment and they can serve young millennials’ interests in self-expression by marketing unique designs.

Hong Kong jewelry conglomerate Chow Tai Fook is thriving with this trend. The brand launched a 22k collection in May this year, featuring a range of designs targeting Chinese millennial consumers and priced on a per-piece basis rather than the weight of fine gold.