While luxury can mean different things to different people, there’s a growing segment of affluent Chinese consumers that have moved past thinking that luxury products — from apparel to accessories to beauty — are simply items to enhance the way you look. Instead, more and more are now focusing on a new premium lifestyle, where everything they use and purchase must be of the highest quality, with everyday items like coffee/tea drinks, food, stationery, home decor, subscription services, home appliances, and more becoming, in essence, a luxury purchase.

This phenomenon is partly attributable to the fact that Chinese consumers, especially young consumers such as Gen Zers, China’s single consumers, and super moms all have higher disposable incomes, and therefore, want higher living standards. However, the premiumization of everything in China is much more related to the psychology of consumers. Previously, purchasing premium products meant looking good in front of others. Consumers tended to splurge on luxury items (traditionally flashy, logo-laced items like luxury watches, handbags, or cars) as a way to boost their social status. But now, this group aspire to a premium living standard simply because they want to surround themselves with nice and appealing things.

The premiumization of everything in China covers all aspects of life for Chinese consumers. Take daily necessities like toilet paper, for instance. Previously, Chinese consumers would simply go for brandless toilet paper or whatever was available to them. Nowadays, Chinese consumers are more aware of the quality of these products and consider factors such as the number of layers and the safety for babies or young children before making purchase decisions.

Another example is the brand Wuchang Rice (五常大米), often dubbed the “Royalty of Rice.” This premium rice originates from Wuchang, Heilongjiang Province, and is famous for its unique fragrance and flavor. The unit price of one container (roughly 500 grams) of Wuchang Rice can cost up to 15 RMB while normal rice only averages around 5 RMB. Even when the price of Wuchang Rice is three times that of regular rice, Chinese consumers are still very much willing to buy it. The demand is so great that dishonest merchants started producing fake Wuchang Rice by adding flavoring to low-quality varieties. In fact, the official annual production volume of Wuchang Rice is no more than 1 million tons. Yet there are currently a total of 10 million tonnes of self-proclaimed Wuchang Rice that have been sold over that last calendar year.

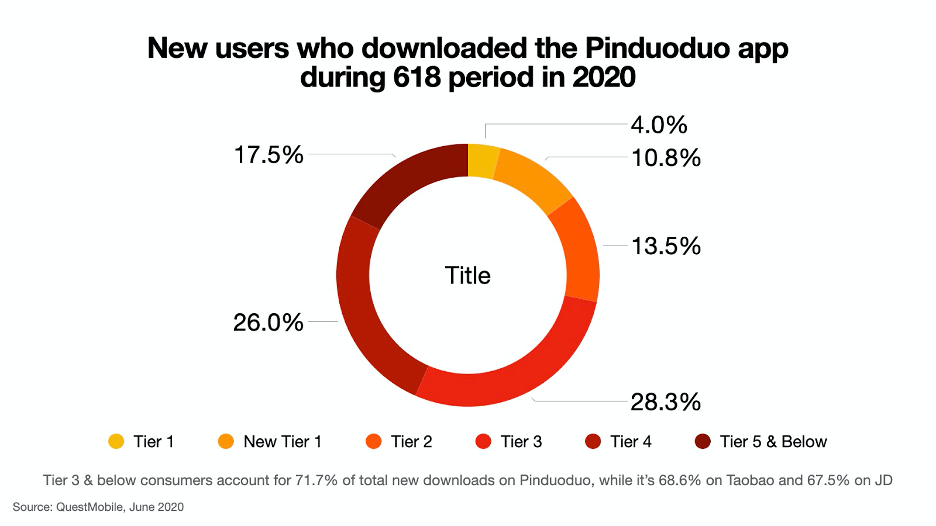

The growing trend of premiumization in China is mainly based on affordability. In the post-COVID-19 era, consumers in different city tiers have been affected differently and also show slightly different spending behaviors and decisions. Consumers in Tier 1 and 2 cities tend to be more optimistic about the economy and are still willing to splurge on items just to treat themselves well. They have moved on to purchasing entry-luxury items such as perfume, leather card holders, exercise equipment, premium pajamas, etc. Meanwhile, consumers in lower-tier cities are more conservative post-COVID-19, as the pandemic has generally affected them more. We have noticed lower-tier consumers returning to sites such as Pinduoduo to score deals and promotions when making purchases. In the long run, though, they still look up to first-tier cities and have aspirations to fill their lives with premium experiences and products.

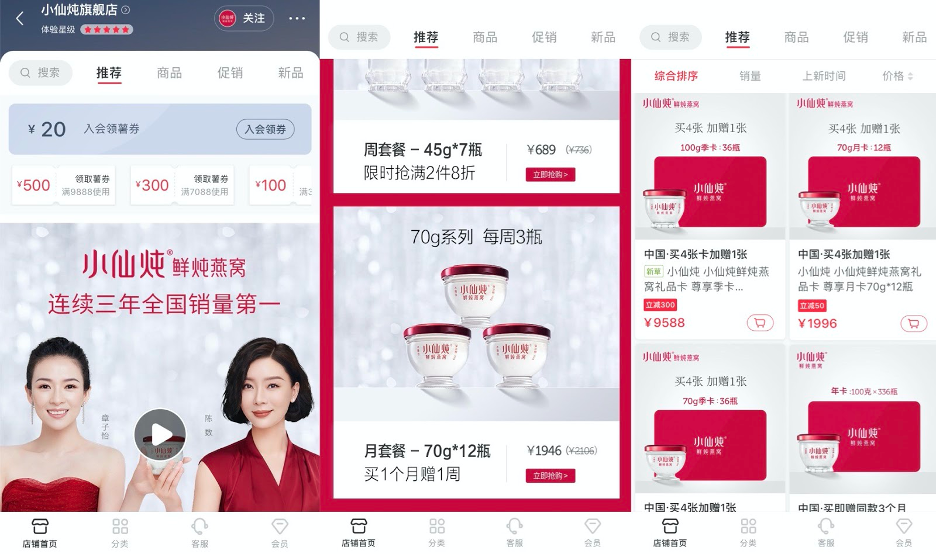

Consumers in first-tier cities aspire to live an international lifestyle and can easily spend top dollar for the finer things they like, such as subscription services. The brand Xiaoxiandun (小仙炖) has been particularly popular in China lately, especially among tier-1 female consumers. Xiaoxiandun sells Yanwo, which is an edible bird’s nest and is among the most expensive animal products consumed by humans, with retail prices up to about 6,600 per kg, depending on the grade, and is believed to have amazing health benefits, especially for the skin.

The consumption of Yanwo dates back to the 1500s when only royalty would be able to access it. Xiaoxiandun has packaged such a top-tier luxury food as a convenient subscription service for consumers. Customers can choose to commit to different subscription plans by weeks, months, or even years (for Yanwo, the advised consumption is once a day or twice a day.) The 45g and 100g products currently sell at around 98 RMB and 265 RMB, respectively, meaning these consumers can easily spend up to 100 RMB per day on supplementary snacks that have skin benefits. It’s interesting to see how modern Chinese consumers would consume a royal treat at such a scale.

For consumers in lower-tier cities, the ability to live a premium lifestyle mainly depends on what’s in their wallets. For example, while many may not be able to afford up to 30 RMB for a coffee or tea drink (the typical price point in top-tier cities), most can afford and are willing to spend perhaps a fraction of that amount. The famous tea drink chain HEYTEA (喜茶) has acted on this and launched its sister brand, Little HEYTEA (喜小茶), to specifically accommodate these consumers.

Given this, Little HEYTEA branches are mainly located in industrial zones as opposed to HEYTEA, which are located in core business districts. Also, the prices for Little HEYTEA’s drinks range from 11 RMB to 16 RMB — half the amount of the original HEYTEA brand. This pricing strategy has been very effective in attracting a wider consumer base in lower-tier cities.

What’s ahead for the industry in 2021#

The premiumization of everything is not ending. While it may have taken a different form during COVID-19 times, we know the trend is still present and increasing. Premiumization will only bounce back and continue to grow in 2021. We expect to see more and more premium products from both Chinese and foreign brands being delivered to Chinese consumers, including those from lower-tier cities. In fact, 3- to 5-tier cities will soon be the main drivers of consumption in China. Total consumption in these lower-tier cities and rural areas is expected to reach 8.4 trillion in 2030, according to a Morgan Stanley study. Therefore, brands must pay close attention to these consumers and plan their business and marketing strategies well in advance.

Key takeaways for businesses#

- Create new consumer profiles — Do your research and determine who your up-and-coming customers would be instead of just focusing on those who are buying from you currently.

- Issue entry-product lines to cater to the needs of consumers from lower-tier cities -—Little HeyTea is a good example of this.

- Premiumize your entry-luxury products that are appealing to consumers from higher-tiered cities and add a sense of exclusivity in your product offerings to attract top-tier customers.

- Do not only focus on crowded and highly competitive markets such as watches, shoes, and bags — try focusing on offering other items such as stationery, kitchen appliances, pet outfits, exercise equipment, beddings, etc.