Key Takeaways:#

Brands’ value propositions have shifted away from catering to stereotypes and towards re-defining masculinity, breaking gender boundaries, and embracing fluidity.

Even when it comes to male fashion, streetwear is still a golden ticket for luxury houses wanting to tap young male consumers in China, and beauty, fragrance, and grooming products are all significant growth engines.

The biggest challenge for brands seeking a place in this market will be to create dynamic and relatable content for online platforms that’s aimed at their target male consumers.

Male Chinese consumers have historically ranked at the bottom of the market value chain after women, children, and even pets. Yet, male consumption has been underestimated over the past few decades. And now, the “He Economy” has fully emerged in post-COVID-19 China, becoming even more powerful than its female counterpart.

According to a paper titled Analysis of Luxury Goods Consumption in China's Lower-tier Cities, which was released by Deloitte and SECOO, the number of the country’s male consumers has surpassed female consumers in terms of online luxury purchases.

Thanks to China’s shift away from traditional masculinity and towards a more fluid and inclusive definition — as well as its growing disposable income — the He Economy now offers many untapped opportunities for luxury brands. Jing Daily takes a look at how they can best reach and decode the nuances of this demographic.

A reconstruction of the male stereotype#

As in many other parts of the world, masculine stereotypes are undergoing a radical transformation in China. As such, marketers' understanding of the male consumer has been shaken up, and they have been forced to reconsider Chinese male habits. Today, these men take more care of their appearance and seek a more polished look in their professional and daily lives.

Recently, brand campaigns designed to encourage men to transcend cultural norms have surged in China's social arena. A project initiated by the Chinese qualitative consumer insights and youth marketing consulting agency Youthology — appropriately titled Wake Up, Guys — explores how brands and their male customers shape each other.

According to Youthology, brands’ value propositions have shifted from catering to old-fashioned stereotypes to redefining the concept of masculinity by breaking boundaries and embracing gender fluidity.

This direction has been aided by evolving social media perspectives and celebrity endorsements of fashion and luxury brands. Younger men, in particular, have been exposed to lifestyle and fashion content on social media that challenges the binary aspects of genders.

KOLs are also ushering in this transformation. Jia Zhang (@JZ on Little Red Book) shares outfits, grooming & fragrance products, and style tips for men on his social platforms. Content like Zhang’s is fast becoming the norm, not only contributing to a more dynamic male consumption landscape but also sparking opportunities for brands to leverage this newfound openness.

The craze for luxury and streetwear crossovers#

The influence of KOL and celebrity social posts on Chinese male consumers extends beyond emphasizing physical appearance. Men's wardrobes are also transforming. Business suits are disappearing, as men of all ages adopt a more casual approach to dressing.

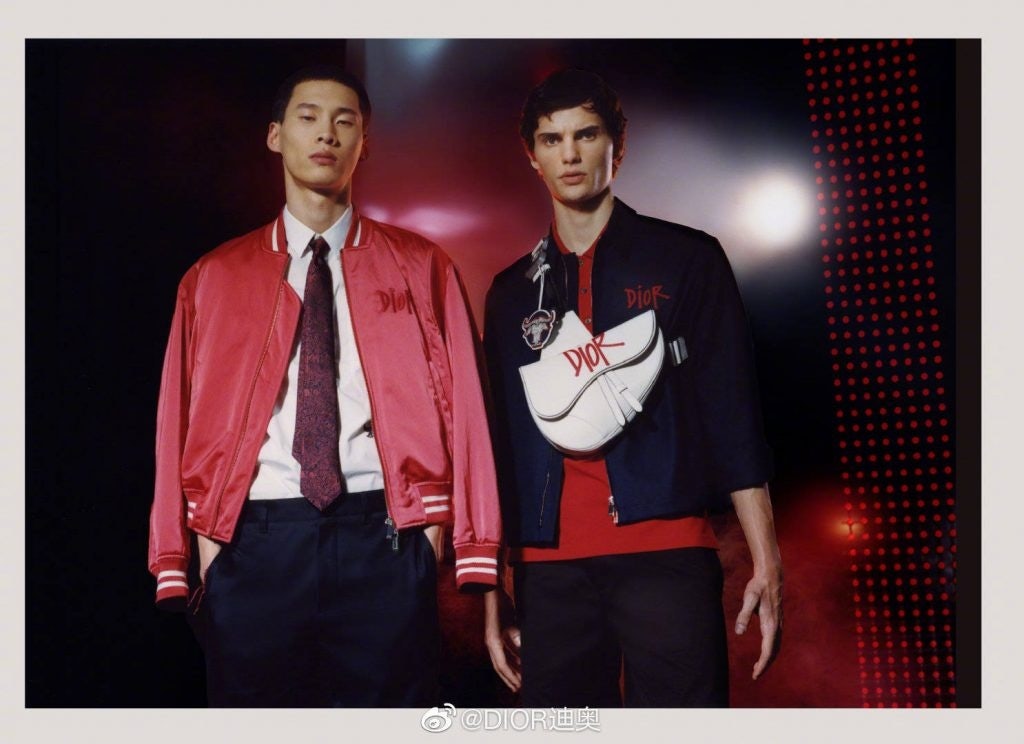

In particular, the growth of athleisure is driving the menswear boom, as pointed out in February of 2020 by Euromonitor International’s report on menswear in China. Streetwear continues to be the golden ticket for reaching young male consumers. As such, recent global appointees at established houses like Louis Vuitton and Dior (Virgil Abloh and Kim Jones respectively) and collaborations such as Gucci’s partnership with The North Face have become the norm for luxury houses catering to local shoppers.

In addition to collaboration marketing, the “drop” launching model — a strategy born from streetwear — has now been adopted by luxury players themselves. The monthly B Series by Burberry uses an online drop model, and the Dior x Air Jordan 1 sneaker employed drops to tap into the luxury/sportswear collaboration hype.

Yet, there are still market gaps for untapped categories in the luxury sector, said Pablo Mauron, the managing director of Digital Luxury Group China, to Jing Daily. “Tactics like crossover collaboration and drop retail have largely been observed for the clothing, accessories, and sneaker categories, but much less for hard luxuries such as watches and jewelry.”

What worked (and what didn’t)#

While the popularity of male livestreamers like Li Jiaqi have helped to reshape the perception of masculinity in China, their audiences are still mostly women. Nevertheless, brands can still look to female consumers to leverage male consumption, especially among older male consumers who are more influenced by their female partners.

In order to attract this market, luxury houses have been partnering with young male stars and idols also known as Little Fresh Meat. Yet, up to now, most partnerships have barely engaged with male consumers directly because female followings of male celebrities are usually driven by an attractive appearance, while male adoration is often based on an expertise in games, sports, and music.

Discerning players have realized this nuance, and are now casting influencers that attract male consumers. Fendi tapped League of Legends esports players Liu Qingsong and Doinb for this year’s Qixi campaign, and Dior used the player Yu Wenbo (@JackeyLoveasdzz) to promote its Air Dior menswear capsule collection.

But often, endorsements won’t optimize netizen engagement enough on social platforms, especially when it comes to those with unique user bases. “The biggest challenge for brands will be creating content for these platforms that are relatable for their target male consumers,” said Mauron. One platform that does this successfully is Bilibili.

Mauron highlighted a 2019 partnership between Bilibili and Louis Vuitton that used an AR filter of the League of Legends characters as the benchmark for brands eyeing that arena.

From a more practical marketing perspective, he suggested brands could use targeted social media ads for the male segment in the cities that they see the largest potential in, especially in second- and third-tier cities where they might not necessarily have a strong physical presence. They can also scale up with social CRM to segment and better target content, which, in turn, will improve conversion rates.

But before segmenting demographics, luxury brands should create offerings and brand communication strategies that break with traditional gender labels, as they often resonate with young male consumers. And if those strategies are carefully executed, older consumers will often come along for the ride.