The strength of personal luxury goods consumption in China is empowering a global recovery of the luxury market in 2017, according to a joint annual report released by Bain & Company in collaboration with Altagamma Foundation on October 25.

The global personal luxury goods market is set to rise 6 percent at constant exchange rates this year after a stagnant 2016, and the total market value is about to hit 262 billion euros (304 billion). The latest prediction is up from Bain’s mid-year forecast, which estimated a 2 to 4 percent growth of the sector to reach a total of 254 to 259 billion euros by the end of the year.

The upward revision of the growth forecast reflects Bain’s view that a healthy “new normal” pattern of growth is ultimately taking shape in the global luxury market thanks to a robust Chinese market and a rise of global millennial consumers.

The report also points out a number of emerging market trends that luxury brands need to understand to formulate an appropriate strategy when approaching this new generation—whose nature and shopping habits of luxury items are remarkably different from their predecessors.

Growth of Luxury Market in China Beats All Other Countries#

As luxury spending by Chinese consumers continues to surge both on the domestic and international scale, the Bain & Company report projects China’s local luxury market to grow 15 percent. It also predicts that Chinese consumers will account for 32 percent of global luxury consumption in 2017. The report attributes the strength of the Chinese luxury market to consumers’ renewed confidence in the country’s economic development.

The projected market growth in China is more than twice that of any other country or region this year. The Asian market as a whole, excluding Japan, is likely to grow by 6 percent. The growth in Hong Kong and Macau is expected to return to positive numbers, while growth in South Korea and Taiwan will continue to stagnate.

Japan is set to grow 4 percent owing to both Chinese tourist spending and local spending. The same factors are projected to boost the European market by 6 percent. However, the recovery of the U.S. market is comparatively slower with an estimated 2 percent growth.

Rise of Online Luxury Market Results in A Shifting Role of Physical Stores#

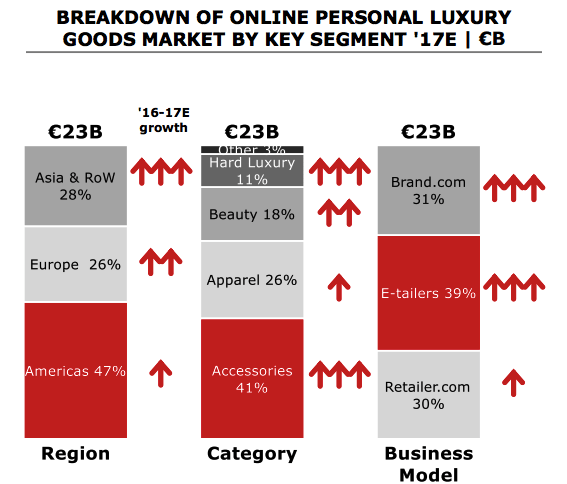

The online luxury sector is booming in 2017, which Bain estimates will rise by 24 percent. The report predicts that the market share of online channels will reach 25 percent by 2025, up from nine percent in 2017.

A breakdown of online luxury sales channels indicates that online retailers are outperforming brands and retailers’ websites to contribute 39 percent to the 2017 total growth. The report attributes this to the solid relationships online retailers have built with brands, as well as the strength of their unique content and commerce integrations.

At the same time, the usage of luxury brands’ own e-commerce websites is catching on in 2017, with this channel making up 31 percent of total online sales globally. Over the past year, a slew of elite luxury brands including Gucci, Hermes, and Louis Vuitton have all stepped up their e-commerce efforts.

The above development marks a shift in attitude by luxury players toward the digital channel. In the past, brands were reluctant to embrace digitalization as, in their view at the time; it does more harm than good in fostering a sense of exclusivity for consumers.

Therefore, “offline” retail networks will continue to shrink in the next decade, according to Bain.

“Players [need] to consider stores as episodes of the brand narrative, to impress and reassure the customer simultaneously,” according to the report—pointing out the new role that physical stores should play in the era of new retail.

It is also essential for luxury brands to integrate a variety of sales channels to build a seamless online-to-offline shopping experience for consumers. Bain advises brands to leverage the online platform as a 360-degree support channel for their physical retail network.

Price Increase Strategies No Longer Drive Growth#

The report also notes that the price inflation strategy, which has been effective in driving luxury revenue growth since the 1990s, is obsolete. Nowadays, luxury market growth is driven by increasing volumes; not price inflation.

The finding is in line with a recent study by investment bank Exane BNP Paribas, which claims that China’s luxury consumers had played a significant role in driving this trend. Exane BNP Paribas’s report explains that “middle-class Chinese consumers have significantly lower discretionary spending power than the rich early adopters,” continuing “the present demand environment is not—and will not be—conducive to high price inflation.”

Jean-Jacques Guiony, Chief Financial Officer (CFO) at the French luxury conglomerate LVMH also confirmed that price inflation was no longer relevant. The luxury giant has recorded a 21 percent revenue jump in Asia throughout the past quarter, and Guiony firmly stated that the growth was not a result of the price increase of their goods.

Brands Need to Capture the Traveling Luxury Consumers#

The flourishing global travel and tourism market, especially in China, has increasingly blurred the line between luxury purchases domestically versus abroad and demonstrated the growing importance for brands to serve traveling, luxury consumers.

Chinese tourists have a keen interest in buying luxury products when traveling abroad, but reasons differ between market segments. While China’s budget-conscious middle-class consumers enjoy taking advantage of price differences and tax exemptions at overseas duty-free stores and outlet malls, ultra-wealthy customers prefer to shop abroad to receive better customer service and more product selection.

In response to this trend, Bain suggests that luxury brands should develop an “insider abroad, stranger at home” approach to address this rising need. It means that when serving outbound tourists, brands should treat them as locals through “adjusting store concept,” “offering location-specific product and in-store experiences, not transactions,” and “making them feel welcomed and recognized, everywhere.” When serving domestic customers, brands should encourage them to travel by providing multiple shopping formats across the city, frequently refreshed assortments, make the in-store experience relaxed, and create a seamless shopping experience.

The Rise of Millennialism Gives Birth To “New Luxury”#

With the entrance of a younger generation to the luxury market, the meaning of luxury has dramatically changed, according to Bain. Luxury consumption has become a way of self-expression, which can make them feel part of a group with shared values. Generation Y and Z value brands with creativity and strong opinions as they view shopping behavior as a way to express their ideas and preferences.

Also, millennial consumers demand a much closer relationship with brands compared to the previous generation. “Consumers don’t want to just listen to brand stories, but want to live the story,” the report finds. Therefore, luxury brands need to come up with creative marketing campaigns to engage with consumers, making them part of the ongoing dialogue and fully immersing them in the luxury experience that brands create.

Looking forward, Bain holds an optimistic view of the global luxury market, expecting it to grow 4 to 5 percent annually in the near future. It particularly refers to the growing Chinese middle class and Gen Y and Z as the main forces driving the market.

However, this rosy outlook does not necessarily guarantee a successful future for all brands. Winners and losers will continue to surface with the best-performing labels driving standardization of sales channels across successful categories