What happened

According to new data from Euromonitor International, China will become the largest consumer of denim clothing in the world by 2023. The Chinese jeans market is forecasted to grow at an annual rate of 13.5 percent, eventually reaching 13.4 billion. Global figures show that the jeans market is expected to reach 106 billion by 2024. Also, China only currently boasts 3.7 pairs per capita (compared to 5.8 pairs of jeans per capita in the US). Altogether, that points toward China accounting for an impressive share of this future market.

Jing Take:#

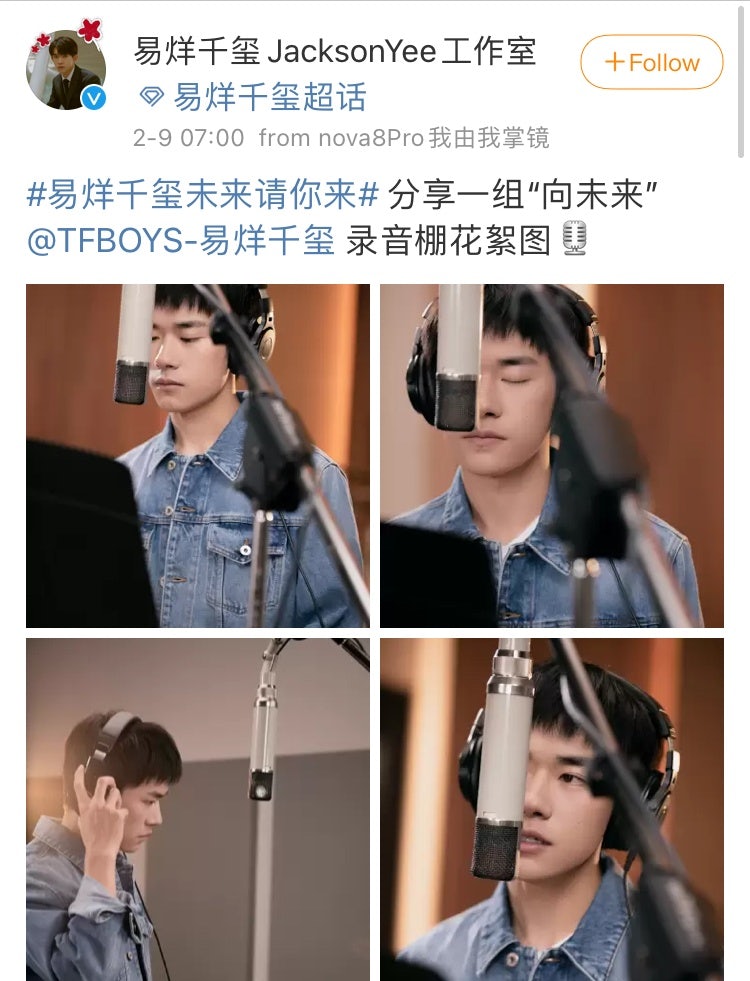

With China overtaking the US in denim sales, there will surely be more jeans sold to computer programmers than cowboys. Tmall data shows that due to this demographic, the “three-piece set of coders” (referencing plaid shirts, backpacks, and, of course, jeans) achieved explosive growth during the Double-11 pre-sale period, and jean sales increased by a whopping 1,917 percent during the 618 period in 2020. Pictures of mega-celebrity Jackson Yee wearing denim jackets on Weibo are undoubtedly doing wonders for the fabric among Gen-Z followers. His latest post, which has collected 80,000 likes and 17,000 comments, is propping up men's brands like Tonlion 唐狮 and Afs Jeep 战地吉普, as both are selling well on Taobao and Tmall.

But between 2014 to 2018, four of the five top brands in China were international, and two were dedicated jeans brands (Lee and Levi's). That means global names are leading the market, at least for now. However, according to Euromonitor, these top five (including Chinese fast fashion brand Heilan House) only accounted for 10.8 percent of the sector. That leaves nearly 90 percent of sales filled by miscellaneous brands. It is little wonder that international brands are stepping up their game. Wrangler expanded into China via Tmall late last year, taking a savvy, digital-first approach. Meanwhile, Diesel went physical, debuting its first hub — a highly-personalized shopping spot for Chinese consumers — in Shanghai. No doubt, global brands and niche names will be on a jeans gold rush until China produces its own definitive denim brand.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.