Luxury brands’ “Great Chinese Dream” is largely dependent upon China’s millennial and Gen-Z shoppers, who Bain & Company estimated would account for 46 percent of luxury purchases in the market by 2025. But what if this promising outlook is partially fueled by debt?

A recent survey from HSBC shows that the debt-to-income ratio of China’s post-'90s generation (typically refers to individuals born between 1990 and 1995) has reached a staggering 1,850 percent. Meanwhile, the average amount of debt this group owes to a variety of lending and credit-issuing institutions is over 17,433 (RMB 120,000).

To make a rough comparison, that’s nearly half of the debt millennials in the United States have right now. American millennials who carry debt owe an average of 36,000, according to the latest statistics from Northwestern Mutual’s 2018 Planning & Progress Study.

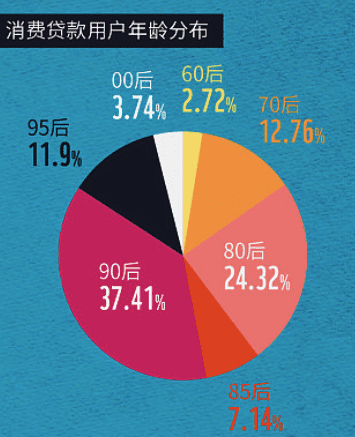

Another set of data released by U.S.-listed Chinese financial lending platform Rong360 indicates around 85 percent of applicants for consumer lending in China were born after 1980. A detailed breakdown of the survey shows that 24 percent of lending applicants were post-'80s, 7 percent post-'85s, 37 percent post-'90s, 12 percent post-'95s, and 4 percent post-'00s.

Young Chinese may decide to embrace a life with debt for several reasons. As a group that desires instant gratification, running into debt to pre-own a high-profile luxury item that they will only be able to acquire in the future is certainly acceptable.

Yu Runting, a 26-year-old Chinese woman working in a marketing and public relations agency in Shanghai is one of them. Yu’s monthly net income is only 1,316 (RMB 9,000), and she spends around 95 percent of it on rent, basic necessities, and other expenditures.

However, only this year, Yu has bought four new luxury items – Celine’s “Medium Classic” Box (retail price of 4,400), Chanel’s “Gabrielle” Hobo Bag (retail price of 4,500), Bvlgari’s “Serpenti Forever” shoulder bag (retail price of 2,100), and a Tasaki “balance eclipse” gold earrings (retail price of 1,800) – by maxing out four credit cards and using credit offered by Alipay’s online lending system Huabei (花呗). Thus far, she has only repaid some of the credit card debt and none of the Huabei loan.

Currently, Yu has around 8,400 in debt, and her monthly interest payment stands at 300. “Everyone working in my company, from receptionists to managers, own at least two luxury handbags, and I know a majority of my colleagues at my level borrow money to pay for this high-spending lifestyle,” said Yu, who sees it as a common practice in her industry.

When asked if she is concerned about repaying the debt, she said no. “I will ‘beg’ my parents to pay it off for me when I go home for the Lunar New Year in February.” Yu is highly confident about that scenario because she said she did not ask her parents to buy her a luxury car as many of her friends did.

Yu’s optimism over her debt situation shows how the consumer debt issue in China differs from the West.

“Many of these millennials and Gen-Z luxury consumers are single children using family money,” said Chen May Yee, APAC Director of the Innovation Group under J. Walter Thompson Intelligence. “And they are free from the practical or cultural constraints of their parents’ generation, who were taught to save, save, save.”

It is fair to say Chinese parents are the ones who are truly powering the luxury consumption of these young shoppers. However, the sustainability of this spending model for luxury brands is uncertain.

“Our hypothesis is that their attitude toward 'big ticket' items -- housing and automobiles -- will be very different from previous generations,” said Pascal Martin, Partner at OC&C Strategy Consultants.

Martin believes many of these consumers will simply give up owning an apartment because it is unaffordable. Also, for the same reason, and because alternative shared transportation solutions will become more common and convenient, they may be less interested in owning a car.

“As a result, they may have more disposable income that they can devote to buying nice things for themselves (e.g., luxury) and enjoyable experiences (e.g., traveling, cruises)," Martin noted. "If so, there is a high probability that they will carry on with their high spending habits as they come of age.”

However, JWT Intelligence’s Chen May Yee cautions that while it may be sustainable in the near term, beyond that, it’s hard to say. “I don’t think luxury brands can take anything for granted these days, and I am sure they are not,” said Chen.