Global consultancy Bain & Co., in collaboration with Italian fashion association Altagamma, released a new report on November 15 that is set to boost the confidence of luxury players.

It forecast the global personal luxury goods market sales to grow 6 percent at constant currencies this year, the same growth rate as 2017. The report also called current concerns about a U.S.-China trade dispute and economic slowdown in China (the home to today’s most affluent consumers) just “some possible bumps along the road.”

These “bumps” will not offset the ongoing strong fundamentals. By 2025, China’s millennial and Gen-Z shoppers will account for 46 percent of purchases in the market, up from 32 percent in 2017, according to the report. Nonetheless, China will account for half of those expected sales, under the guidance of the country’s government (lower import taxes, price difference, and daigou crackdown) and as a result of the improved presence and service of international luxury brands there.

Over the past few months, global luxury brands including Louis Vuitton, Gucci, Burberry, and Marni have taken cues from the Chinese government, marking down retail prices from three to eight percent on average to encourage domestic spending.

Elsewhere, the European luxury market is lagging behind owing to strong currencies that impede tourist spending; the Japanese market is facing a soft landing as the local demand is weak, the report noted. The American market is positive thanks to a robust economic cycle but brands are all mindful on the potential impact from the trade war.

Online: the fastest-rising sales channel#

The report also said online sales channel, including brands’ official sites, e-tailers and retailers’ e-commerce platforms, will account for 25 percent of the market value by 2025, up from 10 percent in 2018. Beauty and accessories categories experienced rapid sales growth online as these items do not require buyers to physically try on.

In addition, 100 percent of luxury purchases by 2025 will be influenced by an online interaction, Bain & Co. said, which calls for brands and retailers to consider the digital footprints of luxury shoppers – how to direct them to reach loyalty level, from awareness, consideration, and purchase.

Online influencers, social media, and content commerce have come together to shape the future of shopping experience for luxury consumers. This is particularly advanced in China, where the nation sees the rise of all types key opinion leaders (KOLs) and different social media platforms, such as WeChat, Little Red Book, Weibo, and Douyin, that assist brands in selling items.

Offline: airport retailing and off-price stores reaching potential#

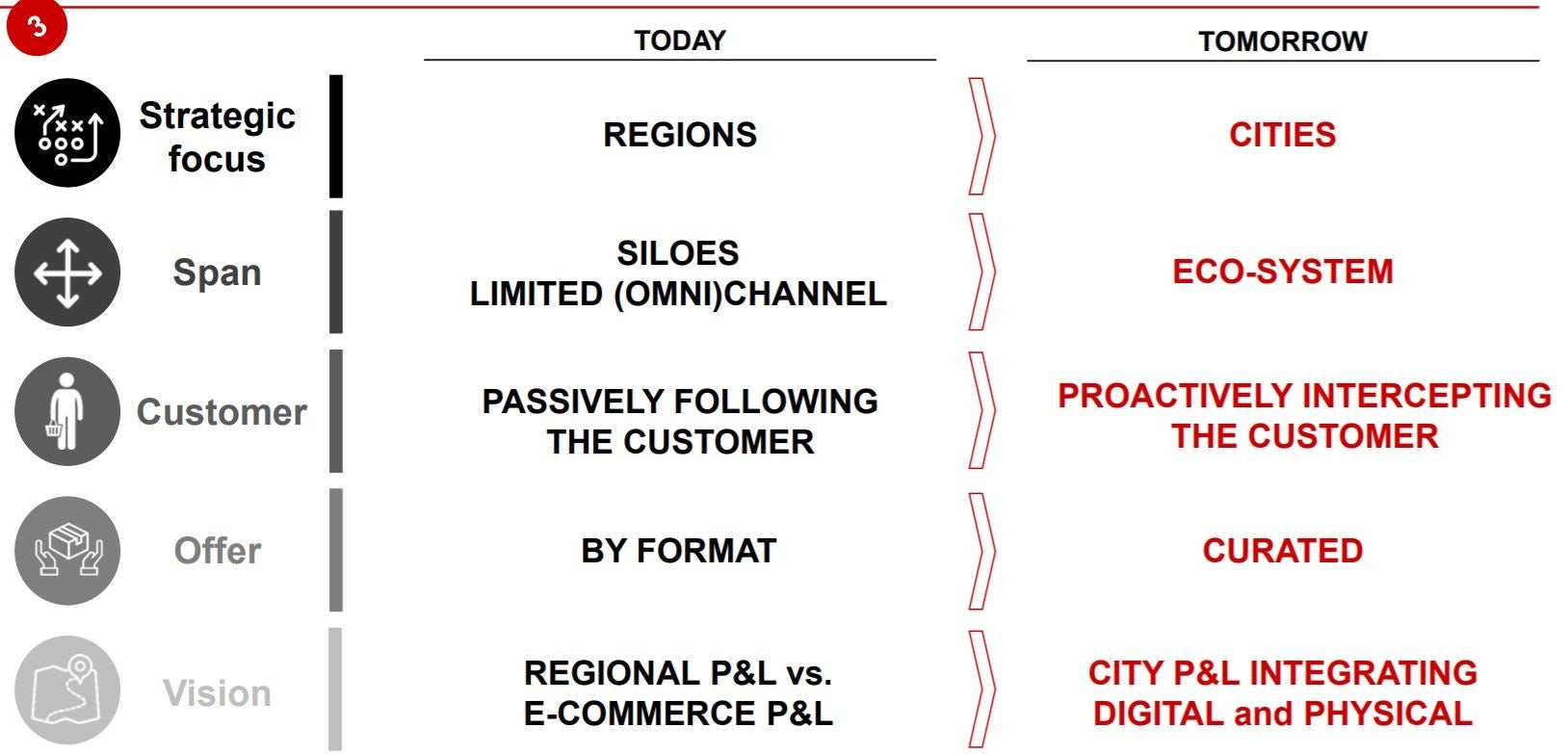

From now through 2025, the landscape of physical stores will go through a dramatic transformation, the report pointed out. Physical channels have to reshape their purpose and mission, focusing on the core elements of value, as they are pressed by the online channel.

Bain & Co. expected airport retailing (duty-free stores) and off-price stores (like outlet malls) would continue to grow, up to 7 percent (from six in 2017) and 13 percent (from 12 in 2017), respectively. More traditional channels such as department stores and specialty stores will lose relevance gradually. The market shares of department stores will decrease to 13 percent in 2025 from 21 percent in 2017, whereas that of specialty stores dropped to 17 from 22 percent.

In the next few years, the report also expected to see a negative growth of net store opening in the luxury arena, as the role of a physical store will transform to a point of touch from a point of sales.

Convergence of luxury, lifestyle, fashion and sportswear brands#

Over the past two years, the personal luxury goods market has seen fierce competition between luxury fashion, lifestyle and sportswear brands, with the success of sneakers being a prime example of this trend. Bain & Co. believed different brands will cross-over typical competitive boundaries, converging into one market. In the near future, two types of brands will emerge, namely monographic brands and anthological brands.

The report also emphasized how a successful brand need to be a platform that offers the best products and experience as well as conveys a point of view that resonates with consumers.

Be adaptable to different subcultures#

A set of values and norms that are previously distant from luxury brands will come to determine their future. These include cultural inclusion (gender, race, body shape, religion, and ethnicity) and sustainability mindset.

The report highlighted two customer segments – M Millennials (Muslim millennials) and C Millennials (Chinese millennials). These two groups are known to have quite different cultural, political and religious beliefs that require brands to take note.

Chinese Gen-Z is different from the rest of Gen-Z around the world#

It is not surprising that Gen-Z customers will eventually surpass millennials to be the biggest buyer in the market. By 2025, the report estimated them to represent over 55 percent of purchases and would deliver more than 130 percent of total growth over the 2018-2025 period.

It further highlighted the different characteristics that China’s Gen-Z has – luxury attitude, social and Chinese pride.