What happened

China’s tech giants are racing to introduce similar services to OpenAI’s advanced artificial intelligence (AI) chatbot ChatGPT, which is taking the internet by storm.

E-commerce giant JD.com announced on February 10 that it will release an “industrial ChatGPT” called ChatJD that’s intended to help businesses with content generation, human-machine interaction, livestream e-commerce, and customer service in finance and retail. JD.com’s chief competitor Alibaba said last week that it’s internally testing a generative AI platform similar to ChatGPT. Neither JD.com nor Alibaba provided a launch timeline.

Baidu, which operates popular Chinese search engine Baidu.com, revealed that it has since 2019 been working on a similar chatbot called Ernie Bot, with a release scheduled for next month. Meanwhile, internet giant NetEase said it’s developing a generative AI for its education subsidiary Youdao and aims to release a demo soon.

Notably, Chinese luxury e-commerce retail platform Secoo stated on February 6 that it will “conduct in-depth research and expansion on AI Generated Content (AIGC) and ChatGPT-related technologies” to improve its customer conversion rate. Secoo’s stock on Nasdaq jumped by 124 percent that day to 3.77 per share, the highest since March, 2020.

The Jing Take

Although internet users in China cannot easily access ChatGPT, Chinese netizens, like their global peers, are deeply intrigued by it.

An analysis of Google Trends in late January found that China accounted for a high volume of searches for ChatGPT, and the hashtag “when will China’s own ChatGPT emerge” has gained 220 million views on Weibo. It’s no surprise that China’s tech giants are riding the ChatGPT wave. Chinese AI-related stocks have surged since the start of 2023 as Chinese investors are betting that domestic options will emerge soon, and it’s in the interests of Chinese tech companies to maintain this momentum.

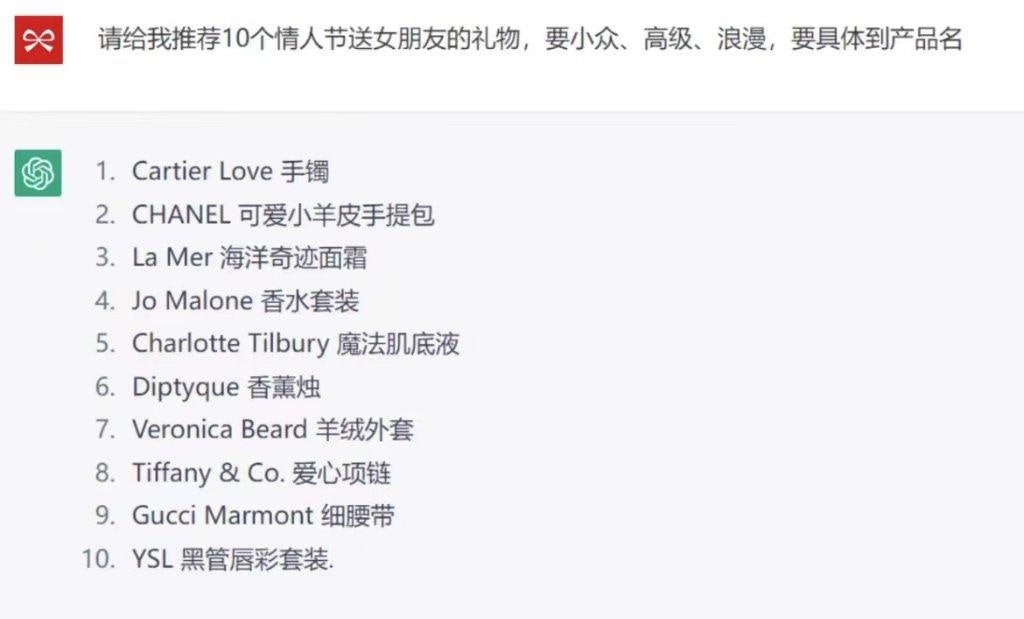

AIGC has the potential to impact China’s luxury retail. AI-generated text, videos, and product descriptions could help with consumer engagement, especially for consumers wishing to know more about a brand or its products. For instance, a Xiaohongshu user shared his experience of asking ChatGPT for recommendations on which niche brand products to give for Valentine’s Day. The posted chat record shows that ChatGPT was capable of introducing brands, products, and prices, as well as tailoring its responses based on user feedback. If well-integrated into e-commerce platforms and luxury labels’ social media mini-apps, AIGC could make the luxury retail experience more seamless for consumers and cost-effective for brands.

However, ChatGPT and its potential counterparts in China are still in the early stage of development. So far, there’s been no product demo or detailed service solutions from China’s tech giants, meaning that observers can only speculate as to what exact role the latest technology will play in retail.

For Secoo, which has been struggling to deal with lawsuits, user complaints, and reports of “rug-pulling”, leveraging AI chatbot technology could enhance consumer curiosity in the short term but is unlikely to reverse its fortunes overall. In fact, prematurely relying on the technology could increase the likelihood of errors occurring, and mistakes made by the chatbot would likely be quickly identified and discussed by China’s digitally-savvy consumers, which could make Secoo’s situation even more precarious.

Luxury brands in China should wait till Chinese tech companies come up with proven generative AI solutions before incorporating them into their retail strategy. Until then, the crucial task of connecting with Chinese consumers should firmly remain in the hands of humans.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.