Champagne Sales Rose 7 Percent Globally Last Year#

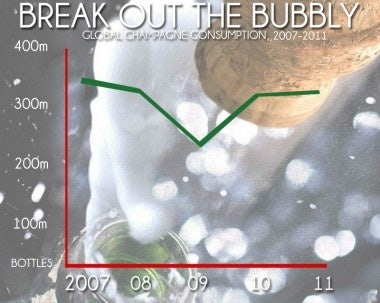

Along with other emerging markets like Russia and Brazil, demand for high-end bubbly among China's growing middle class is causing a highly welcome boost for an industry that's encountering tougher times at home. Last year, global champagne sales rose seven percent by value, with the industry group CIVC saying this week that 323 million bottles of champagne, worth an estimated 4.4 billion euros (US$5.9 billion) were consumed last year, with demand for upmarket brands leading the way. According to CIVC spokesman Thibaut Le Mailloux, despite a 1.9 percent drop in champagne's home country of France, and a general slowdown throughout Europe, "It is exports which are driving the growth in champagne, especially with the emergence of new markets which are taking up the slack in old established markets."

Still, outside of France, several developed champagne markets registered impressive gains in 2011, with the US market surging 14.4 percent to 19.4 million bottles, Japan rising 6.7 percent and Australia shooting up 32 percent to 4.9 million bottles. Though less than Russia's 24 percent rise, China recorded a 19 percent increase in champagne imports, to 1.3 million bottles. This puts China neck-and-neck with Singapore, which also imported 1.3 million bottles of bubbly last year -- itself a 20 percent rise -- while elsewhere in Asia South Korea rose 31 percent to 480,000 bottles and India consumed 290,000 bottles, a significant increase of 58 percent over 2010.

In Europe, overall sales eked out a 2.1 percent rise, driven by Germany and Belgium, which both recorded 8.5 percent increases in demand, as well as Italy and Sweden, which gained 6.3 percent and 6.6 percent respective gains. Traditionally strong importer Britain, whose luxury industry was hit hard last year, saw a 2.7 percent decrease in champagne demand as domestic consumers cut back.

Following a dramatic 28 percent drop in champagne exports in 2009, French producers have been keen to tap the newly wealthy in growing markets like mainland China, as well as fellow BRICs Russia, Brazil and India. Despite a consumer base more geared towards red wine at the highest end of the market, top brands like Moët & Chandon and Veuve-Clicquot have aggressively turned to fashion and art influencers, as well as social media platforms like Sina Weibo, to target younger Chinese drinkers. As Jing Daily noted last month, Moët & Chandon in particular has been among the fastest movers on Weibo in the luxury industry in the past year, using their Weibo page to educate potential buyers while brand-building in a potentially lucrative market. Though champagne continues to lag far behind red wine in sales in China, Moët has sought to leverage the popularity of Weibo to raise its visibility among the 25-35 year-old demographic, launching recent efforts like its “Mr. and Mrs. Moët” contest alongside on-the-ground events in Beijing and Shanghai, and changing the look of its Weibo page to promote its rosé champagne around Valentine’s Day.