Key Takeaways:#

China’s third generation of social media is driven by a mixture of Social OS and AI content, which produces feeds based on content rather than networks.

Luxury brands like Cartier have already embraced this change in China by creating fun campaigns on short-video platforms.

The inclusivity seen in Cartier's user-generated content campaign on Douyin is crucial when targeting China’s younger buyers.

The rapidly-changing consumer landscape has moved at a slower pace in the luxury industry, mostly due to ingrained notions about what "luxury" means and the resulting behaviors they produce. But in China, where a digital transformation has led to a new generation of social media, the luxury market has begun shifting dramatically.

Traditional marketing campaigns that rack up high-production costs through glossy ads and commercials aren't going to work for Western luxury brands that want to gain a foothold in China. Today, brands must compete on the country's most powerful platforms: third-generation social media.

Yet, a few luxury brands have already embraced this shift with wild success, and one of the most adept in China right now might surprise you: the French luxury brand Cartier. Now, let’s take a closer look at how the latest form of social media evolved in China and how Cartier was able to harness it.

The shift from network to content feeds#

Even though it’s already a prominent and accepted marketing source in China, third-generation social media has only just begun to see traction in the West. But what exactly was this shift, and why has China so readily adopted it?

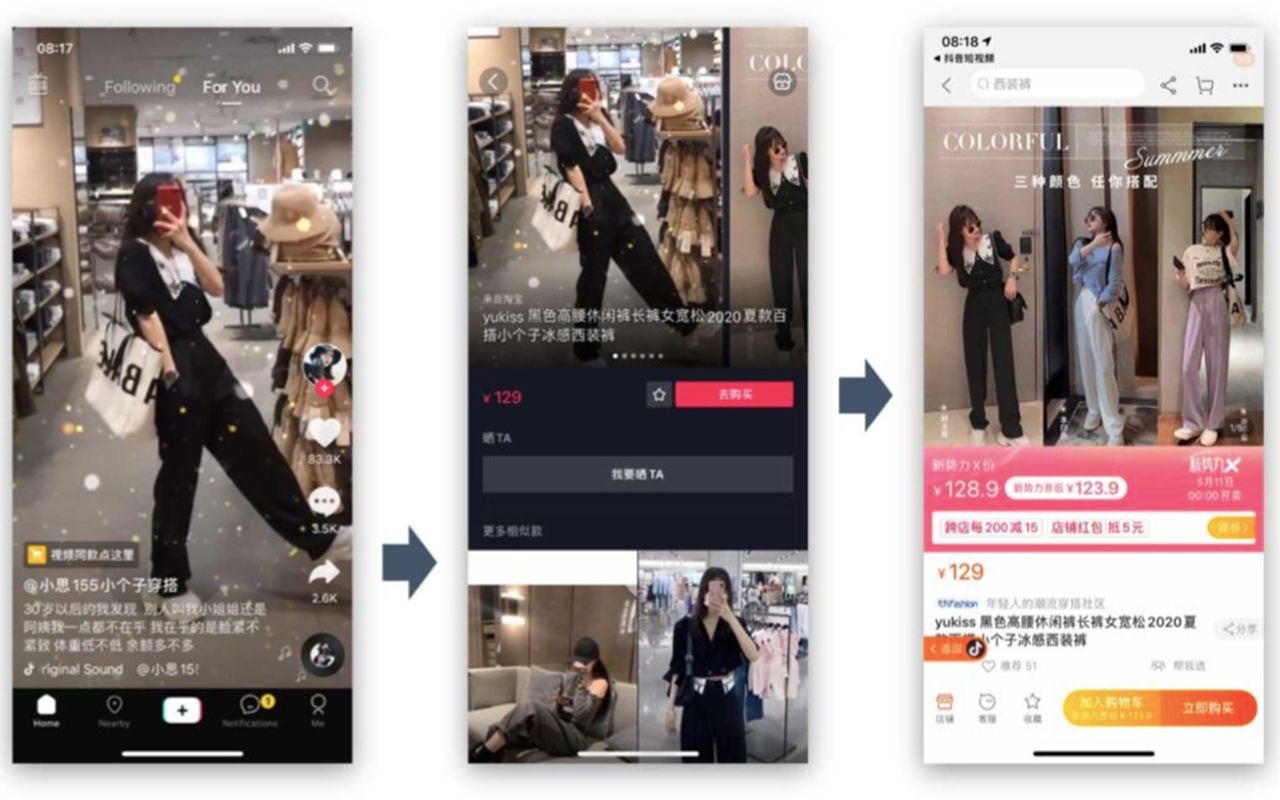

China has moved away from the aggregated, network-based social feeds that defined second-generation social media, such as Instagram, Facebook, or Twitter, and toward a more content-focused approach. Unlike second-generation platforms, these third-generation ones don’t require users to build a network to engage with this content because their feeds are driven by a mix of social networks and Artificial Intelligence content engines.

These content-based feeds benefit creators and sellers much more as they can appear on anyone’s ‘for you’ page without the need for paid promotions. That is a stark difference from what we’ve seen thus far on Western social platforms.

China is now home to a growing number of short-form video platforms, the most popular being China’s version of TikTok, Douyin (over 600 million daily users), and Kuaishou (over 257 million users). On these platforms, the AI-driven “swipe” replaces the need to click through and follow individual profiles. Algorithms provide recommendations based on the user content preferences.

The analytics derived from this machine-powered learning is based on a combination of the user’s likes, comments, shares, watch time, “dueting” videos (those that require user-generated content), and “stitch” videos (those that begin with up to five seconds of another creator’s video). This format has become so popular that a growing number of platforms, like Weibo and Xiaohongshu, are integrating short-video and livestream features into their feeds. But it’s also because these third-generation platforms also contain e-commerce features that link feed content directly to shopping.

Short-form video platforms may seem ‘low-fi’ compared to expensive and thoroughly-planned campaigns, but they have become crucial to successfully resonating with Chinese audiences. Chinese luxury buyers are younger than Western luxury consumers, so they need to be targeted through different channels, which Cartier has done with its recent campaign.

Cartier appears in young consumers’ feeds#

Cartier is an old hand in the Chinese market, having launched there in 1992. However, it has only recently embraced social media — and, more importantly, third-generation social media — in the country. This strategy can be seen in its Make Your Own Path campaign, which was released late last year to promote the brand’s new PASHA DE Cartier watches.

While luxury brands almost always try to give off an heir of exclusivity, Cartier invited everyone on Douyin to participate in its user-generated content campaign. The premise was simple: show off your dance moves in a video, apply Cartier’s special filter to it, and post it under the campaign hashtag. This simple-yet-effective campaign brought in 1.1 billion views and inspired thousands of users to boogie! Cartier even upped the ante by launching a livestreamed clubbing event by partnering with a hip-hop dance crew and the famous trap artist DJ Anti-General at a Shanghai club.

The fun, refreshing campaign smartly tapped into China’s creative consumers, club-going youth, livestream lovers, and social media content creators. Cartier also invited celebrities to participate in the campaign. As a result, the platform’s algorithm boosted the campaign widely on user feeds and generated considerable organic support.

Luxury brands: come down from your pedestal#

As demonstrated by Cartier, luxury brands have to be more experimental in China to resonate with younger audiences. Brands that are creative and innovative on third-generation platforms will be rewarded by Chinese consumers via both engagement and sales. As such, now is the right time for luxury brands to be more democratic and embrace China’s newest era of social media.