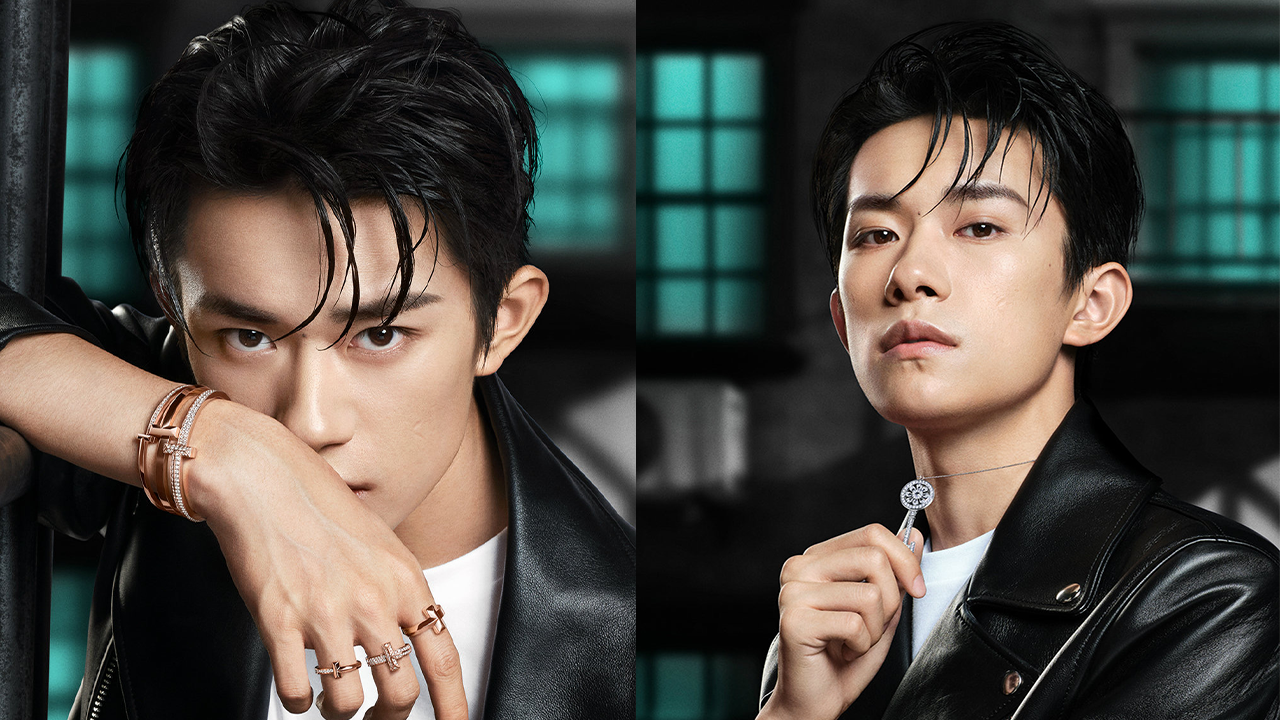

On June 2, Tiffany & Co. announced that Jackson Yee, the wildly popular singer, dancer, and actor would be the brand ambassador of its iconic Tiffany T collection via the brand’s social accounts on Weibo, WeChat, and Little Red Book. According to the brand’s official statement, Yee represents Tiffany’s brand identity and values — persistence, independence , and confidence. As one of the top-tier Chinese male idols, Yee wields a huge influence among Chinese millennials and Gen Zers, with a whopping 84.6 million Weibo followers. Tiffany’s campaign post has garnered over one million reposts and engagements. While user comments below the post agreed with Yee’s characteristics aligning with Tiffany’s T collection, many also seconded their support by purchasing pieces from this collection.

The Jing Take

Tiffany is not the first luxury jewelry house to bet on a young celebrities’ influence in China’s vast luxury market. Whether Bvlgari hiring Kris Wu as its brand ambassador or Cartier casting Hua Chenyu and Zhang Xueying for its 520 campaign, the brands’ celebrity selections have tended to lean on younger talents. Likewise, Yee’s endorsement for the Tiffany T collection, which was a discerning choice given that Yee’s appearance fits well with the clean, sharp design of the collection.

Though there are debates whether a luxury house resorting to young idols will dilute their brand equity and possibility lose loyal consumers, leveraging celebrity power can optimize digital strategies and help them recover their China business post-COVID-19. In Tiffany’s case, the brand has decided to doubled down on the Chinese market. Chief Executive Officer Alessandro Bogliolo expected double-digit growth in China last December despite the weak economy. The prolonged slump of the luxury sector amid COVID-19 has not only disrupted the company’s ambition, but it also might have affected its deal with LVMH. The luxury conglomerate has confirmed on June 4 that LVMH is “not considering buying Tiffany shares on the market.” Tiffany’s market price has been bumpy since the rumor came out.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.