Nascent Demand And Domestic Rivals Pose Market Challenges#

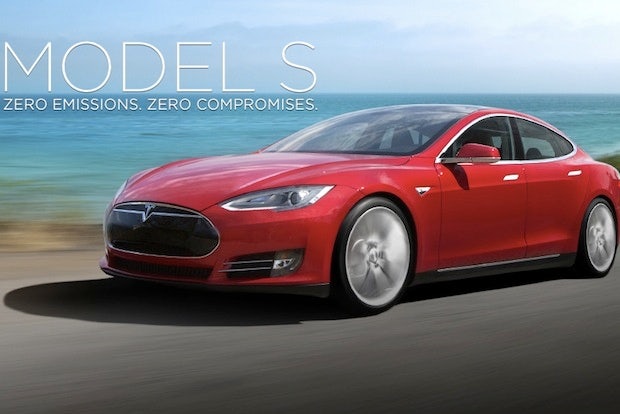

Tesla's Model S electric vehicle. (Tesla)

U.S. luxury electric carmaker Tesla has served as a pioneer in the burgeoning field of electric vehicle production at home, and now industry watchers are closely eyeing its plans for China expansion to see if it can make industry waves across the Pacific. After recently announcing plans to open a dealership in China, car experts have waited with high anticipation, and rumors have swirled regarding when and where the new location will be. When Tesla finally makes it to the mainland, however, it's going to have its work cut out for it thanks to China's uncertain market for foreign electric vehicles.

Since Tesla’s original announcement, details of the China opening have been hard to come by. China Youth Daily reported earlier in June that a sales outlet was slated to open “soon” in Beijing, but no specifics were provided.

Tesla would be entering the market early, as demand for hybrid and electric vehicles has not yet taken off in China as it has for other car models in the country. While this is mainly due to a current lack of infrastructure such as charging stations, the pollution-plagued Chinese government is making strong efforts to encourage the purchase and production of energy-efficient vehicles, officially establishing a goal to make China the world leader for plug-in electric vehicle (PEV) sales.

These efforts include a combination of tax breaks for purchase, investment in infrastructure, and encouragement of innovation and production. While all of these plans will help develop the general electric car market in China, policies aimed at encouraging the domestic market may pose a challenge to foreign automakers like Tesla in the long run.

Tesla will mainly benefit from the government’s investment in infrastructure, such as the installation of thousands of EV charging stations in major metropolitan areas. However, the government's strategy of providing tax breaks for purchases of electric vehicles is focused on domestic production, meaning that price won't be a likely selling point for customers interested in Tesla. A national tax break for electric vehicles available in 2012 has since expired, but the government has expressed plans to reinstate it. An article in state-run Global Times about Tesla recently pointed out that the company wouldn't enjoy these tax breaks and interviewed auto analyst Jia Xinguang, who stated that the pricing and tariffs on Tesla models would dampen sales.

Some foreign companies such as GM have managed to sidestep this rule by producing joint-venture electric cars in China. For example, buyers of GM’s joint-venture SPRINGO EV model in 2012 saw substantial tax breaks of US$9,500 from the central government and an additional US$6,500 from the city government if they lived in Shanghai. With a strong focus on branding, Tesla may be wary of considering such an approach.

Development of both domestic production and innovation are also on the agenda for the Chinese government and both state-owned and private companies, and the Chinese Minister for Science and Technology Wan Gang has stated that additional investment in production and technology will accompany the eventual phasing out of tax breaks. The government has provided low-interest loans to electric automaker BYD, and Chinese automaker Geely has had its eye on electric production, for a time mulling the purchase of troubled Fisker. In addition, Chinese auto parts company Wanxiang has bought an American manufacturer of electric car batteries.

These factors show that Tesla faces both great opportunities and obstacles in its plans for China expansion. If the government retains its commitment to the development of investment in EV infrastructure, owning a Tesla in China may someday be more convenient than owning one in the United States. It will likely have to compete in the future with government-favored brands, but traditional foreign car companies to date have not had much trouble yet on this front.