Two popular Chinese marketplaces specializing in the resale of sneakers, Nice and Poizon, both list the price for a pair of Dior x Air Jordan 1 High OG sneakers at a whopping 14,123 (RMB 99,999). That is quite a jump from the Dior WeChat boutique’s initial price of 2,563 (RMB 18,000). Unsurprisingly, this sneaker drop quickly earned one of the highest resale values on the Chinese market to date.

As it is in the rest of the world, the sneaker business is booming in China, where streetwear culture has won over Chinese millennials and Gen Zers alike. In addition to desirable limited-edition drops from sportswear brands, luxury-streetwear crossovers have brought even more hype to this booming market.

On China’s resale market, hyped kicks have become hard currency capable of fetching major markups. Meanwhile, venture capital firms have cosigned the financial potential of this market by betting hard on start-up resale platforms. Poizon and Nice each raised 1 billion (RMB 6.9 billion) in Series A funding and “tens of millions” of dollars in Series D rounds, as reported by the local media outlet 36Kr. According to the local data-mining company iiMedia Research, the sneaker resale market in China officially surpassed one billion dollars in 2019.

But even the flourishing sneaker market couldn’t escape the grip of the COVID-19 crisis, which has thrown a series of obstacles at China’s streetwear companies. Overstock inventories, canceled sporting events, and wavering consumer sentiment all took a toll on this promising business. And with products marked down in primary markets around the world, the secondary market became vulnerable to price slumps.

But as China's market moves beyond the apex of the pandemic, there is once again promise for the secondary sneaker market. From the debut of the most significant sneaker exhibition this past May, Sneaker Con Museum in Chengdu, to the recent drop of the “Air Jordan 1 OG Dior” sneaker, a few standout moments have pointed to a growing market potential for carefully curated streetwear products.

But how will China’s market hype respond to this changing sneaker market? Has the power dynamic between sellers and sneakerheads shifted? To unravel the complexity of this mania, we talked to local streetwear insiders, KOLs, and sneakerheads about the post-pandemic sneaker market.

A bit of turbulence during the COVID-19 outbreak#

Secondhand sneaker trading has blossomed in China, and the country has quickly become one of the biggest sneaker resale markets in the world. Yet, at the apex of the pandemic in February and March, resale prices of certain top-sellers slumped, and some even fell lower than the original retail prices, indicating shrinking market speculation.

Fluctuations have been tied up in the dynamic relationship between supply and demand, and surging prices usually occur during a marketing push. However, the pandemic and lockdowns have clearly dampened consumer sentiment and financial confidence in this arena, so buyers tend to act more rationally when investing in appreciating production.

On the supply side of this secondary market, sellers have struggled with their stock. Some chose to sell out their shoes at reduced prices while others waited to gear up for a post-pandemic rebound. Many smaller brokers are younger and are hesitant to sell when prices are down, yet they’re desperate for cash flow.

Unlike Western markets, global sportswear distribution channels in China prefer to lean on franchise models rather than wholesale. This mutually dependent relationship between brands and regional sportswear franchisees has helped both get through a period of impacted offline sales due to COVID-19. Brands allow franchisees to pay orders in arrears as a way of relieving their cash flow problems while franchisees help brands better distribute stock.

Elsewhere, Alibaba’s Tmall and JD.com have helped athletic brands cope with their overstock inventories via online direct-selling flagship stores. These have worked particularly well during the Double Five Shopping Festival in May and the 618 Mid-year Shopping Festival. Those platforms’ digital coupons have also helped brands by serving as alternatives to discounts and encourage consumer spending.

Yet while offline and online retail partners have, to some extent, mitigated sales pressures for brands, many of their frequent discounts have diluted the primary market. According to Himm Wonn, co-founder of the local streetwear multi-brand shop DOE, one of the most unfavorable impacts of this pandemic is that “discounted sneakers flood the market while the sell-through rate of full-priced ones has decreased.”

Resilience with a deflated bubble#

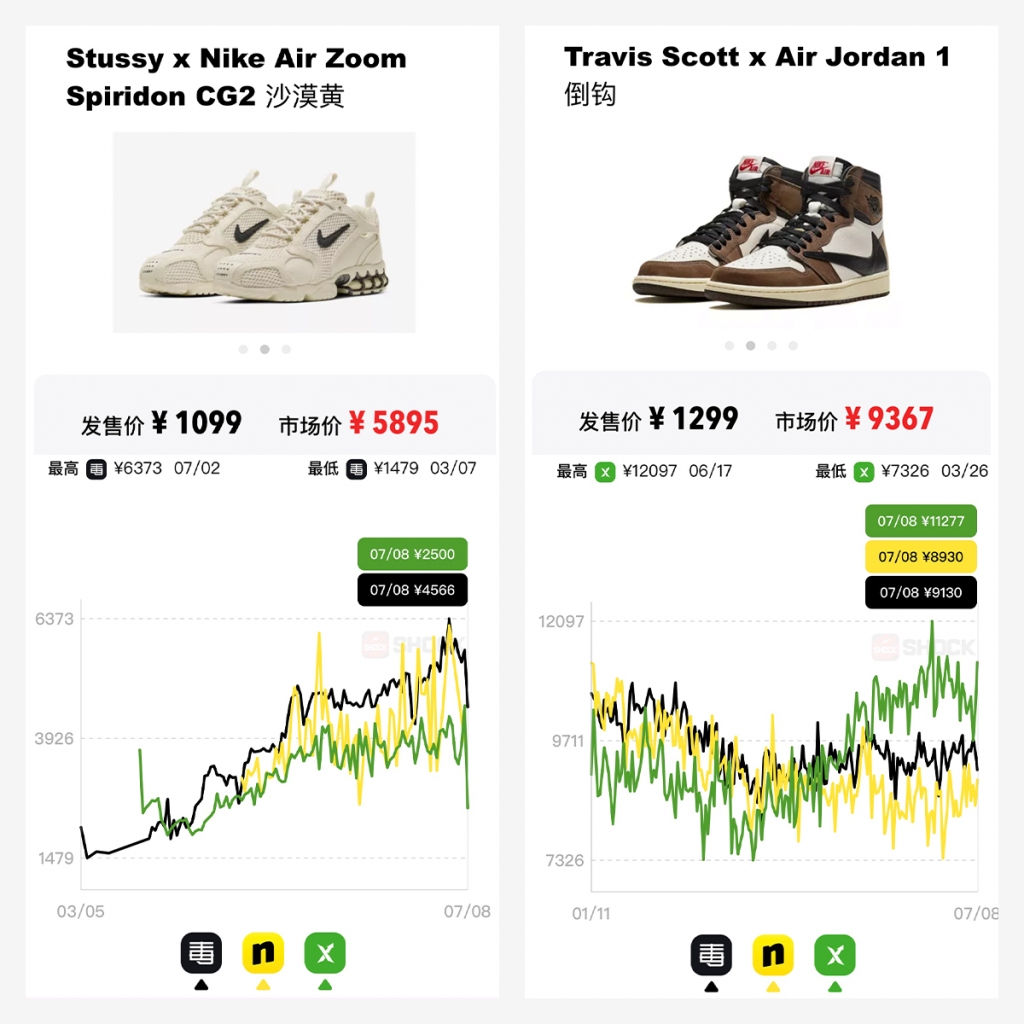

As the pandemic in China reached its turning point, the gloomy sneaker market climate gradually eased. Resale prices for the most hyped kicks dropped at the end of 2019, including the Travis Scott x Air Jordan 1 High OG. But the kick has seen progressive rebound and stability since March. Prices of other March releases, such as those for the Stussy x Nike Air Zoom, have continued to see growth. Shock, a resale transaction tracking tool for sneakers, proves this point, showing that the value of most hype products haven’t depreciated since the pandemic started receding in China.

Local sneaker insiders agree that there has not been an overall crash in the secondary market, despite fluctuations. As the sneaker influencer Ricki Dai explained to the local media outlet Jiemian News, “the resale price of exclusive editions like rare patterns of Air Jordan 1 are still resilient with high appreciation space despite being a bit lower than pre-COVID.” Proof of this assertion can be found in the recovering turnover numbers on Nice and Poizon beginning in April. And as online platform verification and shipping services have rebounded, so too has resale trading.

While the sneaker market experienced a bumpy ride during the pandemic, sneaker mania hasn’t cooled down. If anything, the slight drop in resale prices encourages consumers to purchase those wanted items at more reasonable prices. In China’s largest online sneaker community, Flightclub’s WeChat account, followers commented on how “the prices are finally back to reasonable, and it’s a perfect time to buy in.” Therefore, demand amongst “shoe dogs” (a term referring to veterans of the footwear industry) remains strong despite the pandemic.

But what about the consumer perception of luxury sneakers? One of the most anticipated collaborations of the year — the “Air Jordan 1 OG Dior” sneaker — sold out online immediately after becoming available on June 25. According to the users who won a draw to get a chance to buy these shoes at Dior’s WeChat boutique, they’re betting on the resale performance of these limited-edition shoes, despite their hefty retail price.

Weibo user @adamgeri commented that “I will definitely sell it out if I can win the draw,” while other netizens claimed they were interested in the shoe's promising resale returns rather than the sneakers themselves. But one experienced sneaker consumer, Nate Li, told us that he wouldn’t pay 2500 for this pair, let alone for its even higher sticker price, even though he frequently shops for luxury brands. “It’s not for the real sneakerheads,” he said. “There’s not any street culture or hip hop origin in Dior.”

Sneaker brokers, who are one of the biggest drivers in China’s sneaker market, aren’t necessarily the type of sneakerheads who are obsessed with the culture. As sneaker KOL Yifei Wang said, players in the domestic market attach greater importance to prices than the culture or story behind the shoe, which leads to a darker side of the market: price manipulations. “It was an open secret that certain brokers controlled a large number of hype kicks and took over the pricing power in the secondary market,” Wang explained, saying this was one of the reasons why the sneaker bubble has blown up in China over the past few years.

Thanks to the efforts of thousands of sneaker KOLs in the social domain, China’s sneaker frenzy continues to grow in the post-COVID-19 era. Limited editions or collaborations are still hyped and desirable to local youngsters, while high resale performances continue to encourage primary market sales. This sneaker market has massive potential to brush off the remains of the pandemic as long as brands can impress their savvy consumers with continued exclusivity and newness.